LNG exports, prices surge to record levels as iron slumps

Queensland liquefied natural gas producers are exporting at record rates as Asian prices for the fuel trade at the highest seasonal levels for a decade.

Queensland liquefied natural gas producers are exporting at record rates as Asian prices for the fuel trade at the highest seasonal levels for a decade, echoing a surge in coal prices since the start of the year.

Combined LNG supplies from the three Queensland plants have soared to the highest volumes on record over July and August and are running up to 20 per cent higher than this time last year, according to consultancy Energy Edge.

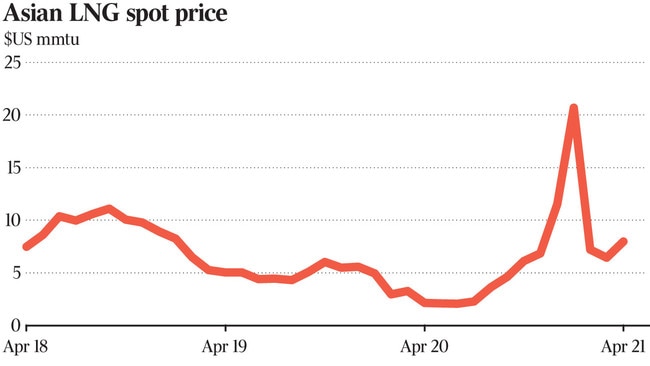

Exporters have partly been responding to a jump in Asian LNG prices to nearly $US20 a gigajoule, an unexpected boost for producers, with the last price spike occurring in January when buyers were caught out by freezing winter temperatures.

LNG spot prices have doubled in the last three months while gas to be delivered in February 2022 is also twice as high as levels at the end of April. LNG exports rose to $10bn over the three months to July 2021, a 17 per cent increase on the previous quarter, the Australian Bureau of Statistics said.

Despite the high international benchmarks, prices on Australia’s east coast have remain relatively subdued at or below $10 a gigajoule since August 1.

Higher renewables output, limited new contracts from industrial customers and a milder winter had limited domestic consumption, Energy Edge said, and helped keep a lid on local prices, which are increasingly tied to international LNG markets.

With the price of Newcastle coal hitting a record $US173 a tonne last week and metallurgical coal some 150 per cent above earlier year-lows, two of Australia’s biggest export spinners were helping to offset a dramatic fall in iron ore prices from record levels, Resources Minister Keith Pitt said.

“Both coal and LNG have made a remarkable recovery from the pandemic-induced economic slowdown,” Mr Pitt said. “Rising demand for both commodities is forecast to grow in coming years and justifies industry confidence we’re seeing through billions of dollars of investment in new projects, particularly for LNG.”

Iron ore, which is set to rake in $149bn of revenue in the 2020-21 financial year, has sunk more than 40 per cent since its peak in May.

Iron ore prices came under renewed downward pressure on Monday as China’s central government continued to curb steel production to clamp down on pollution, and iron ore stockpiles rose.

Singapore futures for 62 per cent iron ore fines dived almost $US13 a tonne or 9 per cent to a three-week low of $US130.05 a tonne during Monday’s trade.

After surging to a record high of $US233 a tonne in May after a strong rebound in China’s economy and supply disruptions in South America in the early stages of the Covid-19 pandemic, the spot price of Australia’s most valuable commodity export fell more than 40 per cent to an eight-month low near $US130 a tonne last month before rebounding above $US150 in recent weeks.

Steelmakers in the city of Handen have been told to shut furnaces accounting for almost a tenth of the city‘s steelmaking capacity, Mysteel reported.

Angang Steel will make sure that its full-year output doesn’t exceed 2020 levels and has a maintenance plan in place, executives told an investor meeting hosted by Citi. The steelmaking giant and other steelmakers warned of looming price declines for iron ore. China’s iron ore port inventory hit a four-month high of 130.66 million tonnes last week, according to China Steelhome data.

Prices for the steelmaking raw material are estimated by the Australian government’s commodity forecaster at $US150 a tonne on average in 2021, before falling below $US100 a tonne by the end of 2022 as Brazilian supply recovers and Chinese steel production softens.

The recent slump may require tweaks to the Morrison government’s revenue expectations. It had bet that buoyant iron ore along with strong markets for coal, copper and LNG will deliver overall resources exports of $310bn, beating a $296bn forecast made in March. An even bigger leap is expected to $334bn in 2021-22 as economies strengthen, driven by a rise in infrastructure spending before falling back to $304bn in 2022-23.

Rising prices for metallurgical coal, used for steel making, and a near 10 per cent jump in exports over the next two years will propel export receipts to $30bn in 2021-22 and $32bn the year after, cementing Australia’s position as a major provider to predominantly Asian buyers.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout