Former Crown Resorts chair Robert Rankin could face ASIC probe

The NSW inquiry into Crown has heard the gaming group’s former chair should be referred to ASIC for breaching director’s duties.

The public inquiry into the James Packer-backed Crown Resorts will consider referring former Crown chairman Robert Rankin to the corporate regulator following the bombshell revelation that he refused to co-operate to provide vital evidence to the hearings, including in relation to an extraordinary threat made by Mr Packer during talks to privatise the casino giant.

After weeks of questions being raised by The Australian’s Margin Call column about Mr Rankin’s non-appearance before the inquiry, Counsel assisting Scott Aspinall revealed on Wednesday that Mr Rankin — who now lives in Britain — had refused to answer written questions or accept a summons to provide evidence to the inquiry.

Mr Aspinall said Mr Rankin failed to explain his knowledge of the risk to Crown’s staff in China prior to their arrests in 2016, the steps he made to place the company on “high alert” against such risks, and the steps he did or did not take to inform the board about those risks.

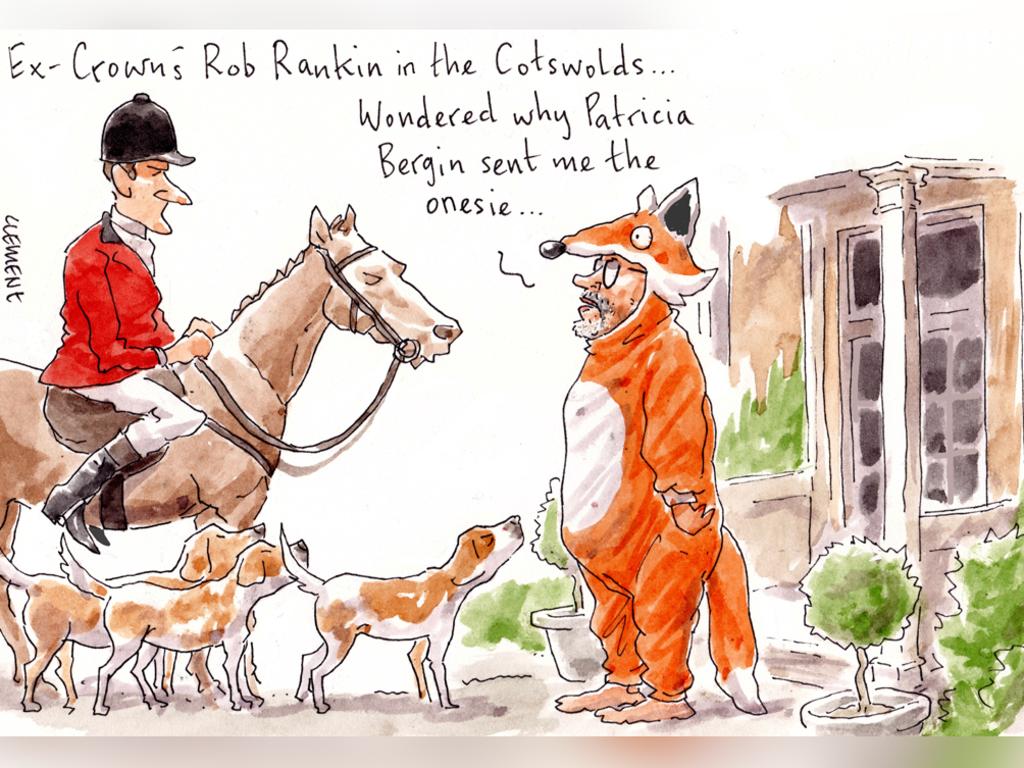

Mr Aspinall added that Mr Rankin had also failed to explain his knowledge of the threat Mr Packer made to a Melbourne businessman — believed to be former TPG Capital executive Ben Gray — during privatisation discussions at the end of 2015.

Mr Rankin was CC’d on a series of emails sent by Mr Packer to Mr Gray that were understood to involve Israeli intelligence group Mossad and which led Mr Gray to hire security for himself and his family.

Mr Aspinall said it was “open to find” that Mr Rankin “without justifiable reason” failed to comply with his duties as a company director.

“In those circumstances you may determine to recommend to the Independent Liquor and Gaming Authority that it consider referring Mr Rankin to ASIC for investigation for possible breaches of section 180 of the Corporations Act 2001,” he told commissioner Patricia Bergin.

Mr Rankin is the first current or former Crown director that has been recommended to be referred to the Australian Securities & Investments Commission following the inquiry by ILGA into Crown’s suitability to retain the licence for its new Sydney casino.

A spokesman for ASIC said on Wednesday: “We are following the inquiry with interest.”

Former Deutsche Bank and UBS investment banker Mr Rankin was also chairman of financial services group Sargon Capital, which went into receivership in January.

The ILGA inquiry has heard evidence of widespread governance, compliance and risk-management failings at Crown in its dealing with junket operators bringing high-rollers to Australia and which enabled money laundering at its Australian casinos.

On Monday, Crown revealed that financial crimes regulator Austrac had begun a formal investigation into the company after it allegedly failed to act on suspicious transactions linked to junket operators at its Melbourne casino.

Austrac chief executive Nicole Rose told a Senate hearing on Tuesday that the agency had “serious concerns” about Crown’s conduct.

The Victorian Commission for Gaming and Liquor Regulation has also issued Crown with a “show cause” notice following revelations of the casino operator’s dealings with junket operators allegedly linked to organised crime.

In his evidence to the inquiry earlier this month, Mr Packer blamed Mr Rankin, chairman of Crown between August 2015 and January 2017 and also previously the chief executive of Mr Packer’s private company Consolidated Press Holdings, for not passing on safety concerns about the company’s staff in China to the board and risk committees.

Mr Packer said Mr Rankin “let me down … he let the side down”, and that he considered Mr Rankin a China expert. He said they had a brief conversation in April this year, but said they parted as “associates, not as friends”.

Mr Rankin was removed as chairman in January 2017 in the wake of the arrest of Crown’s staff in China and left the board in the middle of that year.

The whereabouts of Mr Rankin have been a subject of speculation, but Mr Aspinall revealed that the inquiry’s counsel managed to reach him in the UK, where he refused to either answer questions in writing or appear at the inquiry over videolink.

“In July 2020 those assisting the inquiry ascertained that Mr Rankin had been overseas for some time and was located in England,” Mr Aspinall said.

“Although Mr Rankin had been requested to do so by those assisting the inquiry, in correspondence since July 2020, he has through his solicitors, firstly, refused to answer any questions posed to him in writing.

“Secondly, (he) refused to accept service outside the jurisdiction and the summons to give evidence to this inquiry.

“And thirdly, refused to give evidence consensually from a remote location.”

Mr Aspinall said attempts to serve Mr Rankin were foiled as the Royal Courts of Justice of England and Wales were not delivering international service due to the coronavirus crisis.

Mr Rankin’s lawyers said their client intended to remain in Europe, away from his home, for a significant amount of time but claimed he had an entitlement, “as a matter of natural justice”, to respond to any “adverse comment” in the inquiry against him.

The revelations regarding Mr Rankin came as the ILGA inquiry wrapped up its interrogation of Crown executives and directors, a day before one of the most anticipated annual general meetings of shareholders in the company’s history on Thursday.

The meeting will consider the re-election of CPH chief executive Guy Jalland, former public servant Jane Halton and one-time doctor to Kerry Packer, John Horvath, as directors.

The Australian understands hospitality industry fund giant Hostplus has voted against the re-election of all three due to the widespread governance failures at the company.

It follows Crown’s biggest institutional shareholder, Perpetual, and other minority investors voting against the directors.

The Australian Council of Superannuation investors has also urged its members to do the same. ACSI members own about 7 per cent of the company.

But Mr Packer’s Consolidated Press Holdings, which holds a 36.8 per cent stake in Crown, has voted for their re-election, which is likely to see them retain their positions despite a significant protest vote.

Mr Packer’s votes last year helped directors Harold Mitchell and now chairman Helen Coonan retain their board seats despite an investor backlash.

US fund Blackstone, which owns 10 per cent of Crown and has applied to the NSW gaming regulator for approval to increase its interest, could yet abstain from voting in the same way Lawrence Ho’s Melco Resorts group did at last year’s meeting.

Another Crown shareholder, the $US415bn ($553bn) California Public Employees’ Retirement System, or Calpers, the biggest pension fund in the US, has supported the re-election of all three directors.

Professor Horvath has been on the board for 10 years, making him Crown’s longest-serving independent director. He told the inquiry last week that he expected to be part of a “board renewal process” and would only remain a director “for a relatively short period”.

Ms Coonan revealed in her evidence to the inquiry that she had already started discussions with some long-serving directors about their retirement plans and she was reviewing the concept of “independence” on the board.

Crown shares rose 3c to $8.38 on Wednesday after Moody’s placed the company’s credit rating and the rate of its medium-term notes on review for downgrading following the ILGA inquiry revelations and Austrac’s investigation.

Crown’s issuer rating of Baa2 will be reviewed by analysts, as will the company’s medium-term senior unsecured notes.

The review for downgrade reflected the potential financial and reputational impact on Crown from escalating regulatory investigations, combined with the continued uncertainty around the coronavirus outbreak, Moody’s analyst Maadhavi Barber said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout