David Neal leaves Future Fund to take reins at IFM Investors

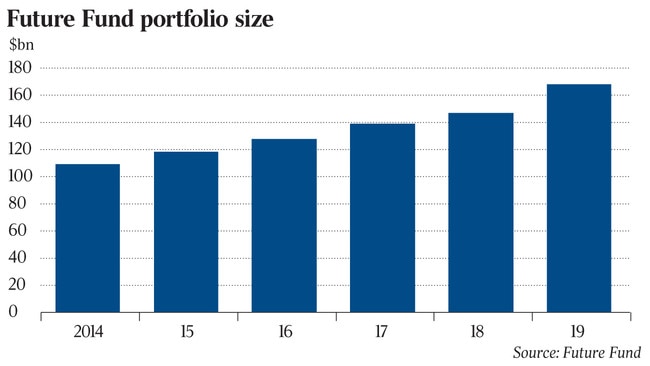

Future Fund chief David Neal has resigned from the $168bn sovereign wealth fund to head IFM Investors.

Future Fund chief executive David Neal has resigned from the $168bn sovereign wealth fund to take up the top job at industry funds-owned IFM Investors, in a move insiders say will be a boost for the global fund manager’s growth plans.

Mr Neal will replace outgoing IFM Investors chief executive Brett Himbury, who announced his retirement late last year, while the Future Fund’s general counsel and chief risk officer, Cameron Price, has been appointed acting head of the sovereign wealth fund as a global search gets underway for Mr Neal’s replacement.

“It has been a privilege to contribute to the establishment and success of the Future Fund. I will be forever grateful for the unique opportunity I have had to help build Australia’s sovereign wealth fund and to work with truly impressive colleagues and board members over the last 13 years,” Mr Neal said.

“While I am looking forward to fresh challenges, I am proud that the organisation is in great shape to continue its mission of investing for the benefit of future generations of Australians.”

The move will likely deliver a salary boost for Mr Neal, who was paid $1.46m last year — including a $770,000 bonus — compared to Mr Himbury who took home $2.87m.

Future Fund chairman Peter Costello said Mr Neal had been instrumental in designing and implementing the fund’s investment strategy.

“The fund is highly regarded as one of the world’s most successful sovereign wealth funds and David has played a central role driving its performance and reputation,” he said.

Mr Neal had been on the executive team at the Future Fund for 13 years, initially as its chief investment officer from 2007, before taking over as chief executive in 2014.

IFM chairman Greg Combet said he was pleased to have secured the services of Mr Neal, who he described as “a superb leader with a highly successful record”.

“David will continue the global evolution of IFM Investors consistent with our purpose — to deliver strong net returns to the millions of members of our super fund, pension fund and institutional investors.

“We have an ambitious agenda going forward — to maintain strong investment performance across our asset classes and products, continue to grow and evolve as an organisation, and to be leaders in responsible investment.”

Mr Combet also paid tribute to the outgoing Mr Himbury, who exits IFM after a decade in the chief executive role.

“The board, staff and clients of IFM Investors thank Brett Himbury for 10 years of extraordinary stewardship. Millions of workers in Australia and tens of millions globally will have a demonstrably improved retirement thanks to Brett’s strong leadership,” he said.

An industry super fund senior executive, who declined to be named, said he was excited that someone of Mr Neal’s calibre was available to IFM to drive it to the next stage.

“You get a chief executive that’s CIO qualified. That’s not a prerequisite but it’s good to have management that’s aware of investment matters rather than having them oblivious to it. Things go wrong in organisations when upstairs doesn’t know what downstairs is doing. He’s energetic, he’s got good interpersonal skills, so on the surface it’s all positive. I can understand why a headhunter went there,” he said.

The $148bn IFM undertook a global search to find Mr Himbury’s replacement after he announced his retirement last September. At the time he gave no definitive date for his exit, simply saying he would leave by December 2020.

Mr Himbury, a former banker, led the fund manager through a period of substantial growth that saw its funds under management surge from $23.6bn as it became one of the world’s biggest infrastructure investors.

Likewise, Mr Neal helped grow the Future Fund from the $61bn in initial seed capital handed over by the Howard government in 2006.

Mr Neal’s commencement date and Mr Himbury’s retirement date are yet to be confirmed but it is expected a transition period will take place to ensure a smooth handover.