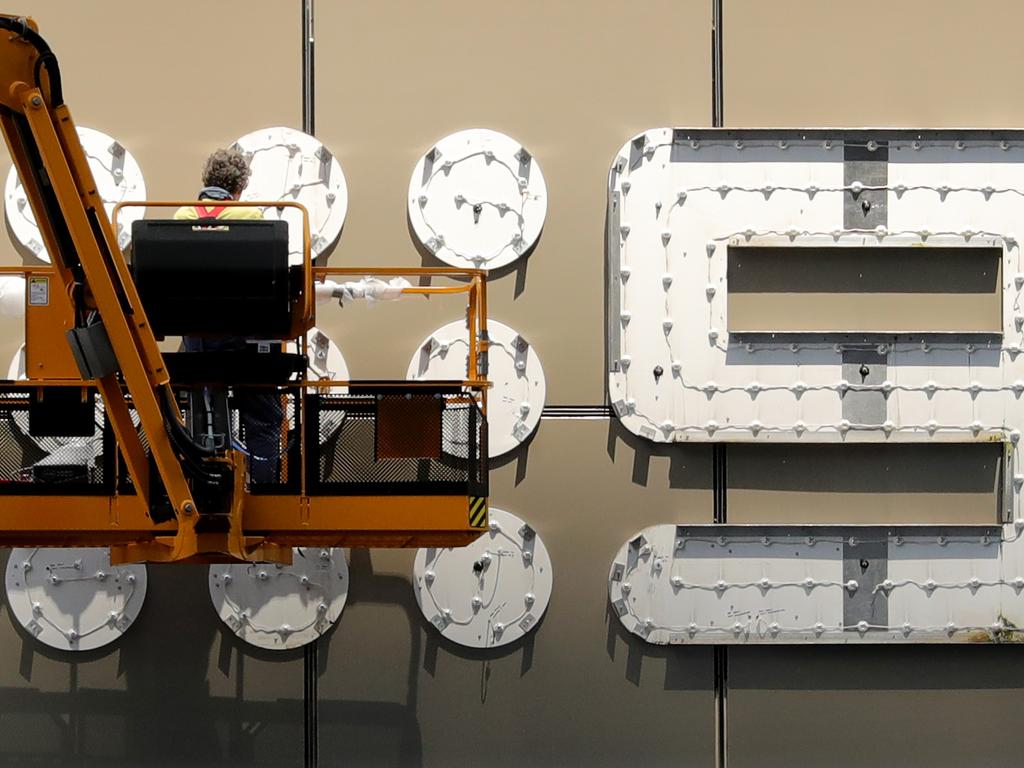

Nine board faces questions over $2m bonus for Marks

Nine’s board faces serious questions over Hugh Marks’s resignation after asking investors to back a $2m bonus for him — two days before he quit.

Nine Entertainment’s board faces serious questions in the wake of Hugh Marks’s resignation after asking investors to back a $2m long-term bonus for the departing chief executive — two days before he resigned after his workplace relationship became public.

Mr Marks will walk away from a potential $5m payday, approved at the company’s annual general meeting on Thursday. Mr Marks resigned on Saturday after a special meeting of the Nine board discussed his relationship with a former colleague who reported directly to him.

His departure was not mentioned at the Thursday meeting, but came a day after he confirmed to the Nine-published Sydney Morning Herald that he was in a relationship with the company’s former commercial managing director Alexi Baker, who departed in October.

Mr Marks’s confirmation to his own masthead came before the Sunday Telegraph was due to expose the relationship.

But Mr Marks, who took the top job at Nine in 2015 and stayed at its helm after the broadcaster merged with Fairfax Media, could risk millions of dollars in remuneration if he is found to have breached his obligations or if the board finds the awards granted in recent years were not justified.

When Nine chairman Peter Costello was notified the relationship was now under serious scrutiny — company insiders say he knew before the rest of the board — the former federal treasurer did not respond to calls.

On Thursday, Mr Costello was specifically asked about previous reports in the Sunday Telegraph that suggested Mr Marks was in a relationship with his executive assistant Jane Routledge.

Despite being photographed picnicking with Ms Routledge, Mr Marks denied any relationship and Mr Costello said he didn’t believe his chief executive had breached any company policies.

Nine has yet to inform the sharemarket of Mr Marks’s departure, although a notice is expected before trade begins on Monday. Mr Marks is expected to stay until February and says he will be remain in the job “to ensure a smooth transition”.

Under the terms of his contract, Mr Marks was due to pocket a fixed salary of $1.55m this financial year, and was in line for a maximum $2.325m bonus as well as the vesting of performance rights worth $1.43m — based on Nine’s current share price — as part of a long-term incentive plan.

Nine investors overwhelmingly approved two share grant proposals for Mr Marks: the first to give him extra performance rights for his 2020 salary package and another $1.94m in performance rights for the current year, which would have been tested against conditions out to 2023.

Despite the difficult trading conditions — and the coronavirus pandemic — Nine said it was performing better than expected, with earnings up 30 per cent. While Mr Marks’s pay measures passed the meeting, influential American pension fund CalSTRS — which has $US254bn ($349bn) in assets under management — voted against the plan and a proposal to re-elect Mr Costello.

Under so-called clawback provisions, Nine has the right to call back grants made under incentive plans “to ensure that participants do not unfairly benefit, including in the event of fraud, dishonesty or a breach of obligation”.

The board may also clawback awards in the case of material risk issues arising or where any information becomes available after awards are granted which suggests that the initial grant or result was not justified.