Perpetual takes aim at three Crown Resorts directors

The fate of three directors of the James Packer-backed Crown Resorts hangs in the balance.

The fate of three directors of the James Packer-backed Crown Resorts hangs in the balance after the company’s largest institutional investor, Australian fund manager Perpetual, voted against their re-election at this week’s annual general meeting.

The Australian understands that after recent discussions with Crown chairman Helen Coonan, Perpetual has voted against all resolutions at the AGM, mirroring the intentions expressed last week by the Australian Council of Superannuation investors.

Perpetual owns over 9 per cent of Crown. The fund manager declined to comment on Sunday. ACSI members own about 7 per cent of Crown.

Other smaller institutional investors, including some industry super funds, have also voted against the resolutions at the meeting following revelations of serious governance and compliance failures at the company during a public inquiry by the NSW Independent Liquor and Gaming Authority.

There is growing speculation that the entire board may be forced to step down in the wake of the inquiry’s findings.

The move by Perpetual to oppose the re-election of the chief executive of Mr Packer’s private company Guy Jalland, former public servant Jane Halton and one-time doctor to Kerry Packer, Professor John Horvath, could put their re-elections to the board in jeopardy.

Professor Horvath has been on the board for 10 years, making him Crown’s longest-serving independent director. He is the chair of Crown Melbourne’s compliance committee, which manages engagement with the Victorian gambling regulator.

Key at the meeting will be whether Mr Packer votes his 249.3 million Crown shares, representing a 36.8 per cent stake in the company, which last year helped directors Harold Mitchell and now chairman Helen Coonan retain their board seats despite large protest votes.

Also unclear are the voting intentions of US fund Blackstone, which owns 10 per cent of Crown and has applied to ILGA for approval to increase its interest.

Proxy advisory firm Ownership Matters has advised its clients to oppose the re-election of all three directors, while another proxy Adviser ISS last week reversed its recommendation on the proposed re-election of Mr Jalland from a qualified “for” to “against”, citing evidence presented to the inquiry.

“This is made on the basis of governance concerns raised at the inquiry regarding the asymmetric information available to billionaire James Packer through his shareholding in Crown held by Packer’s Consolidated Press Holdings (CPH),” ISS said in a note to clients. It supported the two other directors and proxy house CGI Glass Lewis is backing the re-election of all three directors.

ISS and CGI have also queried the substantial non-audit fees paid to Ernst & Young in 2020, which they claimed could have prejudiced its independence. However both said those concerns had been mitigated by the recent appointment of KPMG as Crown’s new auditor.

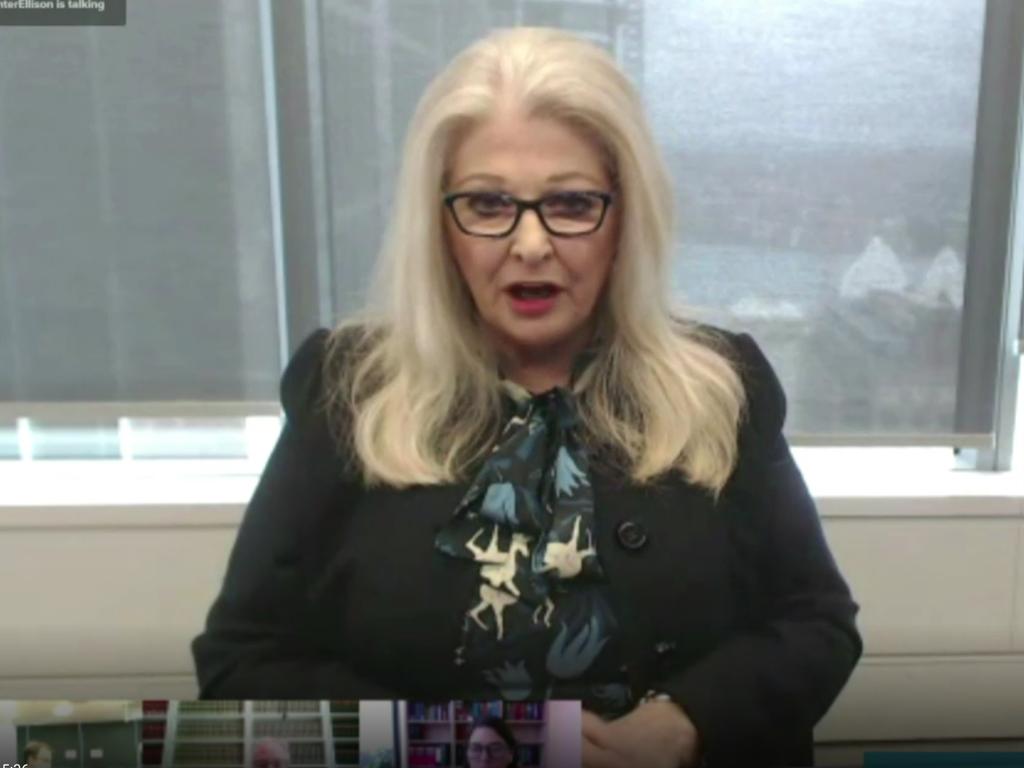

On Friday Helen Coonan told the ILGA Inquiry into Crown’s suitability to retain the licence for its new Sydney casino that she had already started discussions with some long-serving directors about their retirement plans and she was reviewing the concept of “independence” on the board. She also revealed the company’s Australian Resorts chief, Barry Felstead, would be leaving by the end of the year.

But she strongly backed controversial Crown director Michael Johnston remaining on the board, despite evidence presented to the inquiry that he failed to inform the board of risks to Crown’s staff in China before 19 were arrested in October 2016.

Mr Johnston, the financial controller of Mr Packer’s CPH, has also been criticised by inquiry head Patrica Bergin for “wearing too many hats” at Crown and for not declaring conflicts of interest between his obligations to Mr Packer and to Crown.

Ms Coonan’s board shake-up comes after Mr Packer said during his evidence to the inquiry that he expected the Crown board would be more independent in the future and revealed he would be prepared to wind back his control of the company.

Ms Bergin is widely expected to recommend limiting Mr Packer’s ownership of Crown and prohibiting his influence over management if she finds he is not fit and proper to remain an associate of the Sydney licensee company. She may also find that Crown itself fails the same test.

Crown’s rival, Star Entertainment, states in its constitution that no more than one shareholder can hold 10 per cent of the company unless it obtains the permission of ILGA in NSW and the Queensland government.

Asked on Friday about a similar shareholder cap being put on Crown, Ms Coonan said it was a “very difficult question”.

“I think whilst (Mr Packer’s 37 per cent) shareholding is there, it’s certainly my duty as chair and the broader duty of the board to properly manage that relationship, to properly manage the relationship with the nominee directors,’’ she said.

“I would not like to opine on divestment or a time framework for it. It is not a simple matter to be requiring large parcels of shares to be divested.”

In his evidence Mr Packer said he was prepared to jettison his special information-sharing deal with the company.

Ms Coonan said the board was set to decide the future of the protocol and a long-standing services agreement with CPH.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout