Japan’s green target threatens Australian LNG, coal

Australian LNG and coal exports to Japan could fall by a third by 2030 after Tokyo mandated new green power targets

Australian LNG and coal producers face a new threat from one of their biggest export markets after Japan declared plans to drastically cut its use of the two fossil fuels by 2030.

Japan in April pledged to nearly double its target for cutting carbon emissions by the end of the decade and has followed that up by sharply cutting its planned use of the two commodities in favour of renewable energy.

Its use of LNG will fall by nearly half by 2030 while coal is set to decline by 40 per cent from current levels, according to a draft government report released on Wednesday.

The move “will send a shiver down energy majors’ spines. Given large LNG investments, they may have discounted the pace for renewables to displace gas in power generation,” Bloomberg Intelligence analyst Will Hares said.

Australia’s LNG exports to Japan will fall by a third to 20m tonnes in 2030 from 2019 levels while the nation’s thermal coal shipments will decline by 32 per cent to 53m tonnes at the end of the decade according to forecasts from Simon Holmes à Court, a senior advisor to the Climate and Energy College at Melbourne University.

Japan jostles with China as Australia’s largest LNG export market with $21bn of LNG shipped to Japan last year while nearly $10bn of Australia’s annual thermal coal exports are sent to Tokyo.

The Asian nation plans to reduce its use of LNG to 20 per cent of the overall power mix by the end of the decade from 37 per cent in 2019 and compared with its previous 27 per cent target. Coal will fall to 19 per cent from 32 per cent last year and against a prior 26 per cent goal.

Renewables will more than double to between 36-38 per cent of electricity supply from 18 per cent in 2019 and an existing 22-24 per cent target by 2030.

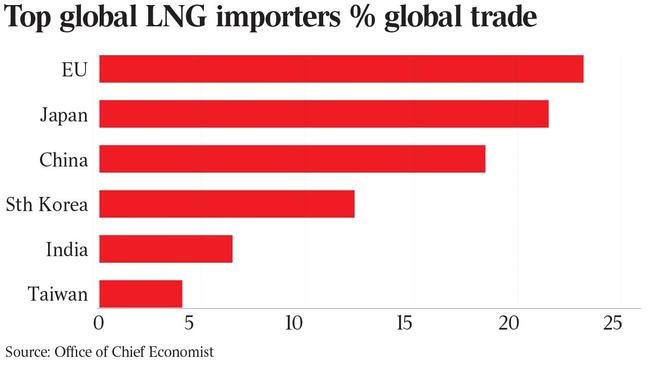

Relegating LNG as part of its power mix was not expected by the market given Japan has for decades been the world’s top LNG importer and seen as a stable market for both producers in Australia and its rival, Qatar.

“Japan’s announcement that it aims to reduce the share of gas in electricity generation by 45 per cent is a nail in the coffin for Australia’s LNG exporters,” Australasian Centre for Corporate Responsibility climate director Dan Gocher said.

Australia’s biggest LNG producers facing a hit from the move could include Inpex’s 6.1m tonnes sent to Japanese customers from its Ichthys plant, Chevron and Woodside Petroleum’s Wheatstone plant, Woodside’s Pluto facility and Santos’ Darwin LNG.

“As many of these are long-term contracts, Japanese customers may be forced to on-sell that gas into an oversupplied market, putting pressure on prices,” Mr Gocher said.

“BHP, Oil Search, Origin, Santos and Woodside all have significant gas expansion plans. There now hangs a huge cloud over the economic viability of those plans, especially Barossa and Scarborough, and Woodside’s planned selldown of Pluto LNG.”

Santos, however, had already signed a decade-long supply deal for Barossa gas with Japan’s Mitsubishi in December which would run into the 2030’s and is unlikely to be affected by any policy changes.

Hydrogen was also added to Japan’s power mix plans by 2030 but is only set to provide 1 per cent of overall supply, despite the nation’s ambitious plans to target the fuel as a potentially major new source.

Japanese buyers and investors are also expressing strong interest in Santos’ Moomba carbon capture and storage project and the potential for zero emissions hydrogen made from gas, Santos chief executive Kevin Gallagher said.

“We see Japan’s energy transition to net zero emissions as a huge opportunity, building off our historical relationships and into new clean energy products such as CCS and hydrogen,” Mr Gallagher said.

Woodside Petroleum also defended the prospects of its $16bn Scarborough and Pluto gas expansion from Japan’s plans.

Japanese utilities would be among potential buyers of gas from the project, waiting to be sanctioned by the end of this year, but Woodside pointed to strong demand late this decade with half its gas already sold to buyers.

“Woodside is seeing strong demand for LNG in Asian markets, including Japan, as customers consider their energy requirements for the second half of this decade. This timeframe supports the development of Scarborough and Pluto Train 2 and we have already contracted half of our expected equity offtake gas from the project,” a Woodside spokeswoman said.

Gas from Scarborough will have a low carbon intensity while Woodside also touted its tie-up with Japanese companies to develop clean fuel ammonia exports to Tokyo.

The Australian Petroleum Production & Exploration Association, an industry body, also expects Australia’s “long and stable trading relationship” with Japan to continue and pointed to strong demand and the emergence of hydrogen production.

“Australian LNG is an important part of a cleaner energy future and will still be needed in Japan to power their large manufacturing industry,” Appea chief executive Andrew McConville said.

China overtook Japan as Australia’s biggest LNG export market in the 2021 financial year, according to consultancy EnergyQuest, although reports emerged in May that several Chinese importers have been told to avoid buying supplies of gas from Australia amid trade tensions.

Japan, China and South Korea have already made plans for net zero ambition, seen threatening demand for two of Australia‘s biggest export earners. The three countries combined buy two-thirds of Australia’s coal and three-quarters of LNG exports.

Still, Japan and South Korea’s goals have been described as “hugely aspirational and daunting” by consultancy Wood Mackenzie given both rely on hydrocarbons for 80 per cent of their primary energy supply. That will have to halve to a 40 per cent share by 2050 for the economies to meet their targets, a worrying sign for the future of Australia’s commodity exports.

Japan is aiming for a 46 per cent cut in emissions by the end of this decade compared with its previous 26 per cent goal which was based on 2013 pollution levels.