‘Wall of cash’ ready for green energy shift, say nation’s top bankers

The net-zero transition in Australia will match with the nation’s last great investment boom in the resources industry, it is estimated.

The Glasgow climate summit has delivered a “massive” opportunity for the major banks to help fund Australia’s multi-trillion-dollar transition to carbon neutrality by 2050, according to the nation’s top bankers who will sign the cheques.

Commonwealth Bank head of institutional banking and markets Andrew Hinchliff said there was a wall of funds looking to finance the transition, not just because it was the moral and ethical thing to do but also for the business opportunity.

“There’s a whole lot of problems associated with why we’re here at zero interest rates, but one of the beautiful things is that there’s a lot of very, very cheap money in the system so the world can more readily afford the capital expenditure for the necessary investment,” Mr Hinchliff told The Weekend Australian.

“It goes to the concept of ‘build back better’ – if you have to spend a lot of money to repair economies and create a bridge to the other side, then build it in such a way that makes it greener and more productive.”

As the COP26 meeting draws to a close, the unanimous assessment is that a lot has been achieved, even if a lot more remains to be done.

Among the big successes was this week’s surprise deal between the two biggest emitters, the US and China, to jointly tackle the climate crisis by reducing methane emissions, protecting forests and phasing out coal.

ANZ bank institutional boss Mark Whelan said the potential of the initiative should not be underestimated, as it was the first positive dialogue involving the implacable strategic foes in six years and could potentially lead to a “reset” of the relationship.

The bankers also hailed the breakthrough announcement by the IFRS Foundation, the body responsible for global accounting standards, that it would urgently develop minimum sustainability disclosure requirements.

This would elevate sustainability reporting to the same level and widespread use as financial reporting.

As KPMG global chairman and chief executive Bill Thomas said: “You can’t change what you can’t measure.”

On CBA numbers, the net-zero transition in Australia will match up with the nation’s last great investment boom in the resources industry.

Investment is forecast to peak at about 28 per cent of GDP in 2030 or thereabouts, which is about the same as it was in 2013 and one-third higher than its current level.

None of the bankers expressed any doubt about the capacity of the financial system, including the capital markets, to underwrite the transition.

In fact, they’re banking on it.

Westpac institutional boss Anthony Miller said the key message from Glasgow was the critical role of the financial system in picking up the tab for a global transition to net zero that’s expected to cost $US130 trillion ($178 trillion).

While the numbers are stupendously large, they mushroom very quickly when you factor in the $100bn cost of retiring coal-fired power generation in Australia alone over the next decade, according to Westpac.

You can throw in an extra $50bn to modernise the poles and wires so they can carry the necessary renewables load.

“That’s the work that everyone’s doing to calculate the capex required, the level of risk and the opportunity that flows from that set of commitments,” Mr Miller said.

“But what’s needed to attract the capital is a lot of rigour in terms of how it’s all measured and disclosed, which is why I come back to the (IFRS Foundation) announcement.”

At National Australia Bank, corporate and institutional banking boss David Gall said COP26 reinforced the fact that financing opportunities would flow from climate-related innovation, be it in renewables, abating and reducing emissions or carbon trading platforms.

Given NAB’s early involvement in the Australian Hydrogen Council, Mr Gall said the climate summit’s focus on hydrogen was welcome due to its status as an alternative in hard-to-abate industries such as steelmaking.

“So to see further investment in hydrogen, both globally and certainly domestically, is extremely important,” he said.

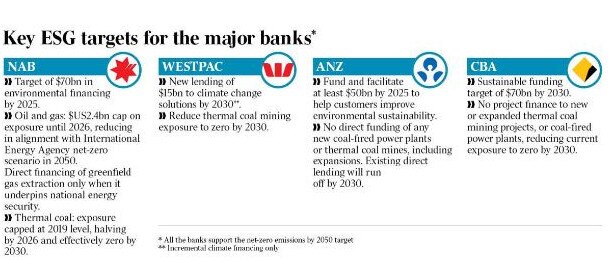

In conjunction with its annual result, NAB unveiled its new oil and gas policy this week, which put a $US2.4bn cap on its exposure until 2026, before reducing it in alignment with the International Energy Agency’s net-zero emissions by 2050 climate scenario.

Activist groups slammed the carve-outs in the policy, but Mr Gall said it served to emphasise that COP26 was a “point in time”.

“It’s a point in time to show what governments and corporates are actually doing, but we need to ensure that the actions we take from here line up with the commitments already made,” Mr Gall said.

“That’s why we were keen to get our oil and gas policy out there.

“There’s a lot of Australian businesses committed to net-zero emissions by 2050, but it’s the commitments, the actions taken and then the transparency of those actions coming off the back end of COP26 that’s going to be critical from now.”

The business opportunity, in the meantime, was “massive”.

Mr Gall said sustainable finance and the climate transition was the fastest growing revenue stream in the institutional bank, with the segment budgeted to contribute 15 per cent of divisional revenue over the medium term.

It covers the gamut of sustainable finance activities, from green bonds to sustainability-linked loans and bonds, derivatives linked to environmental, social and governance goals, renewables financing and carbon trading.

Mr Whelan said the climate transition had mostly been a risk management issue for the past 18 to 24 months, but it had now evolved into a business opportunity as well.

“That ($US130 trillion) figure is massive, and regardless of how you think it breaks down the money is heading there,” he said.

“We’re already seeing that in a number of areas – the investors are in discussions with us about assets we might be funding and how they can come and join us on that, their scrutiny over our lending practices, and importantly the level of demand every time we issue a green bond or a green loan.

“These things are five-10 times oversubscribed, so we know the appetite is there, the commitment is there, and now it’s just a matter of getting the projects under way.”

ANZ recently completed a 16-week deep dive into the opportunities, how big they were, and where the bank was short of the required capabilities.

The next stage of the review, now under way, was how it would execute, with options such as partnership and acquisitions under consideration.

“We haven’t ruled anything out because this is a mega-trend and it’s going to continue,” Mr Whelan said.

Back at CBA, Mr Hinchliff said the carbon markets were one of the nation’s big opportunities.

Although Australia was responsible for about 4 per cent of global emissions, it could contribute about 7 per cent of the world’s carbon offsets, given our land mass and plentiful supply of renewable energy through wind and solar.

Not only would it accelerate the transition to net zero but the revenue stream would be substantial.

The CBA banker said Glasgow has been a clear success.

Coming into COP26, he said, 52 per cent of the world’s emissions were captured under net-zero commitments – a figure that had now risen to 62 per cent.

“I think there will be another 27 per cent under discussion, so in theory you could get to a point where well over 80 per cent of the world’s emissions are accounted, which means you’re well past the inflection point and that accelerates all the way down through the private sector.

“So it’s been a success, but you’d always hope for more.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout