Ad-supported streaming services draw growing audiences

Australian households are shifting to cheaper ad-supported streaming services rather than cancelling subscriptions, as cost-of-living pressures reshape the nation’s viewing habits.

Australian households are shifting to cheaper ad-supported streaming services rather than cancelling subscriptions, as cost-of-living pressures reshape the nation’s viewing habits.

The average number of streaming services per Australian household increased from three to 3.2 in 2024, with ad-supported (AVOD) options adopted by 28 per cent of consumers, according to data released by global audience measurement company Kantar.

In the September quarter of 2023, that AVOD figure stood at just 10 per cent

The percentage of households that subscribe to a premium ad-free (SVOD) service declined year-on-year, slipping three percentage points to 68 per cent in the final three months of 2024.

The total number of streaming subscriptions (both premium and ad-supported) in the Australian market reached 25.2 million in the December quarter, up 1.5 million year-on-year.

The Kantar research found that the average monthly spend on streaming services per household rose to $50 in 2024 – a bump of 16 per cent on the previous year – due largely to the price hikes implemented by every major service over the past 12 months.

Netflix, for example, increased the cost of its premium plan in May 2024, from $22.99 a month to $25.99, and its ad-supported tier from $6.99 to $7.99.

Similarly, last week Netflix announced it would be increasing the cost of both its ad-supported and premium tiers in its North American markets, as well as some countries in Europe and South America.

Australians spent a total of $1.2bn on streaming subscriptions in the October-December quarter, an increase of $200m on the corresponding period in 2023.

Kantar consumer director Andrew Northedge said the fourth-quarter data shows Australians are “finding a way” to sustain their spend on streaming services, despite financial pressures on households.

“People are downgrading, not cancelling,” Mr Northedge told The Australian. “They’re clearly not comfortable with getting rid of a Netflix or a Binge, as the data shows both of those services have quite high uptakes of their ad-supported platforms.

“The shift to streaming, away from the traditional viewing platform of free-to-air television, and even cinema, is continuing.”

However while Australians’ appetite for streaming services grows, Mr Northedge warned there could be some disruption in the sector in 2025.

Warner Bros Discovery is set to launch its Max streaming platform in the first half of the year, Newscorp and Telstra have announced the sale of Foxtel to global sports and entertainment group DAZN, and uncertainty surrounds the future of Optus Sport.

“Not that long ago, there was a strong view that the Australian streaming market was overcrowded and not all the players could survive,” he said.

“And while we haven’t yet seen any notable providers drop out of the Australian market – even though it really is saturated – I think we’ll probably see one or two go off the back of the upcoming changes in the sector.”

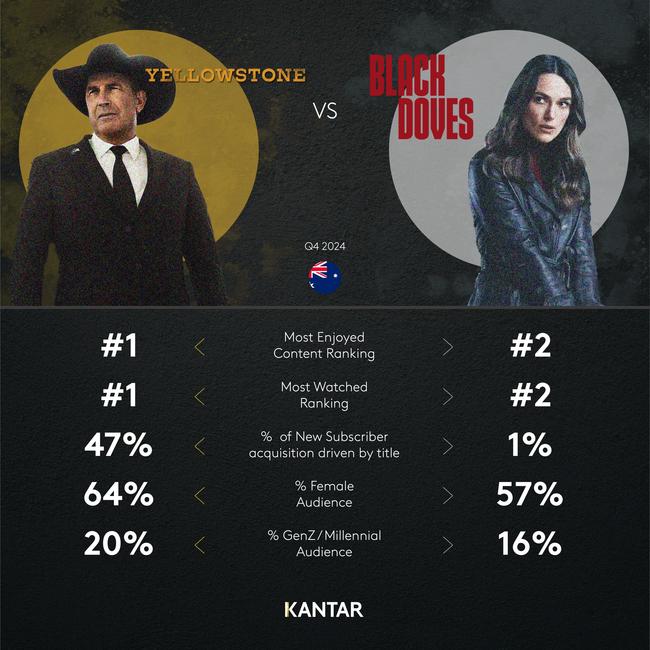

In the October-December quarter, Stan’s Yellowstone was the most-enjoyed and viewed title, followed by Netflix’s Christmas spy thriller Black Doves.

Despite the success of Yellowstone, subscriber numbers for Stan (owned by Nine Entertainment) have flattened, with the streaming service’s share of the market slipping from 24 per cent in Q4 2023 to 23 per cent in the December quarter.

Foxtel’s Binge grew its total subscribers quarter-on-quarter, rising to fourth place in share of new subscriptions ahead of DAZN’s acquisition later this year.

News Corp (publisher of The Australian) will retain a 6 per cent stake in Foxtel after the sale to DAZN, and will also have a seat on the company’s board.

Foxtel’s sports streaming service Kayo was weaker for new subscriptions in the October to December quarter, as is traditionally the case given its emphasis on the winter football codes.

However, Kayo performed well over the longer term, growing total subscribers by 16 per cent year-on-year.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout