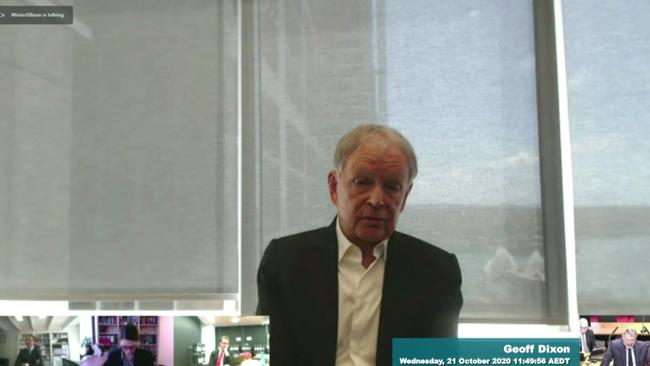

Problems at Crown Resorts were systemic: Geoff Dixon

Former Crown Resorts director and ex-Qantas boss Geoff Dixon said he relied on information that was relayed to him by Crown executives and senior management.

Former Crown Resorts director and ex-Qantas boss Geoff Dixon has agreed with the commissioner of a NSW inquiry into the gaming giant that the company had a “systemic problem” that prevented crucial information being communicated to the risk committee.

Appearing via video link on Wednesday, Mr Dixon was the last Crown board member to give evidence at the NSW Independent Liquor and Gaming Authority’s investigation into the suitability of Crown to operate the Barangaroo casino in Sydney.

Mr Dixon, who sat on the Crown board from 2007 to 2019, faced a line of questioning that heavily focused on his almost equally long tenure as chair of the Crown risk committee.

Counsel assisting Scott Aspinall asked how it could be that certain risks relating to Crown’s operations in China, the company’s association with gambling promoters called “junkets” and signs of money laundering activity were never communicated to the risk committee when they were known by Crown management.

A total of 19 Crown employees in China were arrested in 2016 for illegally promoting gambling.

Mr Dixon said he relied on information that was relayed to him by Crown executives and senior management.

“We were being assured, and people were saying, ‘We’re dealing with junkets that are absolutely clean, they’re not criminal organisations, we don’t deal with criminal organisations, if we find out they are criminal organisations, we assure you we do not proceed with that’.

“It (the risk committee) wasn’t informed is what I’m putting to you, not misinformed necessarily.

“Yes, I agree that it’s — it’s clear it was a systemic problem but what is the problem, is it a systemic problem of not reporting up?”

Mr Dixon was also grilled about his role as part of Crown’s remuneration and nomination committee, and asked whether he was aware that James Packer picked or endorsed almost every board member, even after resigning from the Crown board.

“People were recommended by other people a lot, and I must say I never assumed that the people being recommended were as a result of James Packer recommending them,” Mr Dixon said.

“I am surprised to hear that they — Tony Korsanos and Jane Halton — were recommended by James, I didn't have any idea of that.”

When Mr Aspinall asked Mr Dixon how he came to be a board member, he replied: “James Packer asked me.”

Mr Dixon said he came to know James Packer well when Mr Packer was a board member of Qantas but said although they were friends he had “never been to his house, he‘s never been to my house”.

“I’d be lucky to talk to James once every two years,” he said.

Mr Dixon also said neither he nor any other board member was informed of Mr Packer’s intention to sell almost half of his stake in Crown to Macau gaming giant Melco until it was announced in June last year.

Although he said he supported a shareholder protocol that allowed Mr Packer to receive confidential financial information from the company, he agreed that had he known Mr Packer was planning to sell to Melco, he would have supported the protocol being paused.

Late last night Crown said it had suspended the shareholder protocol.

“Visionaries, people who start these places, people who stay with the places, drive them for a long, long time, should never be subject to not being listened to properly and know what’s going on,” Mr Dixon said. “My only disappointment in most of this is that they didn’t tell us they were going to sell to Melco.”

The inquiry will sit for the final time on Friday where it will hear evidence from the NSW Department of Customer Service’s Better Regulation Division Secretary and Commissioner of Fair Trading, Rose Webb.