Raphael Arndt tops the table for public service pay

Margin Call knows better than to ask any mirror who the fairest is, but this week has taken it upon itself to ask just who the highest paid Australian mandarins are.

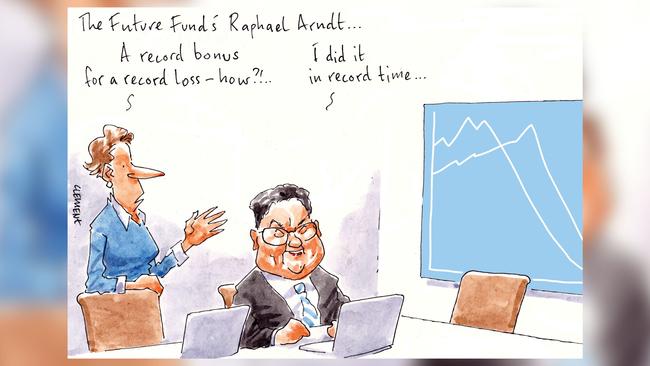

With annual reports aplenty, we crunched the numbers on the nation’s top public sector brass, with pole position given to a surprising candidate, the Future Fund’s chief executive Raphael Arndt — and that was before he even had the top job.

Figures from the Peter Costello-chaired fund show Arndt, who in July replaced acting chief Cameron Price after the departure ofDavid Neal to IFM Investors, took home almost $1.4m last financial year in his role as chief investment officer at the $205bn fund.

Drilling down on his pay cheque, Arndt received a base salary of $690,689, alongside a hefty bonus of more than $628,000 — a slight trim on the previous year.

That’s despite the Future Fund falling victim to COVID-19 market instability to record a staggering $1.4bn loss, down 109 per cent from $16.7bn in net profit the previous year.

Good work if you can get it, and all without the substantial public profile heaped upon the likes of the ACCC’s Rod Sims or RBA governor Philip Lowe.

Both are arguably under more scrutiny than Arndt, but seemingly are reaping far less in rewards.

Take Lowe for example — who was pictured in the bank’s annual report no less than 14 times, including alongside Foreign Minister Marise Payne and fellow influential public servant Philip Gaetjens. Despite the bumper calendar of appearances, he took home just shy of $1.1m.

And Sims — who is waging war against the tech titans Google and Facebook — took home a mere $828,044.

Put the three in a line-up and we’d hazard a guess that that bumper salary wouldn’t account for any more recognition from the average punter.

And while we’re on the topic of Future Fund — hats off to UBS who picked up several equities investment mandates by the fund, to join Macquarie and Blackstone, while the Yann Robard-founded Whitehorse Liquidity Partners joined the ranks of its private equity mandates.

HarbourVest, on the other hand, got the flick from its special opportunities mandate, while AMP Capital held on to its mandate for unlisted infrastructure.

More than OneVue

With the clock ticking ahead of the OneVue shareholder meeting on Wednesday, set to decide if the software group falls into the hands of Andrew Walsh’s Iress, dissident major shareholder Alex Waislitz is using every last minute.

The billionaire tech investor, through his Thorney investment fund, on Monday raised his stake in the group to more than 19 per cent, alongside a renewed pledge to vote down the Iress offer he maintains is “opportunistic and significantly undervalued”.

The purchase, part of which was at a 24 per cent premium to Monday’s closing price, puts him ahead of managing director Connie McKeage and partner Michael Cole’s Abtourk investment vehicle and sets the stage for a showdown come the scheme meeting.

“We are prepared to work with the company to make the necessary leadership and management changes as well as support any appropriate capital-raising proposals to help ensure OneVue can realise its higher potential value for all shareholders in the medium term,” Waislitz told this column.

And all the while there are whispers of a few other suitors in the mix holding fire pending the results of Wednesday’s meeting.

It’s at times like these an in-person meeting would surely bring out a few notable appearances but we’ll have to settle for the popcorn and the small screen.

Gerry’s gesture

Billionaire retailer Gerry Harvey has taken a step to placate some of the corporate governance firms and shareholder agitators that have in recent years disrupted his company’s annual general meetings with protests from the floor, appointing the company’s first female non-executive director.

In Harvey Norman’s notice of meeting for its AGM, to be held virtually on November 25, the retailer is also seeking to allow shareholder meetings to be held in cyberspace, although it has stated that there are no plans to permanently move to a virtual AGM beyond 2020.

Shareholders will also be asked to approve a string of performance rights to Mr Harvey, chief executive Katie Page and three directors, David Ackery, John Slack-Smith and Chris Mentis.

The Harvey Norman board will soon be enlarged as it also seeks to take on a new non-executive director, former Lynas chief financial officer Luisa Catanzaro.

Ms Catanzaro is currently a non-executive director of ASX-listed company Ricegrowers Limited (SunRice), where she is chair of the finance, risk and audit committee and a member of the remuneration and nomination committees.

Meanwhile, at the upcoming AGM shareholders will be asked to approve performance rights to key executives including 778,485 to Mr Harvey, 2.179 million to Ms Page, 648,738 to Mr Ackery, 648,738 to Mr Slack-Smith and 493,041 to Mr Mentis. According to the 50-page notice of meeting, the rights can be exercised in tranches between January 2026 to December 2037. The rights, which involve certain ROE hurdles being met, have a book value of between $19.4m and $40.7m depending on time of grant or time of exercise.

Tough justice

It is nice to see the major banks getting a serve every once in a while, especially with a side of a sass and in the federal court no less.

Such was the case for NAB, as Justice Michael Lee handed down his judgment in the case against its “introducer” scheme — for which former chief Andrew Thorburn buckled under heavy grilling during the banking royal commission.

While much attention has been placed on the potential for a $15m fine for the now Ross McEwan-led bank, it was Lee’s flecks of sarcasm and take-down of bank jargon that caught this column’s attention.

And he wasted no time in sharing his opinions — from paragraph one of the 46-page judgment pointing out flaws in the bank’s loan scheme described as letting unlicensed “introducers” “spot” prospective customers and “refer” them to bankers.

“At any one time there were hundreds to thousands of these untrained introducers,” Lee wrote.

“What could possibly go wrong.”

Further, in his criticism of the bank’s risk management, Lee cites a “Red Conduct Gate (whatever that is supposed to mean)”, along with an “Amber Gate”.

And to finish it all off he took a final stab at the bank’s use of jargon such as “tightening”, “upskilling”, and “engagement protocols” — also seemingly devoid of real meaning.

Just as well no one mentioned a pivot.