Seven renegotiates debt terms with banks

Seven West Media’s renegotiated debt eases liquidity pressure as it works to improve its embattled TV and newspaper operations.

Seven West Media, the media company controlled by billionaire Kerry Stokes, has renegotiated the terms of its $750m debt facilities with its bankers, easing liquidity pressure as chief executive James Warburton works to turn around its embattled television and newspaper operations.

Most importantly, the changes give Seven access to $250m during the coronavirus crisis, which Mr Warburton said provides “funding certainty” during its transformation plan over the next 18 months.

Mr Warburton, who took the helm last August, said the group is “working tirelessly to transform both our television and newspaper businesses”.

“While we are focused on achieving the lowest possible cost-base, our energy has been directed to driving audience and winning the content battle in both television and newspapers to deliver ratings, revenue and cash flow,” Mr Warburton said in a statement.

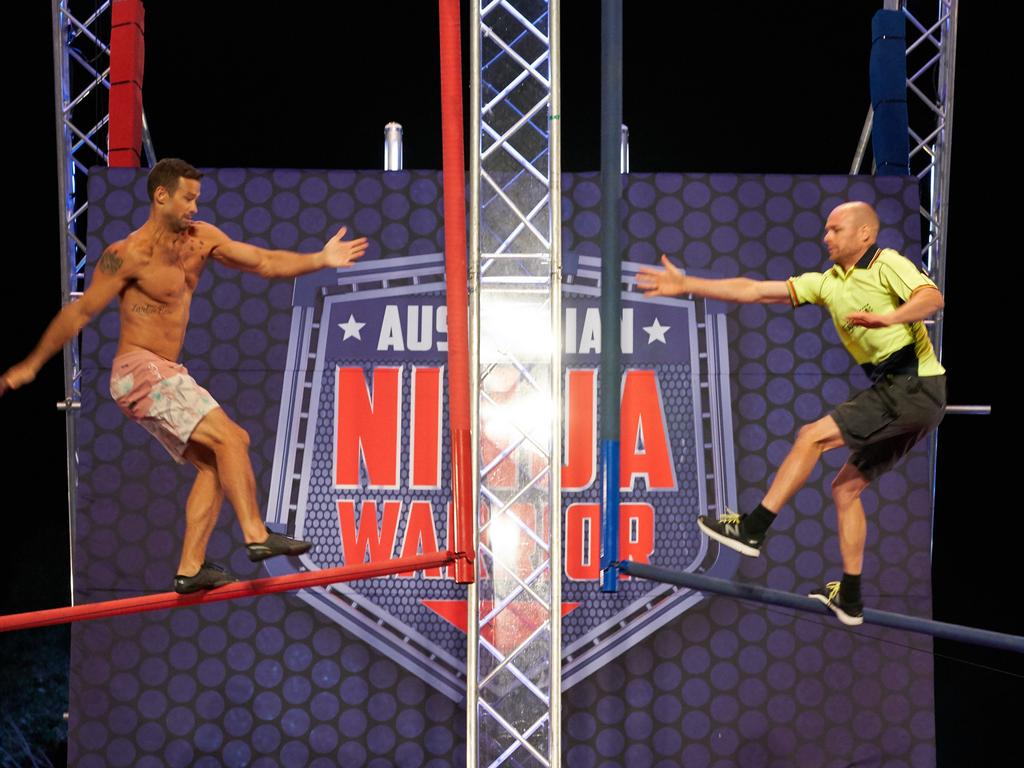

“Our content-led growth strategy has come to life with the success of Big Brother, combined with the strength of the AFL and our programming spine throughout the day.”

Seven has identified $170m in cost cuts across the group including in AFL, with the majority of benefits to be delivered in the 2020 and 2021 financial year.

As a result, Seven’s television cost base will drop to its lowest level since 2007 following a year-on-year reduction of 20 per cent, and its lowest headcount since 2003.

Seven said additional temporary cost savings of $50m were made in the 2020 financial year to offset the major impact of the difficult advertising markets.

Mr Warburton said the group remains focused on cutting its debt pile, which stood at $541.5m in February, with a “number of significant asset sale processes underway”.

Seven is also looking to offload TXA, a joint venture with Nine Entertainment that owns broadcast towers, plus its Ventures portfolio, which includes investments in lender SocietyOne, GP booking platform Health Engine and online job marketplace Airtasker. It’s also looking to sell Australia’s biggest TV production company, Seven Studios.

The group has already raised $150m from the sale of its Pacific Magazines business, properties in Western Australia and Queensland, plus some radio stations in WA since Mr Warburton came on board.

A Seven spokeswoman declined to name Seven’s lenders, but The Australian understands there are eight, including Australia’s top four banks.

Seven will provide further details on its transformation plan and revised debt facilities when it reports its 2020 financial results on August 25.

Seven shares were up 4.3 per cent to 96c on the ASX on Thursday afternoon.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout