Former Crown Resorts chairman Rankin missing from casino licence inquiry

A smorgasbord of current and former Crown executives and directors, including James Packer himself, will from the middle of next week start fronting Patricia Bergin’s high-powered NSW gaming inquiry, which is considering whether the casino giant could retain the licence for its Barangaroo project.

The likes of Packer, current Crown chairman Helen Coonan, former chairman John Alexander, Harold Mitchell, Geoff Dixon, Jane Halton, Ben Brazil and Andrew Demetriou appearing in the box should make for gripping viewing, as will the appearance of Consolidated Press Holdings chief executive Guy Jalland and finance director Michael Johnston.

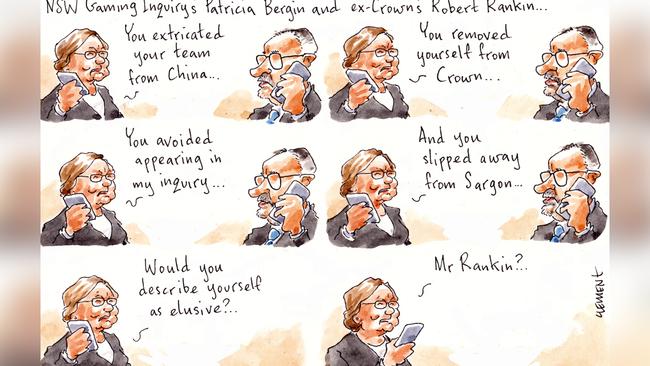

But there is one big name seemingly missing from the line-up: Robert John Rankin.

Packer recruited the former Deutsche Bank and UBS deal-maker to run his private company CPH in late 2014 after former UBS Australia chief executive Matthew Grounds introduced Rankin to the billionaire a decade earlier.

By mid-2015, Rankin was also chairman of Crown — including when its staff were arrested in China in October 2016 — until he stepped down from the role in January 2017 and left the board in June that year.

You would assume the chairman of the company during one of the most controversial periods in its history would be a prime focus of any Crown inquisition? But apparently not.

Mystery also surrounds who might be covering any of Rankin’s legal fees relating to the inquiry.

Margin Call understands neither Crown nor CPH are paying up. So has Rankin dipped into his own pocket? Or did someone else stump up?

Perhaps none was even payable given Rankin appears not to be a person of interest for Bergin and her team.

In our colleague Damon Kitney’sbiography on Packer, The Price of Fortune, released in 2018, Packer said of Rankin: “The Crown China arrests happened on his watch.”

Packer also added: “Rob, I thought, was a China expert, which was partly why it hurt so much that we got into the trouble we did in China.”

Sounds like pretty good grounds for Bergin’s four counsel assisting inquisitors to want to ask Rankin the odd question or two. You’d imagine another comment in the book by one of their star witnesses, Harold Mitchell, might also have piqued their interest.

Rankin played an active role in helping get Crown’s staff out of China, according to Mitchell.

“Rob did an important job behind the scenes and was sensitive to the China authorities in resolving that issue and deserves credit for that,’’ he told Kitney.

Even Rankin himself had his piece to say in the book: “It was the most difficult and challenging of periods and I led a small team (including Mark Arbib and Karl Bitar) entirely focused on their (the Crown staff in prison) release and wellbeing”.

In his two years as Packer’s right-hand man, Rankin also seemed to be doing everything but overseeing the governance of the company, including working on a Crown privatisation (shelved), a Crown demerger plus property trust (dubbed Project Skycatcher and then shelved) and Packer’s initial selldown and then exit from Melco Crown (dubbed Project Alpha).

So that again begs the question, where is Rankin in the ILGA inquisition?

Rankin was on none of the Crown committees, which perhaps is one reason for his unexpected leave pass? Or perhaps it was just some smooth talking from the former star investment banker.

Rankin, who these days is said to be in London, certainly has more time on his hands following the collapse in January of the financial services group he chaired, Sargon Capital. Rankin resigned as chairman of the group on January 23 a week before Sargon, whose board had included entrepreneur Phillip Kingston and former senator Stephen Conroy, tumbled into receivership.

Rio Tinto race field

With the racing season decidedly more glum this year a la COVID, there’s another field taking shape and its getting larger by the day.

Industry pundits are taking bets on the best pick for the new Rio Tinto boss, after Jean-Sebastien Jacques was pushed out over the Juukan Gorge scandal.

Tips for a potential return to the miner include former iron ore boss Andrew Harding, now running Aurizon, and Harding’s predecessor, Zoe Yujnovich, now at Shell.

Another in the mix is Fortescue chief operating officer Greg Lilleyman, who previously spent 25 years with the miner and is a West Australian to boot — sure to win over Mark McGowan as the WA Premier pushes for a relocation of the group’s head office from London to Perth.

It could be time to shine for former BHP chief financial officer Peter Beaven, who missed out on the top spot to Mike Henry and, if salary is a contributing factor, is not far off JS’s at present.

The dark horse? That’s Charles Waterhouse “Chip” Goodyear IV and, while he is 62, Margin Call hears he would love another turnaround job.

That’s entertainment

As Event Entertainment’s cinemas were shuttered and hotel trade restricted during the coronavirus pandemic, selfless chief Jane Hastings sacrificed $200,000 of her annual salary — taking it down to a mere $1.3m — to get the company through.

The gesture dwarfed fee cuts of 20 per cent to chairman Alan Rydge and other board members such as remuneration committee head Peter Coates and director David Grant, but it is set to be handsomely rewarded if a proposal is passed at the group’s upcoming AGM.

On Friday, the board put forward a proposal to grant Hastings up to $1.55m in rights as part of a “recognition and retention incentive”, in appreciation for her self-sacrifice.

With remuneration policies in the spotlight, thanks to wild bonuses delivered to bosses such as Star Entertainment’s Matt Bekier and Lendlease’s Steve McCann, the chairman penned a special message to shareholders in the group’s annual report, defending the move as key to keeping Hastings in the top job.

“The award has been designed to recognise the additional effort required from the CEO both during the COVID-19 response period and during the recovery period, and the importance in retaining the CEO during this critical period,” Rydge wrote.

“The board has considered the remuneration forgone by the CEO in respect of the 2019-20 year, and is also mindful of the awards under the group’s long-term incentive plan in 2018, 2019 and 2020 that are unlikely to vest, including due to the impact of COVID-19.”

If passed at the shareholder vote, Hastings is set to receive a maximum of $1.55m in rights, vesting in two tranches — the first 60 per cent at the results for the year to June 30, 2021, then the remaining at its 2022 results.

That’s on top of as many as 250,000 performance rights under the company’s long-term incentive arrangements.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout