Ad slump bites oOh! as profits fall

Outdoor advertiser oOh! Media’s annual net profit slumps 54 per cent amid a depressed ad market.

Outdoor advertising company oOh!media has reported a 5 five per cent drop in annual underlying earnings, hurt by weak advertising spending and higher costs.

In line with last month’s revised guidance, underlying earnings fell to $139m last year, from $145.7m, hurt by a slowdown in underlying revenue growth.

Annual net profit dropped 54 per cent to $13.4m from $29.1m, hit by a sharp jump in net finance costs to $58.4m from $8.3m last year due to changes to accounting rules.

Underlying revenue rose 1 per cent to $649.6m as costs of media sites and production jumped 5 per cent to $366.3m last year.

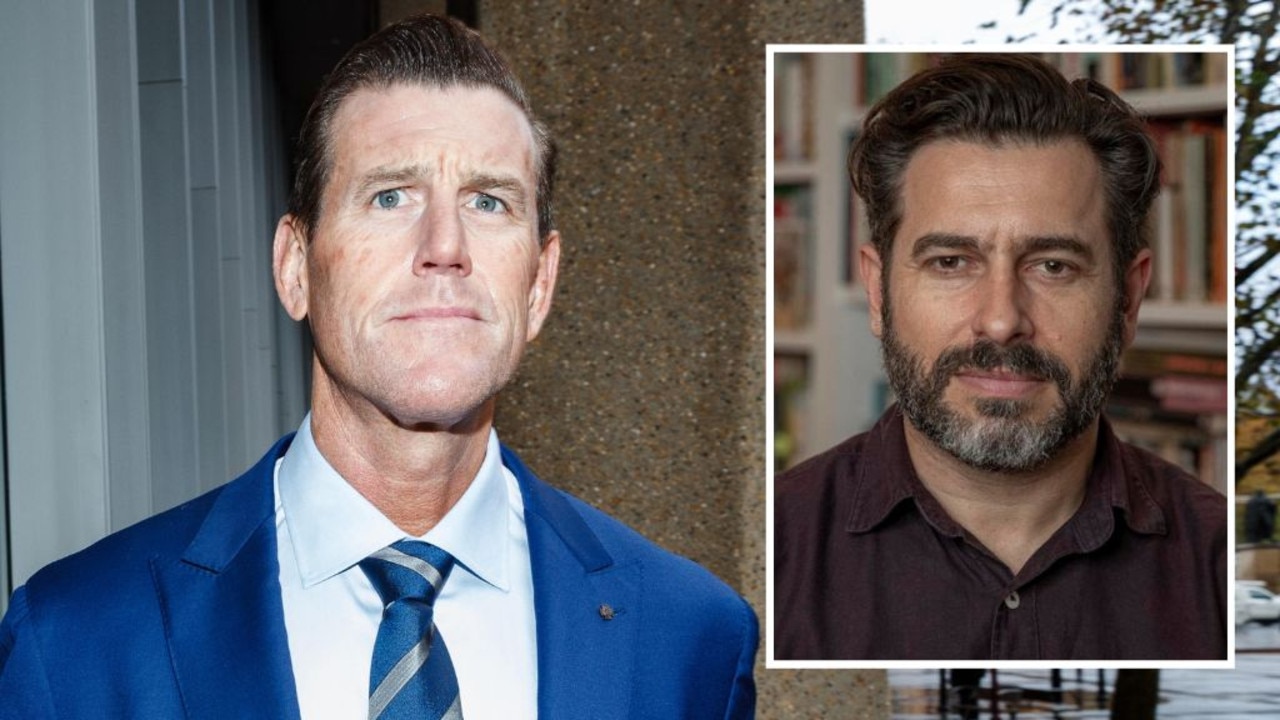

Outgoing chief executive Brendon Cook said the group continued to outperform the broader market, which declined an estimated five per cent.

“Following the difficult second and third quarters, we delivered a stronger performance and recovered hare in the fourth quarter to deliver revenue growth in line with the OOH market and earnings within our guidance range,” he said.

Mr Cook said the integration of its biggest division, Commute, was on track, reporting annual revenue growth of 5 per cent to $234.8m, and $16m in synergies. Commute is forecast to deliver $2m in synergies this year.

“Commute is now our largest division by revenue and its strong performance in 2019 demonstrates its significant contribution to enhancing our diversified asset portfolio and supporting our acquisition business case,” he said.

oOh! expects the outdoor advertising market to continue to gain market share across media formats this year, forecasting underlying earnings of $140m to $155m. It has also forecast capital expenditure of between $60m to $70m.

Its road and fly divisions reported annual revenue declines of 5 per cent to $146.6m and 3 per cent to $65.9m, respectively.

Total operating expenditure more than doubled to $383.3m from $171.1m, primarily due to a hefty depreciation and amortisation expense of $232.1m.

The company last month announced the departure of Mr Cook after 30 years at the helm, and warned that its recently upgraded annual underlying earnings would be towards the lower end of the range, which led to a 6.7 per cent share price slide.

On January 29, oOh!media said its 2019 underlying earnings guidance, which was issued on December 3, will be towards the lower end of the $138m to $143m range, excluding integration costs and changes to accounting rules.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout