Crown’s Australian resorts chief Barry Felstead to exit as directors face shake-up

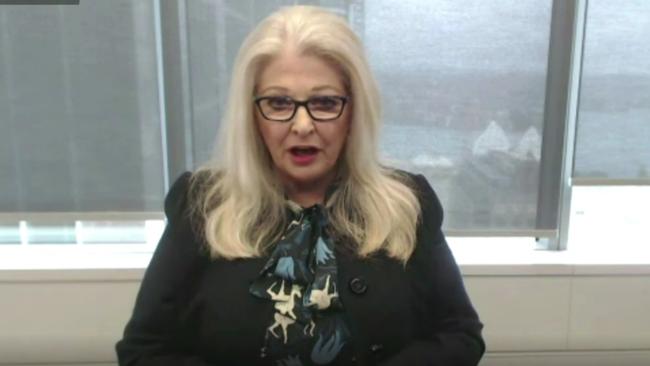

A shake-up of embattled casino group Crown’s board has already begun, chair Helen Coonan has told the NSW inquiry.

Crown chairman Helen Coonan has told a NSW inquiry into Crown’s suitability to hold a casino licence that she is looking to “renew” the board of the embattled company and is talking to some current directors about their exit plans.

Questioned by counsel assisting the inquiry Adam Bell about whether she agreed with James Packer’s testimony at the inquiry last week that going forward the Crown board should be more “independent” of his holding company Consolidated Press Holdings, Ms Coonan said:

“I think that’s a fair reflection of the way which we need to go forward.”

The revelation comes after the Ms Coonan told the inquiry earlier on Friday that Crown Resorts’ CEO of Australian resorts, Barry Felstead, would leave by year’s end.

When Mr Bell questioned Ms Coonan about how independence could be achieved, she said the process was already underway.

“I think we need to go through a very fulsome exercise of looking at the right framework for independence, that includes longevity through independence of thought and ability to bring skills to bear on the board,” she said.

“I’ve commenced conversation with some directors relating to an orderly process for them to leave the board and to get on some more independent directors.”

Mr Bell asked Ms Coonan whether she was familiar with the Star casino’s stipulation that no more than one shareholder could hold 10 per cent in the company, hinting at the fact that Crown could do the same and force James Packer to sell down his 36 per cent shareholding.

“I think that’s a very difficult question,” she replied. “I think whilst the shareholding is there, it’s certainly my duty as chair and the broader duty of the board to properly manage that relationship, to properly manage the relationship with the nominee directors...I would not really want to opine on divestment or a time-frame for it,” Ms Coonan replied.

Commissioner Patrica Bergin asked whether Ms Coonan ever had any conversations over a concern Stanley Ho may have had an interest in Melco when the deal was announced last year.

Ms Coonan said that she thought someone mentioned the potential of modifying the agreement with the NSW gaming regulator to prepare for that possibility.

Earlier in the day. after being presented with evidence that Mr Felstead knew that Crown’s staff in China were expressing fears about their safety prior to their arrest in 2016, Ms Coonan was asked by Mr Bell if she still had confidence in Mr Felstead.

“Well I have to tell you that Mr Felstead’s current position is now redundant,” Ms Coonan answered.

“Mr Felstead was getting very near to wishing to retire, I think recent events have escalated his desire to do that and he’ll part with the company around the end of the year.”

“Arrangement and agreement has been reached with Mr Felstead,” Ms Coonan said.

On Thursday Crown director Jane Halton told the inquiry she no longer had confidence in Mr Felstead and Crown’s legal boss Joshua Preston, after the inquiry had highlighted their extensive involvement in Crown’s risk management and governance failures.

But she said she still had confidence in Crown chief executive Ken Barton, who took over the role in January.

Mr Barton revealed in his evidence to the inquiry last month that the positions of Mr Felstead and Mr Preston had been made redundant and discussions were underway about their respective futures with the company.

Former Crown executive chairman John Alexander has also been another casualty of the inquiry, taking responsibility for risk management failures at the company.

He will not stand for re-election as a director at the Crown annual general meeting next week after stepping down from his role in January.

Other Crown directors up for re-election at the meeting - Ms Halton, deputy chairman John Horvath and Guy Jalland, the CEO of James Packer’s private company Consolidated Press Holdings - are facing a significant investor backlash.

The powerful Australian Council of Superannuation Investors (ASCI) has publicly opposed their re-election, as has the influential proxy advisor Ownership Matters.

However Ms Coonan strongly backed controversial Crown director Michael Johnston remaining on the board.

Mr Johnston, the financial controller of Mr Packer’s private company, has been criticised by inquiry head Patrica Bergin for “wearing too many hats” at Crown and for not declaring conflicts of interests between his obligations to Mr Packer and to Crown.

Mr Johnston has also been criticised for providing confidential information about Crown’s profit forecasts to Melco Resorts before Mr Packer sold a strategic stake in Crown to Melco in May last year.

Ms Coonan echoed the comments of Crown director Harold Mitchell last Friday that Mr Johnston would no longer be providing management services to Crown under an existing services agreement between Crown and Mr Packer’s private company Consolidated Press Holdings. He also provides information under the terms of a controlling shareholder protocol (CSP) that allows confidential information about Crown to be provided to Mr Packer.

Ms Coonan said information flows under both agreements had been halted subject to a review.

“If he (Mr Johnston) is no longer acting under the CSP, no longer getting information under the services agreement or providing services in an executive capacity and is no longer wearing a lot of hats . .. he is a very fine, dedicated and diligent board director who can continue to make a contribution with those adjustments,’’ Ms Coonan told the inquiry.

She said she had worked very closely with Mr Johnston, including on “an eye-wateringly complex tax matter” on which he did an excellent job.

“I plan to have a look at Mr Johnston’s workload. Our committees need some attention,’’ she added. Mr Johnston currently serves on six Crown board committees.

“Yes he is wearing a lot of hats. I plan to relieve him of some of his hats. He is a nominee director. Appointment and removal of directors is a matter for shareholders.”

Ms Coonan was also quizzed on her knowledge of the risk to Crown staff in China prior to their arrest in October 2016.

Despite numerous Crown executives being aware of the Chinese government’s growing hostility towards foreign gambling promoters, the issue was never raised at board level and Ms Coonan said it demonstrated a failure of risk management and company culture.

“There was a tendency to try to manage all these things on the ground, as we now know,” she said.

Ms Coonan also said that she didn’t know prior to the arrest of staff in China that Chinese police had questioned a staff member in Wuhan and required a letter from Crown to corroborate the employee’s statement.

Mr Bell said that Mr Felstead knew about the questioning of the staff, and only told one board member by email: Michael Johnston, who did not tell any other board member.

But Mr Felstead did not tell CEO Rowen Craigie, his direct superior, and Mr Bell asked Ms Coonan if that meant the proper lines of reporting had been “compromised” and that Crown’s risk management process had failed.

Ms Coonan agreed and said that if the wider board had been aware, she assumed that the operation in China might have been aborted.

Commissioner Patrica Bergin also noted that Crown emails about the incident at the time indicate that someone “informed on the company” by telling the Wuhan police that Crown was organising gambling tours.

Ms Coonan agreed it was a concern.

Ms Coonan was asked if she could give an explanation for the China arrests, as James Packer and other executives were unable to during their evidence.

“The root cause of that is pretty obvious, and that is people tried to manage on the ground, and they probably missed the political and social changes in China and probably put over-reliance on legal advice,” Ms Coonan said.

Mr Bell has also noted that in 2015 Crown decided to remove its logo from the tail of the company’s private jets when transferring VIP clients from China to Australia, but Ms Coonan said she did not know about this.

“Plainly these matters should have been escalated,” she said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout