No Sargon Capital creditor has yet expressed any interest in funding an investigation into the collapse of the Phillip Kingston-run fintech superannuation group which offered “next-generation trustee cloud infrastructure”.

But Margin Call gleans the Wexted Advisors liquidators Andrew McCabe and Joseph Hayes held a meeting this week with a litigation funder who is considering an investigation and potentially a public examination of the officers.

The liquidators initially discussed creditor funding for the public examination in March at the second meeting of creditors, pursuant to section 596A of the Corporations Act.

They noted 10 directors, past and present, could be summoned for public examination, including its 34-year-old entrepreneurial founder Kingston, the former senator Stephen Conroy and Robert Rankin, the London-based former Crown Resorts chairman.

McCabe has noted investigations into the company’s affairs had “been hindered by a general lack of company books and records”. Apparently further records have been recently forwarded by Kingston and his wife Fiona Borelli, the company secretary.

“We are reviewing this information and the impact this may have on whether public examinations are required,” creditors were advised earlier this month.

The liquidator has calculated the unsecured creditors seek $119m, along with $79m claimed by the secured creditors. The collapse followed a demand for loan repayment from Chinese state-owned finance company Taiping Trustees, the major secured creditor.

It is back to the Federal Court on Monday where Justice Michael O’Bryan has been presiding over the minor matter of finalising Sargon’s $29.6m sale of its operating business, software and intellectual property.

Its purchase by the US private equity giant Cloverhill almost fell over because the company’s domain name was not properly registered, despite appearing in the balance sheet of Sargon Capital which had built the business up to having $55bn in assets under trusteeship and supervision.

Another Vicars victory

What a windfall for Will Vicars’ Caledonia Investments and his appreciative clients.

First their long play in Canadian online gaming firm Flutter Entertainment has seen the shares double in value on the London Stock Exchange since March.

And now the Europe-based online food ordering giant Just Eat Takeaway has made a $US7.3bn ($10.5bn) takeover offer for the Chicago-based Grubhub, which has the Sydney-based investment outfit as its major shareholder.

The deal saw Just Eat offering $US75.15 apiece, a 27 per cent premium to Grubhub’s previous closing share price.

Caledonia holds around 16 per cent of Grubhub, so they can expect a cheque for around $US1.1bn. They increased their position as recently as late March when the share price was at $39.55.

Zillow, the US real estate company, also sits in Vicars’ three-pronged co-investment fund. That’s been performing all right too, up 31 per cent since the start of the year on the Nasdaq.

Robert Luciano’s VGI Partners also had a stake in Grubhub. VGI cashed out for a what they called a small profit in 2014, and bought back last year, so will take further profits this time, after telling investors in January it was beginning to look like a mistake.

Just Eat Takeaway’s acquisition will create the world’s largest online food-delivery company outside China in terms of revenue.

It was helped along the way when it bought Menulog in Australia for $855m, with the Vaucluse harbourfront home under construction by Menulog co-founder Leon Kamenev a sign of their acquisitive largesse.

Joe’s jibe

Former American ambassador Joe Hockey certainly didn’t mince words in a podcast released on Friday with his old pal from Sydney days, Future Generation Investment Group boss Louise Walsh.

In addition to his well publicised backhander to China’s “bully” Xi Jinping, Hockey also let fly at Australia’s band of rich listers for their lack of philanthropic giving.

Asked by Walsh about the giving culture in America in comparison to what we see here, Big Joe replied: “I think people should be more overt with their generosity and I get so frustrated when I meet high net worth individuals in Australia that are tight, are not generous, that need to be asked to be generous. And then when they give money, which is not a significant amount of money, they think they’re being generous, and it’s all wrong. I mean you can’t take any of your money with you.” Indeed.

But Joe then singled out billionaires Andrew and Nicola Forrest for praise as people who “really wear it and they give and they never say no. And there are many people like that in Australia. There are incredibly generous people.

“I love in America that there’s competition for the generosity and the first point of call for someone who is philanthropic is not to try and get the government to match them dollar for dollar. It is, I want to be generous, I don’t mind if you put my name on a building or recognise it, maybe that’ll encourage others to be generous as well, and that’s really impressive,’’ he added.

Austrade vacancy

Amid heightened trade tensions with China, speculation has started on who will become Australia’s new top trade diplomat. Dr Stephanie Fahey announced on Friday she’d step down next month as chief executive of the Australian Trade and Investment Commission, more commonly known as Austrade.

Deputy CEO Tim Beresford will provide temporary leadership.

Her departure leaves Trade Minister Simon Birmingham to find a replacement at a time when relations with our biggest trading partner China have reached their nadir.

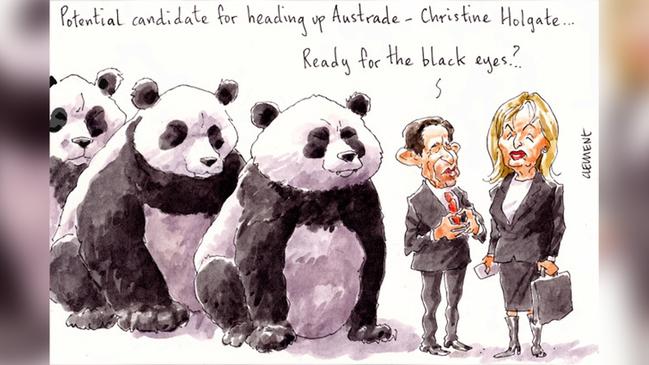

Margin Call would suggest top of the list of potential candidates should be none other than the boss of another government outfit, Australia Post chief executive Christine Holgate, who has form when it comes to fostering relations with China: she oversaw vitamins maker Blackmores’ expansion into the Middle Kingdom.

Holgate also has knowledge of the broader Asian region as chair of the Australian-ASEAN (Association of Southeast Asian Nations) Council.

She’s also a director of the Collingwood Football Club, but Margin Call won’t hold that against her.

Margin Call wonders if the Chinese fortune teller Holgate visited in 2014 in Sydney’s Chatswood ever foresaw her possibly becoming a trade diplomat.

“If you wear something green and meet Xi Jinping, good fortune will come to you,” the fortune teller told Holgate, who saw it happen on both fronts, wearing a necklace with a jade-coloured pendant.

She presided over Blackmores’ meteoric rise to $218 in 2015 — largely due to demand for the company’s products in China.

Home remedy

The youth charity yourtown is set to unveil one of its most luxurious trophy home raffle prizes. The Brisbane-based outfit ventured across the border recently to purchase a Kingscliff Beach home in northern NSW for nearly $4m.

Only a year old and marketed as Kingscliff meets the Bahamas, the six--bedroom home sits in 775sq m gardens with a 13m lap pool.

LJ Hooker Kingscliff agent Nick Witheriff secured the $3,895,000 sale after just 56 days on market. It’s the highest single block beachfront reserve sale on the strip since the GFC.

Led by chief executive Tracy Adams, yourtown was rebranded in 2016 from BoysTown after 55 years. The money raised goes towards tackling issues young people face, including unemployment, family and domestic violence and mental health.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout