Resource, energy exports to hit record high despite falling iron ore price

Resource and energy export earnings will hit fresh highs this year, says a government report, but the good times aren’t expected to last indefinitely.

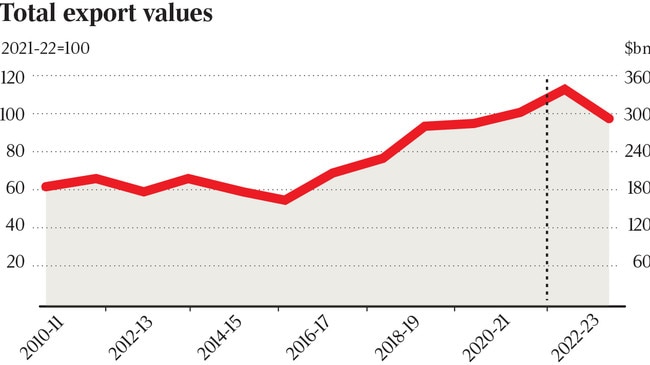

Australia’s resources and energy exports are tipped to defy the global spread of the Covid-19 delta variant and falling iron ore prices to earn a record $349bn in the 2022 financial year, up 14 per cent on the year prior, according to the government’s latest quarterly Resources and Energy Report.

But the report warns the boom times won’t last, with export earnings set to fall just below $300bn the next year as mining operations disrupted by Covid-19 come back online, increasing supply, while government stimulus-led demand for commodities moderates and the iron ore price continues to fall.

The projected earnings growth comes as key Australian export commodities like coal have hit record highs in recent months after experiencing multi-year lows.

On Tuesday thermal coal shipped out of Newcastle punched through the $US200 per tonne price barrier, representing a 270 per cent gain on its 12-month low last October.

Federal Minister for Resources, Water and Northern Australia Keith Pitt said the results showed the resilience of the resources sector, which also achieved record export earnings of $310bn in the 2021 financial year.

“The sector has gone from strength to strength and is performing better than it was pre-pandemic, further building on Australia’s reputation as a reliable and stable supplier of resources and energy,” he said.

“The forecast export earnings for 2021-22 are close to $100bn higher than they were a year ago during the peak of the global pandemic and is testament to the outstanding work of all involved in this critically important sector.”

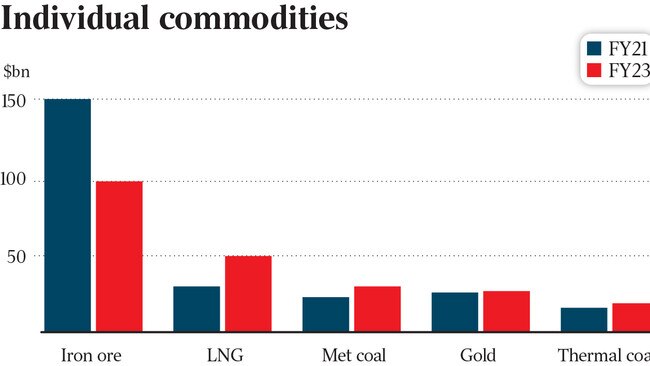

The report says export earnings will be supported by a recovering global economy and weaker Australian dollar, with iron ore, liquefied natural gas (LNG) and coal representing 70 per cent of projected earnings.

It predicts thermal and metallurgical coal exports will contribute $57bn to export earnings in the 2022 financial year, up 46 per cent.

The price of metallurgical coal, which is used to make steel, is set to remain high despite an unofficial Chinese import ban on Australian coal.

“Australian exports have now integrated into new supply chains, with no impact on volumes evident in the wake of the informal import restrictions imposed by China,” the report says.

Electricity-generating thermal coal is set to have an export value of $24bn in the 2022 financial year before edging off slightly to $19bn, with Chinese demand keeping global seaborne prices high to the benefit of Australian coal producers locked out of the Chinese market.

The report also says in the longer term, thermal coal prices could be sustained if net zero emissions commitments from countries and corporations result in the closure of mines ahead of coal-fired power stations.

“Current trends point to a potential supply risk, and a possibility that new coal supply may actually retreat faster than demand, leading to more upward pressure on coal prices,” it says.

But iron ore is expected to contribute export earnings of $132bn, following the record $153bn figure set last year, before falling to below $99bn as Brazilian supply re-enters the global market.

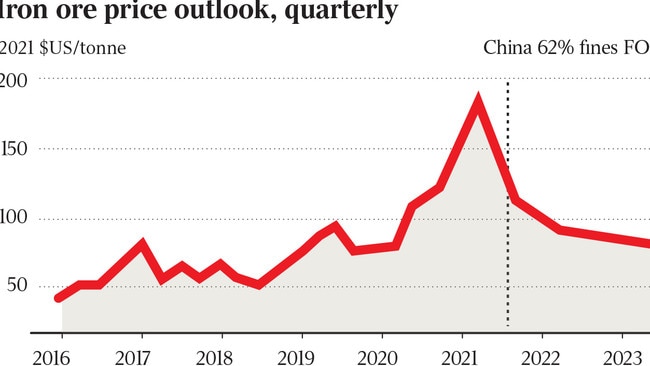

The iron ore price has halved compared to its price in May and July, where it was trading well north of $US200 per tonne.

Reduced steel production in China is set to reduce demand for iron ore further, the report says, sending prices down further.

“Prices are forecast to average around $US150 a tonne in 2021, before falling to below $US100 a tonne in 2022,” it said.

Meanwhile, LNG export earnings are tipped to almost double from $30bn to $56bn in the 2022 financial year as oil-linked contract prices surged due to high demand, particularly in the Asia-Pacific.

Although prices are predicted to moderate, the report says Australian producers will benefit from China’s ongoing “gas-to-coal-switching,” with Australia already accounting for 43 per cent of the country’s LNG imports, helping offset the expected impact of Japan’s move to net zero.

Elsewhere, the report notes that Australia overtook China as the largest gold producing country in the first half of 2021, while lithium exports are predicted to almost match zinc exports by 2023 “as the race to make the world auto fleet electric gathers pace.”

Notable downside risks to the export forecasts include a spike in Covid-19 cases, higher global interest rates and further diplomatic stoushes in China.

“Another downside risk is the extent of any further disruptions to Australian resource and energy commodity trade with China, which took almost half of such Australian exports in 2020–21,” the report says.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout