Skydance deal for Paramount could secure Network 10’s future

The parent company of Australia’s Network 10, Paramount Global, is hoping to close a deal in which US studio Skydance Media will take control of the troubled media giant.

The parent company of Australia’s Network 10, Paramount Global, is hoping to close a deal in which US studio Skydance Media will take control of the troubled media giant in the first half of the year.

There are still a few regulatory hurdles to clear – affecting any decision could be the outcome of a lawsuit President Donald Trump filed just days before the election against Paramount-owned CBS, demanding $US10bn ($15.8bn) in damages over the US network’s 60 Minutes interview with then vice-president Kamala Harris.

The change of ownership is set to close in the first half of calendar 2025, with the “New Paramount” indicating it could keep and nurture the Australian business.

“The only thing that we know at the minute is the transaction will close in the first half of 2025, with the usual conditions and necessary regulatory approvals,” Beverley McGarvey, Paramount Australia and New Zealand’s president of Network 10 and head of streaming and regional lead, told The Australian. “We’re still in that process. For us at the minute, it’s business as usual.”

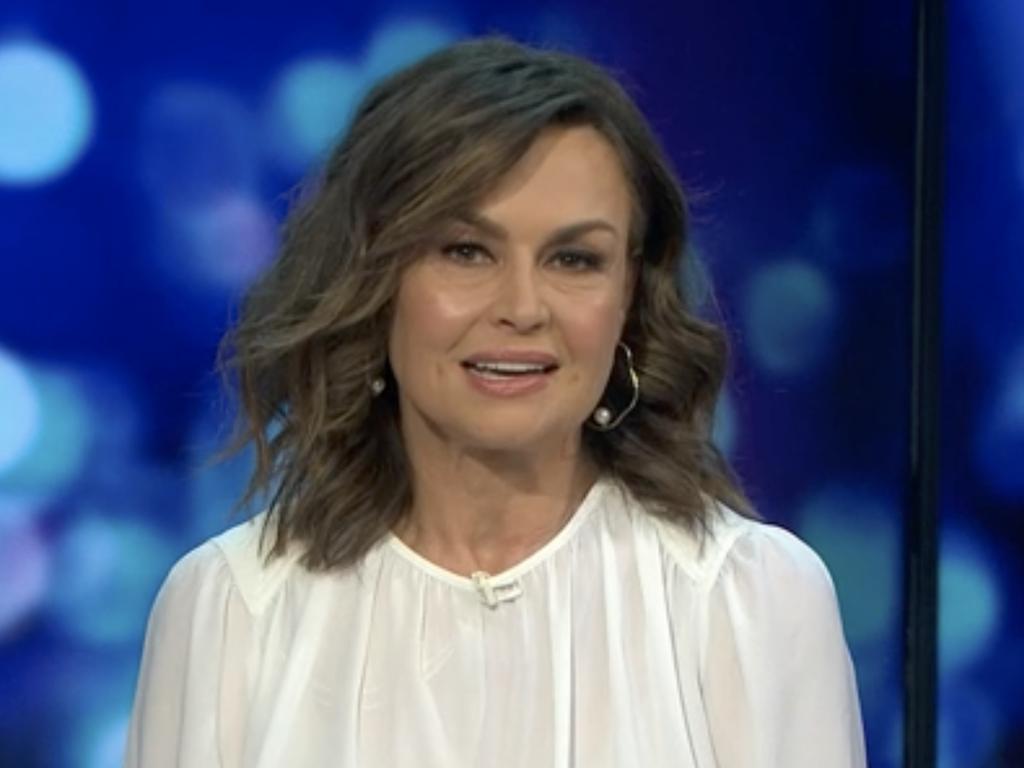

In a sector where performance is measured by the minute, and disruption has been rife, Ms McGarvey is a survivor.

She has steered the business since 2020, having first joined as head of programming in 2006.

Leading a business where the changing face of television is key to success is fraught with obstacles. Ms McGarvey’s counterparts at Seven, Nine and ABC have all departed in the past 10 months.

The core of the business is the Network 10 brand, with people watching either live or on the 10 play BVOD service.

The newer arrival is the Paramount+ streaming service.

While Seven and Nine devote January to major sports rights, 10 starts its annual parade of reality franchises.

I’m A Celebrity … Get Me Out of Here! offers a January alternative for viewers not seduced by cricket or tennis. The 2025 series launched with a national average just over 900,000, up 12 per cent year-on-year, and its best audience since 2022.

Advertisers look for longer-term performance, but they also understand, Ms McGarvey explained, that early figures are “really important”.

“It’s key to get people in to sample the show,” she said.

Having strong programming elsewhere is not necessarily a negative, she added.

“Sometimes when there’s a big night of TV, our ratings actually go up, because there’s more people watching TV. They’re channel hopping, sampling what’s on different networks.”

In a digital world, a broadcast licence doesn’t mean what it used to. Critics who wonder about the viability of three commercial TV networks in Australia don’t grasp the competitive landscape, suggested Ms McGarvey.

“It’s important for the advertising community and for the production community to have a strong, competitive industry,” she said. “Obviously, there is more competition with three. All of the commercial broadcasters have evolved their businesses. We don’t see ourselves in a landscape with only two competitors. We see ourselves as a multi-platform video entertainment company.”

Competitors in that space range include YouTube, TikTok, Netflix and Disney+.

“For the advertising community, for the creative community, it is important to have competition so that you continue to get strong Australian content,” Ms McGarvey said.

The content is ad-funded across 10, 10 play and increasingly on an ad tier on Paramount+.

“There is premium ad-free content for people who are willing to spend a bit of money,” explained Ms McGarvey. “There is a lighter ad load for those wishing to spend a little less.”

Network 10 remains a key part of the offering because of its audience potential.

“Even on the worst night ever, the reach that free-to-air has is phenomenal,” Ms McGarvey said.

“When you combine the reach of Paramount in Australia on an annual basis, it was 94 per cent of the population in 2024 across all of our services. In a month on Network 10, it’s 14.1 million Australians. Advertisers must buy a lot of different things to get that kind of reach on different platforms.”

As well as helping advertisers build brands and shift inventory, Network 10 has been key to the success of Paramount+ in Australia. Not just by carrying marketing messages for the streaming service, but the sharing of content.

That sharing helps the business case for Paramount ANZ’s content investment.

That ranges from drama such as two series of Last King of the Cross and NCIS: Sydney to reality TV staples like Australian Survivor and MasterChef Australia.

The international pipeline from the parent company offers much for viewers too. Key to that is the prolific output of Taylor Sheridan, the man behind many global hits from the Yellowstone universe (including 1883, 1923 and the forthcoming The Madison and 1944) to Lioness with Nicole Kidman, and Landman.

Paramount Australia finally moved recently to take over the regional TV licences held by SCA which carry the Network 10 signal into Queensland, Southern NSW and Victoria. The deal seems a good one for 10 with payment for the licences coming from ad revenue. SCA also gets a profit share.

That deal should close in February 2025. Network 10 will then control its regional signal in all markets except Northern NSW.

Advertisers are expecting that too might be sorted soon, allowing 10 to offer commercial partners a national footprint.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout