Nine falls to $590m annual loss as COVID-19 takes toll

TV, digital and Domain have encumbered Nine with a major impairment that helped swing the media group to $590m loss for 2020.

Nine Entertainment has plunged into the red as the media company booked costs totalling $665m related to its free-to-air television network, online real estate group Domain and its digital operations, which were hammered by the coronavirus crisis.

The group, born out of a $4bn merger with Fairfax Media nearly two years ago, is looking to slash cash costs by $225m this calendar year across its Nine Network, radio stations and metropolitan newspapers. It has already made some savings from the recent renegotiation of its NRL broadcast contract.

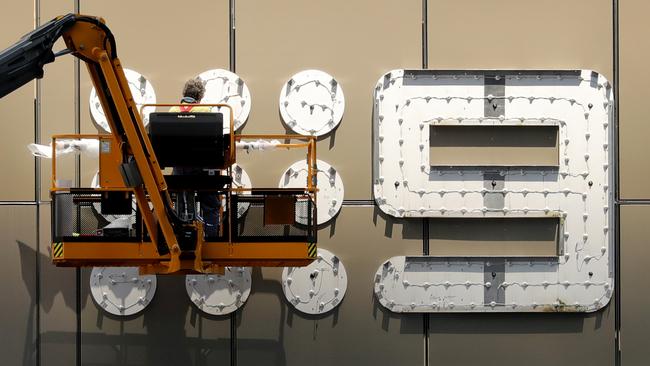

Nine has also earmarked the reduction of around $230m of structural costs from its broadcast and publishing operations by the 2024 financial year as its TV operations moves to its new headquarters in North Sydney, which also houses its mastheads. It’s also looking to spend less on TV shows such as The Voice, which cost $40m to produce, plus newspaper printing and distribution.

After a horrid year for Nine and the broader media industry, chief executive Hugh Marks said the group would focus on ramping up its streaming services Stan and 9Now, which would see staff moving around the business.

“We’re investing in Stan, we’re investing in 9Now and we’re looking for efficiencies in some of the legacy businesses,” Mr Marks told The Australian.

“Rather than saying we’re losing jobs, people will be changing into new areas and I think that’s just gonna be a constant change over the next decade really and that’s the same with probably any business that’s in media.”

Nine has forecast that 60 per cent of its underlying earnings will come from its digital businesses, including its near 60 per cent stake in Domain by 2024, and around 35 per cent of its group revenue from subscription.

Mr Marks ruled out the sale of any assets, in stark contrast to Seven West Media which is selling businesses as part of its three-year restructuring plan, including paying down its hefty debt. He said management are working to get the traditional media businesses back to profit levels reported a year ago.

Nine on Thursday swung to a net loss of $590m for the year to June, hit by impairment charge of $588.7m following the fallout of coronavirus crisis on the TV, digital advertising and property markets. That compares with a net profit of $221.2m a year earlier.

For 2020, Nine’s underlying earnings fell 16 per cent to $355m, with revenue from continuing operations down 7 per cent to $2.17bn.

Its broadcast operations, consisting of TV network, radio stations and its broadcast video-on-demand platform 9Now, reported a 35 per cent drop in full-year earnings to $179.1m with revenue down 11 per cent to nearly $1.14bn.

Nine Network, the biggest earnings contributor to the company, booked a 42 per cent drop in earnings to $123.8m.

Earnings at its radio business, which lost its most high-profile broadcaster Alan Jones in May and subsequent host changes at Sydney’s 2GB and Brisbane’s 4BC, plunged 78 per cent to $5.9m.

Nine’s digital and publishing division, including its newspapers, Pedestrian Group and CarAdvice, booked a 19 per cent fall in earnings to $76.2m. Its Metro Media unit, which includes former Fairfax titles, The Australian Financial Review and The Sydney Morning Herald, reported a 10 per cent fall in earnings.

Earnings at Domain, in which Nine holds a near 60 per stake, dropped 17 per cent to $77.8m.

9Now and subscription streaming service Stan were the standout performers in the 2020 financial year, recording double digit earnings amid strong demand for at home entertainment during the pandemic.

9Now’s earnings rose 36 per cent to $49.4m, while Stan booked earnings of $29.9m with 2.2 million active subscribers. However, Stan’s costs rose 19 per cent amid fierce competition, including new entrants Disney+ and Binge.

Mr Marks expects continued profit growth at Stan, based on the subscriber momentum, and said there would be an “opportunity” to increase the price on its premium tier subscription.

Nine’s results come two days after Kerry Stokes-controlled Seven posted a near 49 per cent drop in annual earnings to $129.6m, hurt by a 14 per cent fall in revenue to $1.23bn as companies slashed ad spending during the coronavirus crisis.

Amid a volatile ad market, Seven is looking to cut costs across its free-to-air TV network and newspapers and offload more assets, as part of efforts to pay down its $480m debt pile. That compares to Nine’s net debt of $291m at the end of June.

Nine declared a final dividend of 2c a share, taking the total for the year to 7c. That’s 30 per cent down from last year’s dividend of 10c. Seven suspended dividend payments in February 2018.

Nine shares closed down 2 per cent at $1.72 each.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout