Mineral reserves put Australia in pole position for renewables race

‘Broadly untapped’ local reserves of critical minerals like nickel and cobalt leave Australia well positioned for the transition to renewable technologies.

“Broadly untapped” local reserves of critical minerals like nickel and cobalt leave Australia well positioned for the transition to renewable technologies, researchers at British bank Barclays say.

In a note on the green energy transition, analysts conclude there will be enormous demand for so-called critical minerals – used primarily in projects underpinning the transition – at a time of limited supply.

“While it is not yet clear which exact path the green-energy transition will ultimately take, many of these minerals and metals are likely to be in high demand regardless of which technologies are chosen,” they write.

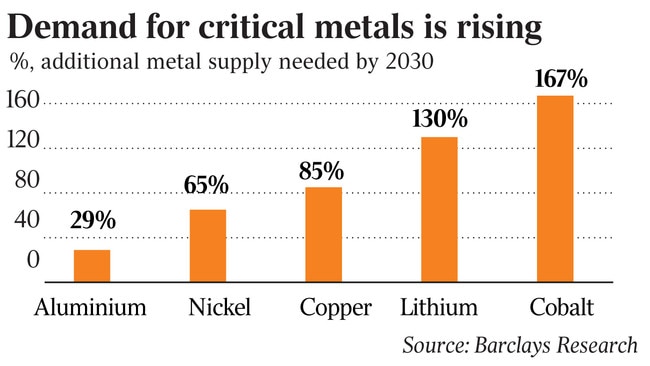

In particular, demand would increase significantly for five metals: copper, lithium, aluminium, nickel and cobalt.

“Most critical minerals are very concentrated in their supply characteristics,” the analysts, led by head of economics research Christian Keller, write.

“Other than the important energy market, for example, where varying technologies are employed and supply is diversified across many geographies, the global supply of the (five metals) is often sourced from very few countries.”

Separate analysis conducted by Wood Mackenzie estimates demand for aluminium will rise by 29 per cent by 2030, compared with a 65 per cent rise for nickel, an 85 per cent rise for copper, a 130 per cent increase for lithium and a 167 per cent jump for cobalt. More than 70 per cent of global lithium exports come from just three countries, while the Democratic Republic of the Congo is responsible for 50.7 per cent of the world reserves of cobalt.

“At the same time, the relation between current production and estimated reserves … also highlights a great potential for a number of countries where current production shares are small compared to their share of global reserves,” the Barclays note reads.

“For example, while Australia is well known for its leading role in lithium (with around 24.6 per cent of global exports of lithium) … its share in global reserves is equally high for nickel and cobalt, offering great potential for broadly untapped resources.”

Australia is currently the sixth-largest exporter of copper and fifth-largest exporter of nickel ore. But it exported only 4.5 per cent of nickel metal, Barclays said.

ASX-listed base metals miners – including platinum, nickel and copper producer Chalice Mining and nickel project operators like Nickel Mines and Mincor Resources – continue to outperform the rest of the market.

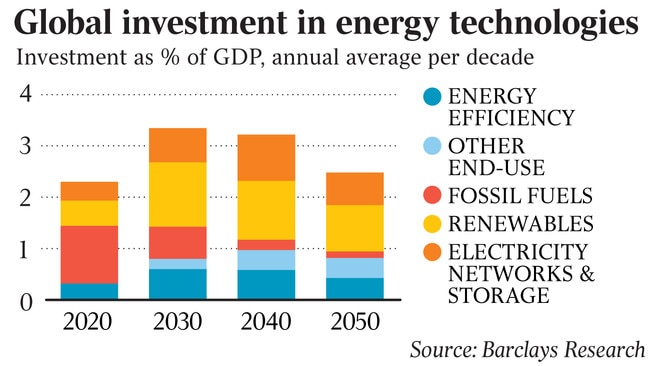

“Just as China’s rise saw it become the biggest single source of commodity demand, we believe the anticipated ‘green-energy transition’ could become a new global driver as China’s economy itself transitions over the coming decades,” Barclays analysts write.

“Policies to limit global warming and create a low-carbon future require a massive investment in low-emissions and clean-energy technologies.”

The Australian on Monday reported that Bluebell Capital partners – an activist fund invested in Glencore, one of the largest coal producers in the country – was agitating for the commodity giant to spin off its local coal mines.

Bluebell chief investment officer Giuseppe Bivona said the company had the “right exposure to all the metals which are key for the energy transition – copper, nickel, cobalt, zinc” but was losing access to investment and finance because of concerns about its coal mining operations, a significant portion of which are in Australia.

Glencore has said it would spin off the mines if the move was backed by investors.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout