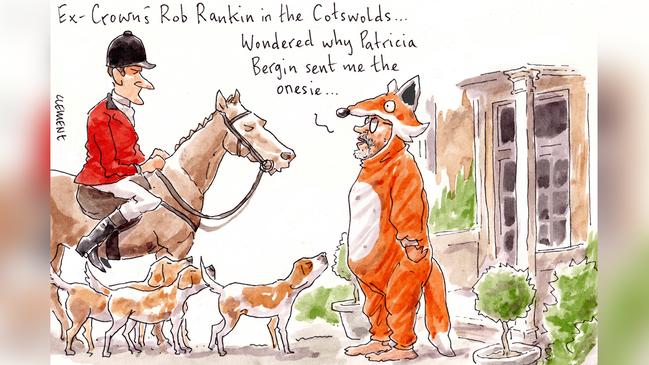

Cotswolds bolthole for ex-Crown Resorts chairman Robert Rankin

Where would you hide if you were former Crown Resorts chairman Rob Rankin and you were seeking to avoid playing any part in Patricia Bergin’s unfolding inquiry into whether the James Packer-controlled company should be allowed to run a casino in Sydney?

How about a luxury country house in the Cotswolds, where Rankin, 57, appears to have been holed up as former NSW Supreme Court judge Bergin’s foot soldiers sought to have the former investment banker-turned Packer lieutenant answer questions about his time at the helm of the embattled gaming group.

Counsel assisting Bergin Scott Aspinall revealed on Wednesday that since the middle of the year Rankin, who was Crown chair for about 18 months from mid-2015, has refused to co-operate with Bergin’s deep dive into the arrest of Crown employees in China in October 2016, as well as allegations of money-laundering and the operation of organised crime at its gambling dens.

Rankin, a former banker at UBS and Deutsche, is refusing to provide the inquiry with any information, won’t answer any questions either remotely or in person and has said that he intends to be in Europe for an extended period.

Still, he maintains “an entitlement as a matter of natural justice” to respond to “adverse comment” about him or in his role as chair — and after his former colleagues have regularly thrown him under the bus over the past three weeks, there is plenty to answer.

Packer pointed the finger at him for Crown’s poor corporate governance and risk management processes, saying he had “let the side down”, while Helen Coonan was quick to note that he hadn’t informed her of the China incident nor had he told Geoff Dixon of Packer’s threat to “Mr X” — widely accepted to be BGH Capital’s Ben Gray.

Still, life in the Cotswolds will make the stress of such accusations — and the prospect of shortly being referred by Bergin to James Shipton’s ASIC — all the easier to bear.

At The Rectory in Broughton, Oxfordshire, situated next door to historic Broughton Castle, there are seven bedrooms for Rankin to rattle around in, plus a lawned garden, heated outdoor pool and workout room (complete with what some might consider an easy-on-the-eye Richard Prince insta “original”).

There’s a kitchen garden for Rankin to potter about in towards cooking up a storm in the home’s kitchen, as well as a self-contained separate cottage in The Old Rectory’s stables.

Perhaps Rankin’s old billionaire friend Packer, who despite personal circumstances managed to muster the personal fortitude for three days of evidence to the Bergin inquiry, could come and visit for some healthy country air.

Then again, maybe Packer would prefer not.

Bergin at beginning

Former judge Patricia Bergin is taking no prisoners in the execution of her duties at the inquiry into Crown’s suitability to run its soon-to-open casino at Sydney’s Barangaroo.

Just before the close of business, Bergin, who is set to hand down her findings at the start of February, spent some time reminding Crown’s lawyers just how she likes her inquiry to be run.

She wasn’t happy with receiving a hostile email from the Helen Coonan-chaired $5.7bn gambling house’s legal rep late into the evening on Wednesday and let Crown’s counsel, which over the course of the inquiry has been led by former Federal Court judge Neil Young and supported by the likes of Rowena Orr, know that a less-confrontational approach to liaising with her inquiry would be welcome.

The slapdown followed much effort from Coonan in her evidence in recent days to Bergin, where the Crown chair expressed regret that the company had been unable to come to an agreed set of facts around certain elements of matters being discussed.

The lawyers seem to have burned Coonan’s olive branch in less than a day.

No place like HomeCo

You don’t need six degrees of separation to trace the UBS connection in Kelly O’Dwyer’s proposed appointment to the HomeCo board of directors.

HomeCo chair and major shareholder David Di Pilla told the market this week that the former member for Higgins and cabinet minister was set to join his group’s board at its annual meeting mid-next month.

The retired Liberal pollie is being billed by HomeCo as an independent non-exec director to bring about a majority of independent directors on the company’s board.

But it shouldn’t take the former revenue minister long to settle in, with her husband Jon Mant a former colleague of Di Pilla’s in investment banking at UBS, and with the HomeCo chair sharing several investment partners in common with O’Dwyer’s husband Mant, who are current and former UBS colleagues.

Mant was one of a clutch of investors from the Swiss investment bank who doubled their money on the $43.5m sale in 2017 of the Springhill shopping centre in Cranbourne, about 40km from the Melbourne CBD. The syndicate of investors included now former UBS boss Matt Grounds and leading bankers including Kelvin Barry, Guy Fowler, Tim Church, Anthony Sweetman, Peter Scott and Andrew Stevens.

Many of the clique have since moved on to plunge millions into another shopping centre investment in the growth suburb of Mernda, about 30km northeast of Melbourne.

Sadly, as far as we can tell Mant and O’Dwyer were left out of the later deal.

Mant’s then boss Grounds was also a backer of Di Pilla’s HomeCo float in 2018, with the pair also co-investors in the growing Aurrum Aged Care operations, which has done several deals with HomeCo in recent times.

Very cosy.

Praise be to Geoff

Hedge fund manager Rob Luciano will be hoping flattery keeps him out of the sights of the acquisitive Geoff Wilson, heaping praises on the industry stalwart at numerous times during his VGI Partners investor webinar on Wednesday.

While Wilson builds his listed investment fund empire, including his holding in Marty Switzer’s Contango — now at 24 per cent despite the Switzer clan’s vocal opposition — Luciano is focused on restoring his listed global and Asian-focused funds back to their former glory.

A remorseful Luciano addressed the webinar alongside senior staff Tom Davies and Marco Anselmi, while top shareholder and head of US research Robert Poiner dialled in from New York, again deconstructing the company’s woes after making what he described as “some missteps” in the timing of the COVID-19 market bounce.

Good thing he has an exemplar to look up to in Wilson — who Luciano noted was the pioneer in the listed investment sector, and who “does an excellent job”.

So much so that Luciano pledged to replicate some of his strategies, including greater shareholder communication and making hires in business development and sales — a function he remarked had been absent so far in the fund’s 12-year history.

“Obviously, this is the strategy that Geoff Wilson has done extraordinarily successfully and we stupidly have not replicated his capability set. We will look to replicate what he has in place.”

If imitation is the greatest form of flattery, here’s hoping Wilson can take a compliment.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout