Australia faces coal, gas threat from net zero: IEA

Demand for Australian coal and gas will plunge within a decade if countries push for net zero emission goals.

Demand for Australian coal and gas will plunge within a decade if countries push for net zero emission goals, underscoring the risks to two of Australia’s biggest export earners amid a global push to boost climate change ambitions, the International Energy Agency has warned.

Scott Morrison’s plan for net zero emissions by 2050 will go to cabinet on Wednesday, with Energy Minister Angus Taylor seeking to reassure Nationals MPs the major shift in climate policy will not come at the cost of reliable power generation or undermine high-emitting regional industries.

However, the future for Australia’s giant coal and LNG industries faces a fresh threat with major economies that account for 70 per cent of global gross domestic product having committed to net zero targets.

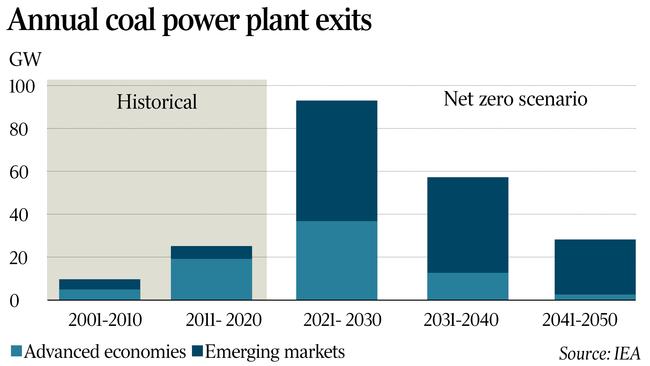

Global coal use would plummet by 55 per cent by 2030 under a net zero pathway plotted out by the IEA, while no new gasfields would be developed beyond those already approved for development and LNG demand would peak halfway through this decade and fall 20 per cent by 2030.

Australia is the biggest LNG exporter in the world and among the largest producers of coal supplying Asian markets.

“Given the low prices of natural gas in the net zero scenario, any LNG projects with a break-even price of more than $US5 per million British thermal units would be at risk of failing to recoup their investment costs,” the IEA stated in its World Energy Outlook released on Wednesday.

The findings mirror a demand made by the UN in September after it declared Australia had fewer than 10 years to shut its coalmining industry and find new jobs for workers under a timetable to keep future warming below 1.5C.

The Morrison government’s only formal climate change commitment is to lower emissions by 26-28 per cent on 2005 levels by 2030, but it is expected to boost its commitments ahead of a critical COP26 Glasgow climate meeting at the end of the month.

More than 50 countries and the entire European Union had pledged to meet net zero emissions targets, the IEA said.

Still, the path to net zero remains highly uncertain ahead of the climate summit. China conceded this week that its energy crisis and need to secure fossil fuels would mean it would reassess its timetable for hitting peak carbon emissions.

The world energy body said investment in clean power needed to be tripled over the next decade to reach net zero emissions of greenhouse gases by 2050, while more countries needed to sign on to net zero goals as climate warming risks grew.

Current climate pledges would result in only 20 per cent of the emissions reduction by 2030 necessary for the world to reach net zero targets by the mid-century, according to the IEA.

“A new energy economy is emerging – but not yet quickly enough to reach net zero by 2050,” IEA executive director Fatih Birol said.

“With emissions, climate disasters and energy market volatility all rising, governments need to send an unmistakeable signal of clean energy ambition and action at COP26 to accelerate the transition.”

Australia’s electricity-generating thermal coal, currently trading at record prices, is set to have an export value of $24bn in the 2022 financial year, while LNG export earnings are tipped to almost double from $30bn to $56bn in 2022 as oil-linked contract prices surged due to high demand, particularly in Asia.

While the long-term picture sets the scene for a dramatic earnings hit, a surge in demand for fossil fuels as the world emerges from the Covid-19 pandemic has propelled the prices of coal and LNG to records and the oil price to multi-year highs as buyers clamour to grab access to supplies needed for power generation and industrial use.

That demand for raw materials, combined with an escalating energy crisis across Europe and China, means global carbon emissions are set for the second-biggest annual increase in history.

“The rapid but uneven economic recovery from last year’s Covid-induced recession is putting major strains on parts of today’s energy system, sparking sharp price rises in natural gas, coal and electricity markets,” the IEA said.

“For all the advances being made by renewables and electric mobility, 2021 is seeing a large rebound in coal and oil use. Largely for this reason, it is also seeing the second-largest annual increase in CO2 emissions in history.”

The IEA cautioned in July that emissions were set to hit an all-time high by 2023 as just two per cent of pandemic recovery finance was being spent on clean energy.

The price surge would see Australia face pressure on gas prices as a global crunch spreads to the nation’s energy sector, top industry executives said this week.

The IEA said more pain may be ahead for energy markets, particularly given severe underinvestment in new supplies due to price shocks in the last five years.

“There is a looming risk of more turbulence ahead for energy markets. The world is not investing enough to meet its future energy needs, and uncertainties over policies and demand trajectories create a strong risk of a volatile period ahead for energy markets,” the IEA said.

“Transition-related spending is gradually picking up, but remains far short of what is required to meet rising demand for energy services in a sustainable way. The deficit is visible across all sectors and regions.

“At the same time, the amount being spent on oil and natural gas, dragged down by two price collapses in 2014, 2015 and in 2020, is geared towards a world of stagnant or even falling demand for these fuels.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout