Finkelstein: no delays or fancy footwork in Crown hearing

Her work may be done, but the spectre of Patricia Bergin looms large over Ray Finkelstein’s hard and fast royal commission into the suitability of the James Packer-controlled Crown Resorts to run a casino in Melbourne.

Former federal court judge Finkelstein kicked off his first public hearing out of the Exhibition Street offices of Fair Work Australia on Wednesday, setting the scene for his commission, which will report by August 1.

While retired judge Bergin, who last year conducted a forensic inquiry into Crown’s suitability in NSW, was nowhere in sight, her scathing findings will form the foundation of Finkelstein’s work.

The 74-year-old Queen’s Counsel has revealed that rather than duplicate Bergin’s work, Finkelstein will adopt her findings — an effective passing of the baton — and spend much of his time assessing whether the reforms implemented by Crown over the course of Bergin’s inquiry and beyond to render itself a “suitable” licence holder are adequate and working.

Bergin found Crown was not a suitable licence holder, had allowed money laundering to occur at its casino, had disregarded the welfare of its China staff and had done business with junket operators with links to organised crime.

So the Fink’s inquiry will be complementary to Bergin’s and will put enormous pressure on Crown executive chair Helen Coonan to outline her program of reform and its efficacy.

Finkelstein says he will also look at some areas of suitability that Bergin didn’t, assess Crown’s performance as an ASX listed company where the highest levels of governance must be maintained, as well as address the question of how Crown, which is 37 per cent owned by billionaire and former chairman Packer, managed to end up where it has and how it has strayed so far from community expectations.

Fink, who told participants yesterday that given his tight time frame he will not tolerate any delays in proceedings, has already written to Crown twice.

First to seek Crown’s acceptance of Bergin’s findings — on which the company he said was somewhat “equivocal” — and second to ask whether Crown considered itself to be in breach of any regulatory provisions, with radio silence on the latter thus far.

Take the stand

So who can we expect Ray Finkelstein and his counsel assisting to haul over the coals in the Crown royal commission witness box when public hearings enter top gear in a few weeks?

Crown’s licence to run the Southbank casino is held by Crown Melbourne Limited, a corporate vehicle that has existed for more than three decades, established in 1998 by property developer Hudson Conway, whose principles were Lloyd Williams and Ron Walker.

No need for the Fink to go back that far, but current Crown Melbourne directors led by chair Antonia Korsanos can expect to be probed on why the licensee should be considered suitable to run the multi-billion dollar gambling den.

Former Crown Resorts director and one-time principal of independent girls’ school Ascham, Rowena Danziger, 83, who hasn’t been on the listed board since late 2017, endures as a director of the Melbourne vehicle.

Danziger took the stand in Bergin’s inquiry, but well before her former Crown board colleagues and did not face the sort of intense scrutiny her contemporaries endured.

This time around she can expect deeper questioning given she’s been on the licensee’s board for almost 20 years and you might think has seen it all.

Retiring listed Crown director John Horvath is also on the Melbourne board, as is group executive chair Helen Coonan.

Interesting will be the performance of newly appointed Crown Melbourne chief executive and director Xavier Walsh, who was recently promoted from chief operating officer thanks to the reshuffle brought about by the exit of Australian resorts boss Barry Felstead.

Walsh hasn’t been in such an inquiry’s hot seat before, only joining the Crown Melbourne board mid-last month, but he’s a key exec of the group and a longstanding approved “associate” of the licensee so can expect some time in the spotlight.

We bet they all can’t wait.

Hazardous work

Workplace health and safety officers aren’t exactly known for their empathy, but a showing before senate estimates on Wednesday exposed how out of touch the government’s own workplace safety organisation Comcare really is.

Sexual harassment, according to the nation’s authority for work health and safety and compo, is nothing more than a “hazard”, the committee heard.

Labor Senator for NSW Deborah O’Neill probed Comcare boss Sue Weston and chief legal officer Matthew Swainson on whether sexual harassment constituted a breach of workplace health and safety law.

“Sexual harassment in the workplace is definitely a hazard under our legislative framework,” Swainson replied.

A choice of word that on-leave Defence Minister Linda Reynold’sformer staffer and alleged Parliament House rape victimBrittany Higgins would surely make.

“A breach would really depend on the systems in place to respond to the hazard,” Swainson went on.

The department, which falls under the remit of on-leave Industrial Relations Minister Christian Porter, is making its own “inspection” of the safety systems in Parliament House the committee heard, a continuation of monitoring and compliance activity dating back to last year.

That is in addition to its “inspection” (not to be confused with an “investigation”) into the goings on in Reynold’s office, which to date has included engagement with the police and “other parties”.

Just what the difference was between an “inspection” and “investigation” stumped the two Comcare staffers however, and that matter is now a question on notice.

Wednesday’s probe was part of a wider grilling of government agencies, with Safe Work Australia and the Fair Work Ombudsman also under scrutiny. No topic was off limits.

Safe Work’s Sarah Costelloe reiterated that a first meeting of sex discrimination commissioner Kate Jenkins’Respect@Work council had finally been convened last Friday, a full 12 months, 14 days and two high-profile sexual assault allegations after Jenkins’ initial report.

Costelloe’s statutory body also is establishing its own mental health advisory group as part of a response to Jenkins’ report — all government agencies seemingly finally getting themselves into gear.

All that as Comcare also looks over the circumstances by which Fair Work’s own deputy president, Gerard Boyce, set off firecrackers on the tribunal’s office balcony after a boozy night out last Christmas.

Who knew WH&S could be so exciting?

Opportunity missed

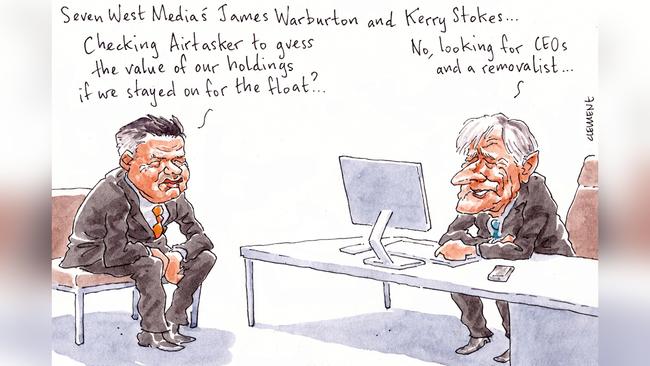

Airtasker’s successful $255m float may be one of the market’s biggest so far this year, but its continued success on day two of trading has further rubbed salt into the wound of former billionaire backer Kerry Stokes and his Seven West Media.

Under Seven chief James Warburton, the media group last year embarked on an asset sale program to bolster its balance sheet, including the sale of several items in its $85m basket of equity investments, which included Airtasker.

Perfect timing then that the Tim Fung-led online outsourcing marketplace was plotting its own IPO, in which Seven could offload its 18 per cent stake for roughly $45m, which Warburton said would be put towards paying down debt.

A prudent decision indeed, especially given the uncertainty of the media market and the group’s net debt position of $329m as CFO Jeff Howard pointed out at the group’s interim results last month.

But you know what would have been even better than wiping $45m of debt from Seven’s balance sheet?

Being able to slash nearly double that — $76.4m to be precise — which is the value of Seven’s Airtasker stake had it retained the holding and enjoyed the tech stock’s two-day opening surge, even after it was delayed due to an ASX processing blunder.

As Seven’s reps tell Margin Call though, the group wasn’t prepared to take the gamble, especially given its stake would have been held up in a two-year escrow period.

But with several other equity investments on its books through its upstart arm Seven West Ventures — the spin-off of which failed to gain traction last year — here’s hoping Warburton can at least take a lesson from the experience.

Seven is also an investor in the Mark Jones-led SocietyOne, which is also said to be testing the market’s appetite for a float following its recent partnership with Westpac.

Warburton might be hoping that listing gives him another shot at a hopefully more lucrative divestment strategy.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout