CEOs bet on polls to lift TV ad spend

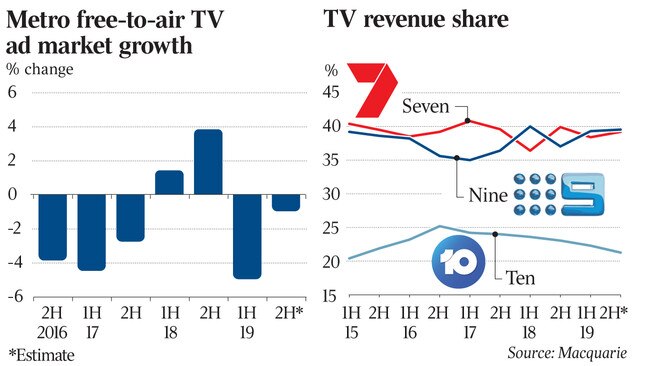

After a disappointing summer, Australia’s top television bosses are betting on an uptick in advertising spending.

After a disappointing summer, Australia’s top television bosses are betting on an uptick in advertising spending driven by political parties ahead of the NSW and federal elections, and a return to the market of the banking sector.

There was a fall in ad spending on free-to-air commercial TV over the summer, despite an avalanche of cricket on Seven and tennis on Nine respectively, but executives are confident conditions will improve through March.

The financial sector, led by the top four banks, is widely expected to ramp up spending on advertising and marketing in a bid to rebuild following the intense bruising from the royal commission, with the final report handed down earlier this month.

Network 10 chief executive Paul Anderson expected ad conditions to improve from next month on free-to-air TV after being “pretty soft” in December and January. “I think that there’s better signs from March onwards, with some of the sectors like banking and finance — more money coming back from them,” Mr Anderson told The Australian.

Mr Anderson also anticipated the NSW election on March 23, and the federal election widely expected to be held in May, to boost ad spending.

“It does seem like there’s some green shoots there,” Mr Anderson said.

Clive Palmer, leader of the United Australia Party, has already spent $3.5 million on his election campaign since the start of the year, taking his total spend to $7m since the beginning of September.

Seven West Media CEO Tim Worner said there were signs of financial companies returning to spending following the recent conclusion of the banking royal commission, which savaged the industry over some of its practices and treatment of customers. Still, Mr Worner cautioned there was low visibility in the TV ad market, one of the reasons behind the broadcaster winding back its annual earnings guidance last week.

“I feel as though we were conservative with our guidance, but things can change and obviously it’s the visibility in the TV ad market at the moment that makes it very difficult to actually make definitive calls,” Mr Worner said.

Apart from election spending by Mr Palmer, the major political parties had so far refrained from spending on TV ads, according to Nine Entertainment CEO Hugh Marks.

“We haven’t seen a lot of activity in the market to this point. I think we started to see some bookings start to come through … over the course of the last week,” he said.

But Mr Marks expected more election advertising to come through as political parties started to target voters.

Grant Blackley, chief executive of TV and radio company Southern Cross Media, said the ad market was “trading shorter than normal” ahead of the federal election, but expected an “uptick in federal government spending” across the board.

“I think once we have a clear outcome in the election, I think we’ll see some return to normality in the way in which the markets were operating,” Mr Blackley told investors.

Mr Anderson blamed difficult TV ad conditions over summer in part on some of the cricket advertising being directed to subscription-TV operator Foxtel, which shared the cricket broadcasting rights with Seven Network following their $1.2 billion deal with Cricket Australia.

CBS-owned Ten lost the broadcast rights of the popular Big Bash League to Seven and Foxtel last year in April after five years.

All other cricket had been on Nine Network for decades before the change, with Nine last year snaring the broadcast rights to several tennis tournaments, including the major Australian Open in Melbourne, over the summer.

The TV bosses are all looking to better leverage their broadcasting and digital operations to squeeze out better returns.

Mr Anderson said Ten’s recently launched subscription video-on-demand services 10 All Access had passed internal expectations, amid a healthy consumer appetite for binge-worthy shows and movies.

“I can’t give you numbers but what I will say is the take-up is ahead of both our expectations and those of CBS, and that’s been after a relatively soft launch in December last year,” he said.

“Like the rest of the strategy, it’s a long- term proposition. CBS has All Access running in the States for five years now, they just had over Superbowl weekend and the launch of Star Trek, their biggest bunch of sign-ups. And over time there will be more original content to come out of Australia.”

10 All Access, which is being sold at $9.99 a month featuring series including CSI and NCIS and has been modelled on parent company CBS’s All Access in the US, entered the local streaming video on demand market in early December. Its main competitors are US giant Netflix and Stan, which is now fully owned by Nine Entertainment following its $4bn merger with Fairfax Media.

Nine last week forecast that Stan will be profitable by June, citing an increase in subscribers and a price increase last month.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout