Australia may face gas shortages in 2022: ACCC

Australia’s east coast could face a gas shortfall next year if Queensland LNG exporters don’t send supplies south.

Australia’s east coast faces a crunch on gas supplies with a potential shortfall in 2022 if Queensland LNG producers export all of their gas, the competition regulator has warned, ratcheting up tensions with the energy giants.

A shortfall of two petajoules (PJ) could arise across the entire east coast gas market next year, sparked by a 6PJ shortfall in the southern states depending on the actions of LNG producers.

One PJ is roughly enough to supply, for one year: 16,000 average Victorian homes, 41,000 average NSW homes, or a large commercial and industrial user.

Some 1981PJs of gas is expected to be produced in 2022 compared with demand of 1983PJs with LNG producers seen having a 101PJ surplus, potentially heading off any gas squeeze.

“There is a real prospect a shortfall in the south could arise, as gas production and withdrawals from storage in 2022 are forecast to be less than demand by 6 PJ. This may be even worse if supply from undeveloped reserves does not eventuate and/or GPG demand is higher than forecast,” the Australian Competition and Consumer Commission said.

The three Queensland producers - Santos’s GLNG, Origin Energy’s APLNG and Shell’s QCLNG - did not adequately comply with a supply pact agreed with the Morrison government in January, the ACCC said.

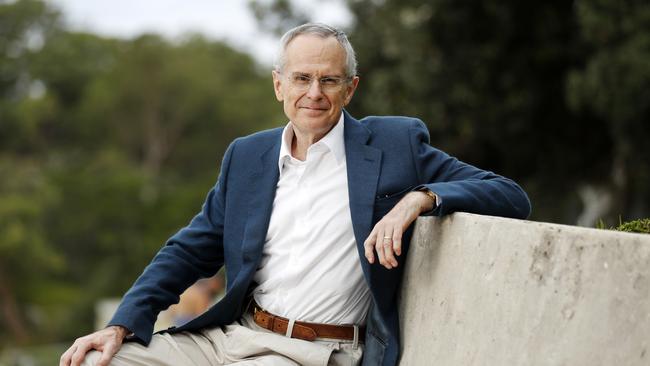

“The initial material LNG producers provided to us did not adequately demonstrate compliance with the new heads of agreement and they will need to lift their game,” ACCC chairman Rod Sims said.

“The initial responses from LNG producers were concerning given that in the near future Australia’s southern states may depend on their surplus gas. We expect to see better compliance from LNG exporters over the next 12 months.”

Resources Minister Keith Pitt was asked in July to consider capping gas exports by a major union and a leading industry group, with claims the nation’s manufacturing comeback was “in danger of being jeopardised by high gas prices”.

The agreement has worked since 2017 by ensuring LNG exporters offer uncontracted gas to the domestic market in the event of a shortfall, ensuring domestic users get enough gas for their own needs before supplies get shipped offshore to Asian buyers.

The new pact signed in January committed LNG exporters to offer uncontracted gas to the domestic market first on competitive market terms before it is exported.

While the three LNG producers already comply with the terms of the new agreement, the Morrison government hoped the strengthened conditions it put in place would help ease tensions with manufacturers who complain they are still paying over the odds for gas.

Some high profile manufacturers such as Qenos and Incitec Pivot unsuccessfully barracked for price controls to be introduced in a bid to lower costs they argue are out of sync with their cheaper international competitors.

Price offers for 2022 fell to between $6-$8 a gigajoule at the end of 2020 and remained low up until February this year, the ACCC said, but big users are concerned by recent spikes in spot prices and think supply uncertainties will also lift contract prices next year.

The alert over east coast gas follows a warning that Victorian manufacturers face a fresh gas squeeze with prices set to soar by 2030 as the state’s production dries up, with several LNG import plants required to help meet the shortfall.

Gas production in Victoria is estimated to plunge 68 per cent to 96 petajoules by 2030, from 305PJ in 2020, as supply from sources including Bass Strait dwindles, according to consultancy EnergyQuest, while gas prices in Melbourne on a spot basis will soar 37 per cent to $11.05 a gigajoule from $8.05 currently.

Mr Pitt said he expects the three Queensland exporters to keep their commitments to the pact.

“Under the latest heads of agreement, the three east coast LNG exporters have committed to offer uncontracted gas to domestic customers first, with reasonable notice and at competitive market terms. We expect the LNG producers to keep their commitments in good faith.”

Prices have been lower for industrial customers but there have been fewer offers in the market, the ACCC said.

“We are also concerned that there have been significantly fewer offers for gas supply being made in the domestic market recently.”

The difficulty in securing offers beyond 2022 may have been partially caused by uncertainty around the gas code of conduct and the ACCC’s LNG netback price series review, Mr Sims said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout