Speeding ticket for Seven West Media shares spike

Debt-laden media company Seven West Media denies any imminent announcement at the Kerry Stokes-backed operation.

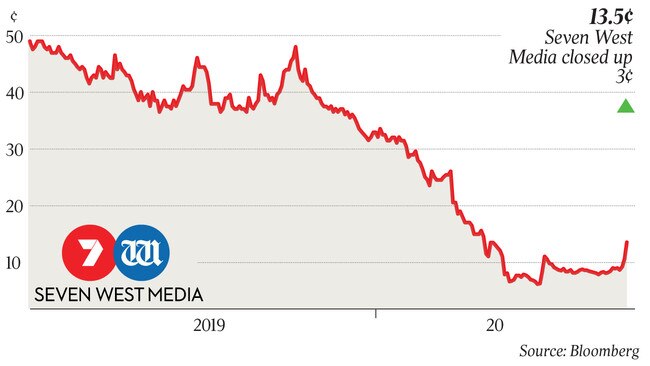

Seven West Media has been questioned by the ASX about conspicuous share price and volume spikes that have seen its stock rise by more than 50 per cent in the past three days.

The debt-laden media company has denied any imminent announcement despite a restructure of the network’s debt expected to be finalised soon.

The Kerry Stokes-backed media company has $569.5m in net debt (as of December last year) which, combined with drastic advertising losses and sports cancellations on the back COVID-19, has dragged Seven’s share price to record lows.

The share price dropped to 6c in April, however in the past three days SWM shares have spiked in price and volume, bouncing from a low of 8.6c on Monday June 1 to an intraday high of 13.5c on June 3. Seven West Media shares closed almost 30 per cent higher for the day on Wednesday at 13.5c, with a market cap of $161.5m as of Wednesday.

The movements attracted the attention of the ASX which sent a price and volume query to the media company asking whether SWM was “aware of any information concerning it that has not been announced to the market which, if known by some in the market, could explain the recent trading?” The ASX also asked Seven whether there was any other explanation they may have for the trading.

Seven West Media responded “no” to both questions, and Seven declined to comment beyond its statement to the ASX on Wednesday.

The Australian reported in April that the corporate debt restructure specialists Grant Samuel had been drafted to assist with discussions around its debt levels.

The Australian understands that while the debt restructure has not been completed, there will be an announcement soon.

Seven sources on Wednesday attributed the price rise to value investors buying up the stock after a sell-off of SWM by some institutional investors.

Seven West Media has also recently sold its Osborne Park property in Perth to Prime West for $74.5m and completed the sale of its Pacific Magazine business to Bauer Media for $40m.

While the AFL kicks off again on Seven next week, it has had to delay the broadcast of the Tokyo Olympics until next year, with Seven paying $170m for Olympics rights over several games.

There had been rumours in the market that Seven was looking to sell its Olympics broadcast rights to the 10 Network, but both networks have denied there is any interest in selling or buying the games.

While Seven West Media continues to struggle, the Stokes-controlled Seven Group Holdings goes from strength to strength announcing on Wednesday a 10 per cent share in building materials giant Boral.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout