Election 2025: Dutton gas plan will drop prices, says BlueScope

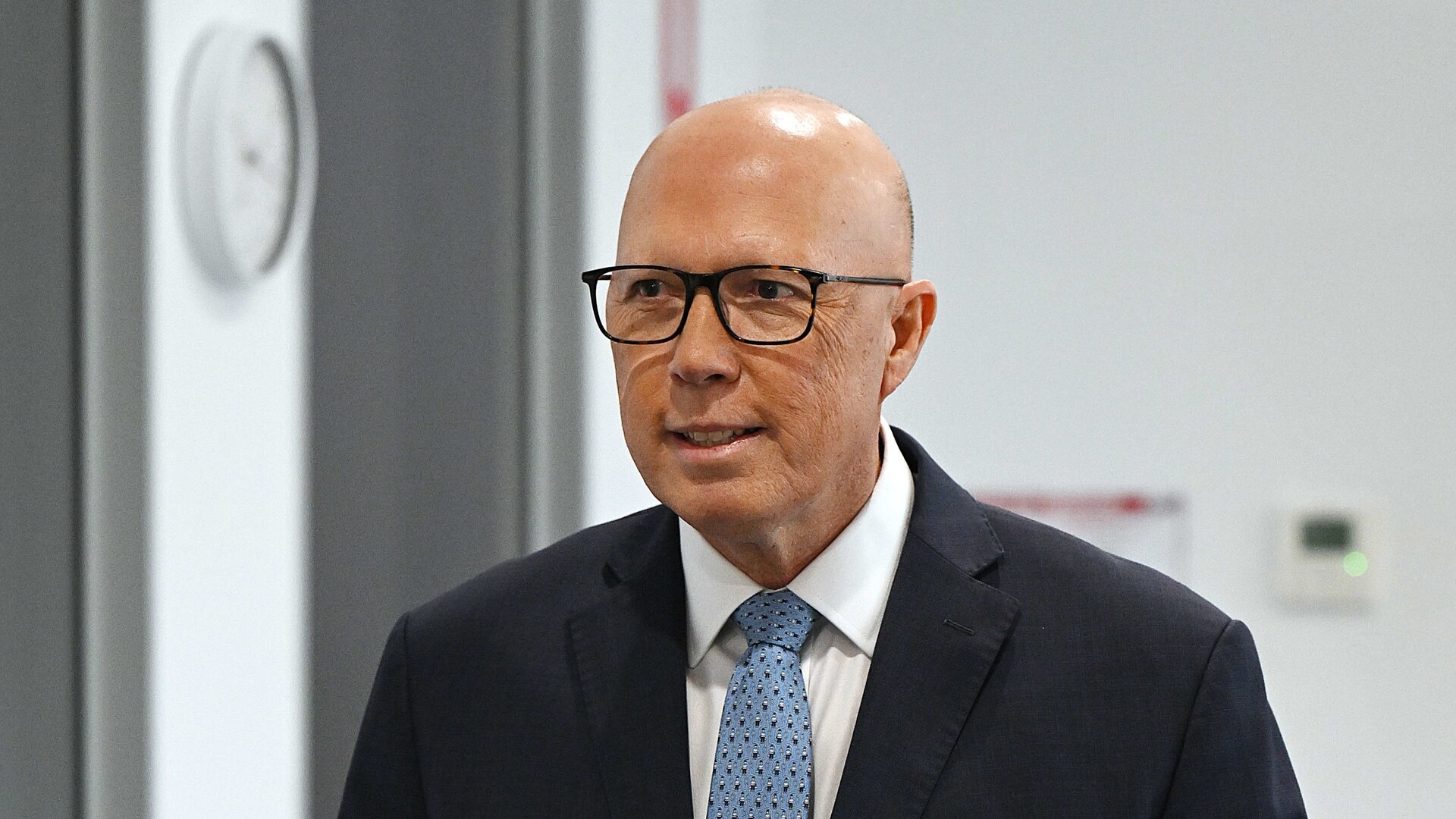

Australia’s largest steelmaker, BlueScope, has backed Peter Dutton’s election plan to bring down gas prices through a reservation scheme.

Australia’s largest steelmaker, BlueScope, has backed Peter Dutton’s election plan to bring down gas prices through a reservation scheme as business chiefs say Anthony Albanese must come clean on Labor’s ability to meet its goal of doubling renewable energy by 2030.

Energy has emerged as a critical election campaign issue with voters set to decide between the Coalition’s “Australian gas for Australians” scheme and Labor’s plan to deliver a green energy-dominated grid by the end of the decade.

The Prime Minister has refused to say if he will model how his second-term agenda will affect power prices over the next three years after Labor bungled its calculations at the last election and failed to meet its pledge of a $275 cut this year.

The Opposition Leader was also notably quiet on its $331bn nuclear plan set to come online in the mid-2030s, instead making the case for short-to-medium-term energy certainty and the promise of lower gas and electricity prices.

The split over energy between the parties follows a fresh warning from the consumer watchdog over the threat of gas shortages on Australia’s east coast hitting this winter.

BlueScope, one of the largest energy users in NSW, has long advocated to keep gas for local use as the Coalition pledged the controversial move would deliver a major price cut from more than $14 a gigajoule to $10GJ.

The steelmaker said the reservation model was a cheaper alternative than importing LNG. “We do not believe that imported gas can fulfil this need because it will be too costly once liquefaction, transport, storage and regasification costs are included,” a spokesman said.

Manufacturing Australia, which represents businesses including NSW’s largest electricity user Tomago Aluminium, said the Coalition’s gas market reforms were in the national interest.

“These are necessary and welcome measures,” said the group’s chief executive Ben Eade. “Our message is clear: If we want Australian manufacturing jobs, we need competitively priced gas.”

However gas producers warned Mr Dutton’s proposal might spark an investment strike and worsen a supply squeeze. They described the move to impose an east coast gas reservation regime as a damaging market intervention.

Australian Energy Producers chief executive Samantha McCulloch said: “Industry welcomes the Coalition’s commitment to fast-track new gas supply and streamline approvals, but the benefits of these reforms risk being undermined by deliberately oversupplying the market. This glut of gas will deter investment in new supply and undermine our trading relationships.”

Federal Labor’s scant reference to its own 82 per cent renewable energy target and broader climate change ambitions also came under fire from business leaders.

Paul Broad, former chief executive of the government-owned Snowy Hydro, said Energy Minister Chris Bowen’s commitment to the energy transition strategy was now a political liability. “They have put Bowen in a box and they won’t let him out,” Mr Broad said.

“They won’t talk about climate change at all. They are going soft on the environment, they have to as they know the public is angry.”

The Coalition has sought to capitalise on the public anger and has moved to link the rise of renewables to energy price increases even as independent analysis continues to show zero emission sources are the cheapest form of new energy.

Lindsay Partridge, former chief executive of Brickworks, said the Coalition’s plan to lower gas prices would be welcomed by heavy industry.

“I do find it hilarious that some politicians talk about helping manufacturing and then they do everything they can to hinder it,” he said. “Energy is critical to manufacturing, it sets the price of goods that we all consume.

“I think we all know that we won’t get to the 2030s targets and it serves Labor to go quiet on them ahead of the election.”

The role of gas shapes as a critical election issue, with Mr Dutton pledging to curtail between 50 and 100 petajoules from being exported to lower domestic prices for manufacturing and households.

The plan wedges Australia’s LNG industry – primarily Australia Pacific LNG, in which Origin Energy owns a near third stake, and Shell’s Queensland Curtis LNG. Santos, which operates the third LNG export facility on the east coast, will escape a clampdown as all of its gas is contracted. The Coalition has promised to force domestic reservation limits only on uncontracted gas.

Both Origin and Shell declined to comment, but other industry sources said both would be unfairly punished.

Josh Stabler, managing director of consultancy EnergyEdge said the policy threatened to exacerbate the problem rather than solve it.

“The issue is that the largest gas producer in the southern markets, the Longford Gas Plant, will decline from a supply market share of 68.7 per cent in calendar year 2022 to 0 per cent in 2034,” he said. “Implementing a policy that artificially intervenes and pushes down the gas prices will only increase demand and reduce supply – the exact opposite of what is currently required.”

Squadron Energy, owned by billionaire Andrew Forrest, has dismissed the Coalition’s gas plan as a waste of taxpayer money.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout