Seems the reach of prominent Indonesian-born but now Sydney-based international property developer Iwan Sunito into the NSW Liberal Party over recent years has known no bounds.

If embattled Premier Gladys Berejiklian had no idea who Sunito was — as she told ICAC this week in the context of her secret boyfriend Daryl Maguire’s efforts to get the property mogul in to see her — she must have been virtually the only one of her colleagues not to have come across the businessman.

Earlier this week Margin Call brought you pictures of Berejiklian and Sunito at a property function at the end of 2017, as well as happy snaps of Sunito with Liberal luminaries including former premiers Nick Greiner and Mike Baird.

Now we hear that just a few weeks ago Sunito was pleased to share the limelight with Berejiklian’s trusted Treasurer Dominic Perrottet at an event to celebrate the topping out of Sunito’s Eastlakes Live project in Sydney’s south.

The hi-vis gathering on September 18 was to mark construction of the highest level of the first building in stage one of Sunito’s development, which was granted development approval in June as part of the NSW government’s new Planning System Acceleration Program.

The Berejiklian government has described Eastlakes Live as a “major project” and a “state significant development”.

Not the sort of thing a leader like Berejiklian would be across?

Sunito has also spent time with Berejiklian’s minister Victor Dominello, who was the developer’s special guest at a charity lunch in 2016 at Sunito’s Crown office in Sydney.

How nice to have so many important friends.

Reserve’s reward

Back in March as the coronavirus was taking hold, Reserve Bank governor and chairman Philip Lowe implored Australians to “pull together in the country’s interest” to get us through the economic impact of the international health crisis.

And now, thanks to the just released, 230-page Reserve Bank of Australia annual report, we can see that Lowe has done his bit towards making sure we get to the other side of the crisis.

At least when it comes to Treasurer Josh Frydenberg’s budgetary coffers.

The report reveals Lowe’s bank made a profit in the year of $2.49bn, down from $4.5bn the year before.

But the RBA is pulling its weight: it paid a dividend to the Feds of $2.57bn (just a bit more than it actually made) from $1.69bn previously. What a beautiful budgetary leg up.

RBA directors include former Macquarie boss and millionaire Allan Moss and rich-lister businesswoman Carol Schwartz, who each get about $85,000 for their efforts on the board.

In return for his efforts, Lowe, who’s been in the top job since September 2016, was paid a total of $1.1m in the year.

Frydenberg would say he’s worth every cent.

Under pressure

You wouldn’t think former top federal mandarin turned non-executive director Jane Halton would be the type to be bullied in the boardroom.

But then, it seems, the formidable bureaucrat and now businesswoman came up against trusted Packer executive John Alexander.

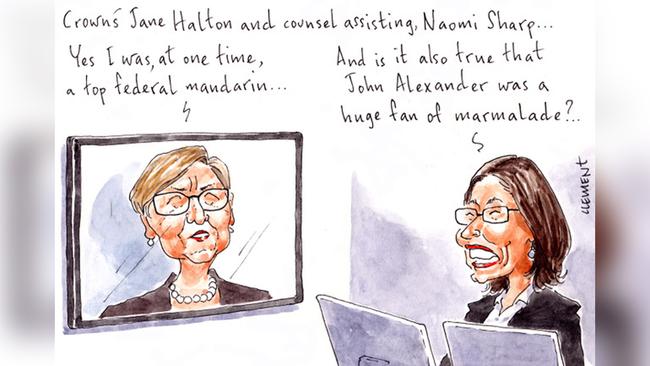

Halton, 60, who’s been on the previously JA-chaired Crown board for two years, was back in the box at Patricia Bergin’s NSW casino inquiry for the second day yesterday, under questioning from counsel assisting Naomi Sharp.

Discussion turned to the full-page ad signed by each of Crown’s directors that the gaming group placed in national media in July last year pushing back against reports in Nine Entertainment media outlets concerning allegations about Crown’s international operations. Halton, who has spent much of her time at the commission sparring with Sharp and her colleague Adam Bell, told former NSW Supreme Court judge Bergin that she had felt “pressured” by executive chair Alexander into signing the full-page letter, which was also submitted to the stock exchange’s official company announcements platform.

Halton, who is also on the ANZ board and has spent much time facing questions at Senate Estimates as a top public servant, said she also felt pressured by other Crown executives to sign the document, but declined to name names.

As if that wasn’t enough, Sharp then led Halton to reveal the bombshell that the exits of Crown Australian resorts boss Barry Felstead and chief legal officer Joshua Preston from the group were now under discussion at the highest level, as predicted by Margin Call this week.

A proposal, Halton said, had been put to Crown’s September board meeting that the pair should exit their roles, but was not acted upon. Their time now looks to be up.

Meat in the sandwich

It was a question from the audience that had everyone on their toes at Thursday’s Global Food Forum.

Big burly Jason Strong, the former chief executive of the nation’s biggest cattle company AAco-turned-Meat & Livestock Australia chief executive, was asked if he had ever tried a plant-based meat burger.

The response was surprising.

“Yeah I have and it was OK. If you went into it thinking it was going to be a McDonald’s quarter pounder or a Hungry Jack’s whopper, you would be disappointed,’’ said the through and through meat man.

“But if you just wanted a feed and you needed some protein as part of it, it was fine. I am not going to be one of those emotive people who says, ‘It wasn’t my thing and it was just like chicken’. It was fine. And if you need protein or a protein solution and you can’t get a decent piece of beef, lamb or goat, it would be all right.”

Strong’s comments came at the end of an at-times spicy debate with Thomas King, the boss of Food Frontier — which calls itself an independent think tank and expert adviser on alternative proteins in Australia & New Zealand.

The man in the middle was Mandeville Meat Group chief Tim Clarke, who still sided with Strong when he said alternative proteins should not be denigrating the livestock industry, when the sector would be part of the solution to climate change.

Earlier in the day it was GFF stalwart Kidder Williams MD David Williams who brought his typically robust opinions back to the table, lambasting the Foreign Investment Review Board’s lengthy approval processes for becoming a barrier to foreign investments, particularly from China.

But the virtual nature of the forum did keep the always strident but highly respected investment banker in check in one respect — for the first time at a GFF he managed not to drop the F-bomb once.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout