Bluebell Capital Partners urges Glencore to carve off coal and grain businesses

One of Europe’s most aggressive activist hedge funds has renewed its call for Glencore to carve off its thermal coal and grains businesses.

One of Europe’s most aggressive activist hedge funds has renewed its call for Glencore to carve off its thermal coal and grains businesses in a move that would affect a vast number of the commodity conglomerate’s local assets.

Bluebell Capital Partners had originally written to Glencore in November demanding the company spin off the assets, largely located in Australia, with banks and investors increasingly reluctant to engage with coal producers.

In an interview with The Australian, Bluebell chief investment officer Giuseppe Bivona accused Glencore management of providing a false impression of their environmental commitments, and said making the hedge fund’s proposed changes could lift the company’s share price by 45 per cent.

“Glencore … has the right exposure to all the metals which are key for the energy transition, copper, nickel, cobalt, zinc, and so on and so forth,” Mr Bivona said.

“But there is obviously a lot of investors who cannot buy shares in Glencore because they don’t want having exposure to coal.”

Mr Bivona said the company’s plan for its coal business was “a bit rich” because it was reliant on the depletion of existing reserves.

“This is like saying ‘I’m going to mine all of the coal I have and somebody is going to buy all the coal I have until I run out of stock’. It doesn’t strike me as the most sensible message in an environment which needs to see a transition,” he said.

Glencore is one of Australia’s largest exporters of coal, and operates 17 mines across NSW and Queensland. The company says the mines employ 9900 workers.

Its Viterra grains subsidiary, which Bluebell is also advocating be sold off, became one of the largest local agricultural business – operating in South Australia and Victoria – after acquiring the ASX-listed ABB Grain in 2009.

At an investor briefing late last week, Glencore chief executive Gary Nagle said that if the majority of shareholders wanted the company to spin off its coal assets, then it would do that.

But 94 per cent of investors had agreed to the current strategy to “responsibly run down the coal business,” Mr Nagle said.

“If they change their minds, these large shareholders, (if) the majority of them say to us they have a different view and they think spinning off the coal assets is the right way to go, then we need to consider it,” he said.

Glencore, which has a number of coal mines in South Africa and another in Colombia, has a target of reducing its total emissions – including Scope 3 – by 15 per cent in the next five years. It has previously argued that selling out of its coal assets will not reduce their associated emissions.

But Mr Bivona, a former Goldman Sachs banker, said owning the coal mines alone was depressing the rest of the minerals business by at least 30 per cent.

“There’s a very strong reason why separating the two businesses … you will create much more demand on the stock and the company will also have more financial flexibility,” Mr Bivona said.

“There is no question that this is not an issue which only affects equity, either. Banks are increasingly also, from the lending side, focusing on cutting exposure to companies invested in coal.

“The counter argument is ‘if you spin off the company you create a business which is all about coal, and you create an incentive to mine more coal, to sell more coal, and actually you do worse’.

“That’s why a spin-off, per se, is not a solution unless you spin off the business with a set of rules and conditions … to make sure contrary to what Glencore is doing today, i.e. increasing the volume production, you eventually decrease in a reasonable time span volume production.”

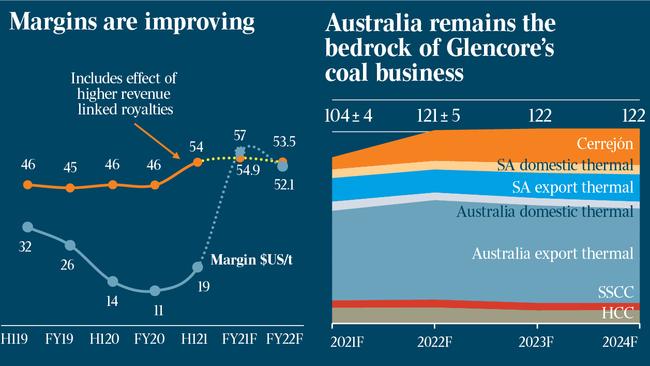

Glencore’s coal production and export from Australia has surged this year to its highest level since 2019 – before the Covid-19 pandemic and restrictions from China on Australian imports.

The company this year also increased its stake in its Colombian coal mine after buying a 33.3 per cent holding owned by BHP for $US294m ($420m).

Bluebell, a small investor in Glencore with total funds under management of about €200m ($323m), has had significant success in forcing change at some of Europe’s largest companies.

Danone, a French food products conglomerate, replaced its chief executive and chairman earlier this year after a campaign from Bluebell and another hedge fund, Artisan Partners, which had accused the company of failing to “strike the right balance between shareholder value creation and sustainability”.

Bluebell in May began agitating against plans by French media group Vivendi to dump its biggest asset, Universal Music, by distributing 60 per cent of its capital to shareholders including its largest investor, billionaire Vincent Bollore. The hedge fund has previously – unsuccessfully – pushed for changes at GlaxoSmithKline and Belgian company Solvay.

Mr Bivona said Glencore was often opaque about its management, especially of Viterra.

“When you get so many problems, its obvious that there is an issue of stewardship,” he said. “These are individual problems but when you put them together you wonder what the board has done in terms of oversight.”

Equities researchers are split on the divestment of Glencore assets. In a note to clients, Deutsche Bank analyst Liam Fitzpatrick said the company’s “asset base is too complex, creating additional oversight and ESG-related risks compared to peers as well as depressing returns”.

“The deconsolidated (agriculture) business is largely ignored by investors,” Mr Fitzpatrick wrote. “The medium-term strategy for the Ag business is still to unlock value via a change in structure. With a book value of (more than) $US3.2bn, there is currently very little in the price for this business and, in our view, improved profitability could accelerate strategic plans.”

The analysis estimated the value of a stand-alone coal business at about $US12bn, and suggested that the Glencore share price could rise significantly if those assets were spun out.

About 21 per cent of the company’s earnings were from its coal division, recent disclosures show.

Glencore, in a statement, said that it “engages regularly with its investors”.

“We are confident that our business model is uniquely placed to produce, recycle and market the materials needed to decarbonise energy while reducing our own emissions and delivering value for stakeholders,” it said.

Several major financiers have begun dropping companies that operate in thermal coal, including the Norwegian sovereign wealth fund, one of the world’s biggest, which in 2020 said it would sell its stake in AGL. It warned it may do the same for its holding in BHP.

Glencore was also struck from the pension fund’s permitted investments at the same time.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout