Analysts cast more doubt on the details of Fortescue’s green hydrogen and ammonia plans

Fortescue has finally delivered its long-awaited investment decision on green hydrogen projects but it’s only served to heighten concern among the doubters.

Doubts are growing about Fortescue’s ability to deliver on its much-hyped green hydrogen and ammonia ambitions, with analysts and even one of the company’s own partners questioning the viability of Fortescue’s plans and a German court ruling throwing doubt on a key European export agreement.

Fortescue announced it had given the go-ahead to two green energy projects ahead of its annual shareholder meeting on Tuesday – a $US550m liquid hydrogen plant in Arizona in the US, capable of producing 100,000 tonnes of green hydrogen a year, and a smaller $US150m plant in Gladstone in Queensland producing up to 9000 tonnes a year.

The announcements underwhelmed analysts, with a Goldman Sachs research note last week noting Fortescue had fallen short of its target of giving the green light to at least five projects in 2023 and had again given no financial guidance on the projects it had approved.

“FMG is yet to complete engineering studies on either project, has no sales offtakes in place and has provided no project economics or financial metrics,” said Goldman analyst Paul Young.

A spokeswoman for Fortescue dismissed the doubters on Friday, saying the company’s “steely fiscal discipline is what has turned us into the highest total shareholder return company on the ASX by many times our peers, delivering $35bn in dividends, and Australia’s third-largest taxpayer.

“If we listened to the analysts in the early days of Fortescue we would not be the $80bn market capitalisation major we are today. We are starting a new industry from scratch that will bring immense value to our shareholders,” she said. Noticeably absent from the list was the company’s Gibson Island joint venture with Incitec Pivot, long lauded as the most likely local project to be given the go-ahead. Under the agreement between the two companies, Fortescue would build a hydrogen production plant and Incitec would return its mothballed ammonia plant to production using Fortescue’s hydrogen.

Fortescue blamed structurally high renewable power prices for the decision to rework engineering and design studies on the Queensland plant, and did not give an estimated date for a final investment decision.

Neither company has given an estimated cost of building and operating the plant, but a separate Goldman note in early November tipped a capital cost of $US1.5bn and production costs of about $US5.50 to $US6 a kilogram of hydrogen – well above the $US2 a kilogram the sector is targeting as a competitor for natural gas as an industrial feedstock.

At renewable energy costs of about $70 a megawatt hour, Goldman Sachs analysts tipped the plant to be loss-making, saying it would need to sell ammonia at about $US1500 a tonne – compared to current spot prices of about $US625 a tonne – to deliver a return.

The Australian understands a key factor in the decision to put the project on the backburner was Fortescue’s failure to find an external buyer for ammonia from the plant.

Australian explosives major Orica – Incitec’s chief competitor – is believed to be among those that turned down an offtake agreement, after Fortescue refused to guarantee it would then buy explosives produced using the plant’s ammonia for use in its West Australian mining operations.

Incitec declined to comment on the Fortescue decision to shelve a decision on the project last week, other than to say it “continues to progress the front end engineering design workstreams” for Gibson Island.

But the company’s own climate change report, released the day before Fortescue’s announcement, said “green hydrogen is not expected to be price competitive with natural gas for ammonia made for traditional uses until around 2040”.

“Ammonia made with green hydrogen has the potential to contribute significantly to the decarbonisation of energy systems and heavy vehicle transport by offering a practical, carbon-free way to store and transport the hydrogen in a safer form (as ammonia) as well as a green fuel in its own right,” Incitec said.

The viability of the green hydrogen project approved by the Fortescue board in Gladstone, using electrolysers produced at Fortescue’s nearby manufacturing plant, is also unclear – though industry sources suggest it may be able to make money under some power prices.

The first phase of the project is only 60 per cent of its eventual 50MW capacity and, rather than lock in a power contract – which would be on offer at the same prices as those for Gibson Island – Fortescue said it would initially buy cheap power when available on the spot energy market and run the plant intermittently.

Extrapolating the figures used by Goldman Sachs analysts for Gibson Island suggests that the Gladstone plant could produce hydrogen for around $US2 a kilogram at power prices of around $20 to $25 per MWh – although that would not factor in the long-term costs of Fortescue’s $US150m capital investment.

Figures released by the Australian Energy Market Operator in October suggest Fortescue could have run the plant for about a quarter of each day in the September quarter at those pricing levels, with Queensland wholesale energy prices dropping into negative rates for about 23 per cent of the day. But that was a substantial jump for the September quarter in 2023, with negative wholesale rates only available in the period for about 10 per cent of the time in the same quarter for the previous four years.

At the same time Fortescue’s European strategy faces a new threat, after Germany’s constitutional court threw a spanner into the works of the country’s plans to incentivise a switch to hydrogen for power and industrial use. The German court ruled that a government plan to switch €60bn of unused debt from Covid-19 pandemic support measures to the country’s climate and transformation fund was unconstitutional, forcing a major rethink of the way the country will find funding – estimated at close to €19bn – to support the growth of the hydrogen sector.

While it is not clear how the flow-on effects of the ruling could impact Fortescue’s European plans, this week it said it was fast-tracking studies on a 300MW green hydrogen facility in Norway for an investment decision.

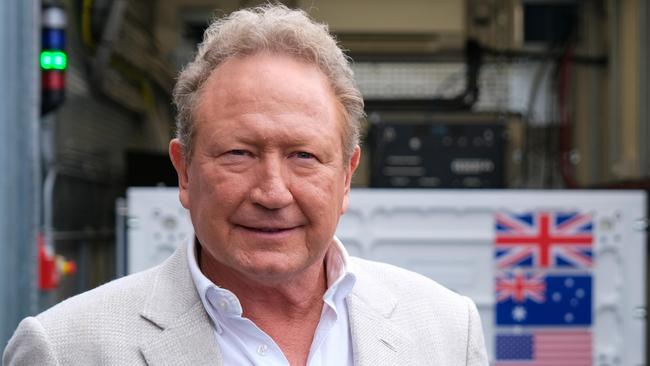

In March 2022 Fortescue founder Andrew Forrest announced a memorandum of understanding with power provider E.ON to supply up to 5 million tonnes of green hydrogen a year into Germany by 2030 – a third of the hydrogen production promised by Fortescue by the end of the decade – in a deal Dr Forrest said would cost up to $US50bn to execute.

A few months later Fortescue signed a $US127m ($195m) deal to take a stake in an LNG import terminal in Germany, with plans to repurpose the facility for hydrogen imports.

The Fortescue spokeswoman said the German court decision did not change the global need for green hydrogen as a clean fuel.

“Green hydrogen from Australia … will have a key role to play in Germany’s transition,” she said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout