Gas price fight sparks fears of government intervention

The price fight between gas users and producers is ramping up, with some claiming the spectre of government intervention is undermining the industry.

A battle between big gas producers and users over east coast prices has escalated, with Santos warning major international financiers are worried about government intervention, putting future investment in the industry at risk.

The Morrison government in September said big producers should aim to better meet the needs of commercial and industrial customers through an industry-led code of conduct.

If they ultimately fail to agree on a shared pact, Canberra would consider stepping in and enforcing a mandatory code instead.

Major industrial gas users claim they may have to shut manufacturing plants due to high gas prices and have been lobbying the government to step in with a price mechanism that they argue would ensure a more level playing field.

Ahead of the annual Appea industry conference on Tuesday, producers including Santos fiercely resisted the move, revealing the threat of possible government intervention had started to cause ripples among its lenders and joint venture partners. Santos runs the GLNG and Darwin LNG export plants and is also a major supplier to east coast users.

“Increasingly, our institutional investors, our debt financiers and our joint venture partners from France, Italy, Japan, Korea and Malaysia are inquiring about the potential for federal government intervention in the east coast gas market, indicating that this is a factor in their decision-making processes,” Santos chief executive Kevin Gallagher said in a submission by Santos to the competition regulator which is reviewing pricing methods in the industry.

Domestic gas prices could rise if new investment and supply for the market is not sanctioned, according to Santos.

“Unless producers can be certain that federal government intervention will not undermine their business cases, which assume the ability to recover their cost of supply and an appropriate return on their investments, new gas supply sources to maintain long-term reliability of supply and add competition to the east coast gas market will not be developed,” Mr Gallagher said.

“This outcome would only lead to higher domestic gas prices as the east coast gas market relies on continuous investment in drilling new wells and without the right price signal that investment would cease.”

Frustration grew among several large consumers of gas after a deal between Scott Morrison and big LNG exporters, including Santos, in January avoided formal price controls, which some manufacturers had pushed for but were strenuously resisted by the LNG industry.

Manufacturers including Incitec Pivot and Qenos fought back, telling the competition regulator that its LNG netback formula - effectively the price of LNG shipped overseas less processing and shipping costs - should be amended.

They have called for the removal of an implicit cost premium built in to pay back the cost of the giant LNG export plants used to ship gas to Asian buyers which they say adds $2 to $3 a gigajoule to the price they pay for gas.

“Producers don’t incur these costs in supplying the domestic market, therefore domestic consumers should not be funding export capital. LNG export capital should be recovered through long term export contracts, not through domestic customers,” Qenos said in its submission.

Shell, one of Australia’s biggest gas producers and foreign investors, and operator of the QCLNG export project in Queensland, rubbished the proposal.

“Changes such as this would significantly disadvantage LNG producers who have already sunk large capital costs in building LNG plants and associated infrastructure. It could have flow on implications for further developments, particularly in new provinces or hubs, where material development scale is required to unlock these resources,” Shell said.

A major divide has also opened up between the two sides over pricing mechanisms.

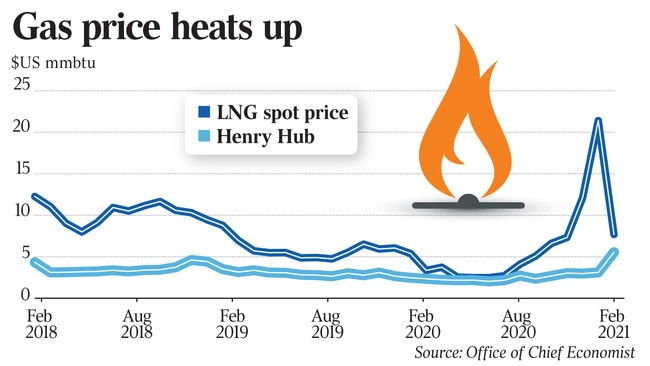

Big users want to establish prices with America’s Henry Hub model which traditionally tracks at low levels given the much bigger scale and abundance of gas in the US market.

The gas sector argues this is an unfair comparison because Australia has nothing like the scale or depth of the US gas markets.

Incitec Pivot called for the creation of a new benchmark it has dubbed the Australian Domestic Netback Price to ensure a fairer deal for big users.

The new pricing method “could easily be derived from Henry Hub after similarly adjusting for transport costs into Asia and then removing all LNG and pipeline capital and fixed costs.”

However, Origin Energy countered that Australia should not be using a pricing benchmark unrelated to the east coast.

“While market dynamics in the USA do influence international LNG markets, the Henry Hub is a netback price that is influenced by the supply and demand balance of its own geographical area. It does not represent a location where Australian LNG producers deliver their cargoes, and therefore should not be considered in any opportunity cost calculation,” Origin said in its submission.

While the Prime Minister has recently signalled the government would not intervene on prices, gas producers have been concerned his energy minister Angus Taylor - whose mission it is to keep consumer prices low - was not of the same view and may force price controls on the industry.

However, Mr Taylor confirmed in May that he did agree with the Prime Minister the market should drive prices.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout