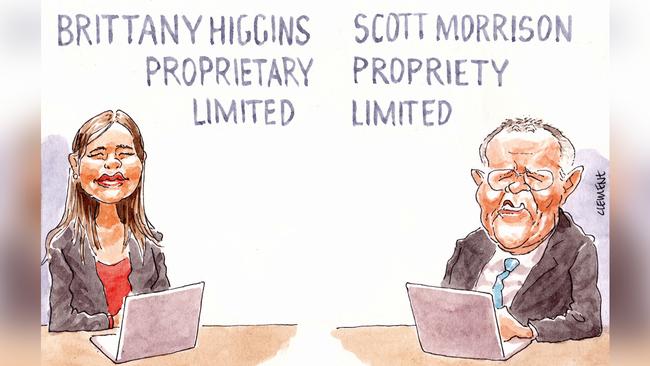

Brittany Higgins Pty Ltd mulls her next move

On-leave Defence Minister Linda Reynolds’former staffer Brittany Higgins was back in the news on Thursday, having written a fresh letter to Prime Minister Scott Morrison.

Alleged rape victim Higgins wrote seeking to participate in the PM secretary Phil Gaetjens’now paused review into her alleged sexual assault in Reynolds’ office in March 2019.

Higgins also wrote to lodge a formal complaint about what she said was “backgrounding” to various media outlets about her partner in the days following publication of her horrific allegations.

But recent days have also seen the courageous 26-year-old put pen to paper elsewhere, making Margin Call wonder just what the former media adviser has planned for her future.

After all, she is a smart, young woman who now finds herself without a job and at the epicentre of a political storm.

At the end of last week, the now Brisbane-based Higgins made the bold move to create her own corporate outfit, appropriately named Brittany Higgins Pty Ltd. Wholly predictable really, given Higgins is now one of Australia’s most recognisable and admired women.

Being only in her mid-twenties, Higgins has the prospect of a long working life ahead of her and an obvious need to earn a living for many years to come.

Margin Call hears there have been several approaches made in recent weeks to Higgins on the potential for her to write a book or tell her compelling story in some other form.

In recent weeks, that’s been a story that has defined the national discourse and is providing a powerful force for change, so it’s any wonder Higgins is being courted towards a deal.

We understand no contract has been signed by Higgins yet, but that she is open to discussing concepts.

Morrison wants the nation to think that he’s made an “offer” to Higgins, too — of her old job back — but sources close to the young staffer said no one from the Liberal Party had made any such offer.

The likes of a book sounds like a much better, appealing and important prospect anyway.

We look forward to the read.

Legal IPO row

The downsized float of HWL Ebsworth was abandoned last November and, with a second lawsuit now lobbed by its own staff against the company in relation to the IPO, we’re starting to see why.

The law firm and its managing partner Juan Martinez were this week hit with a lawsuit by the office’s Sydney litigation partner Greg Lewis accusing them of excluding him from the profits of the IPO and forcing his expulsion. The move had been a lucrative one for all of the firm’s bumper list of 269 equity partners — except for Lewis, who claims boss Martinez sought to exclude him from the IPO.

According to the lawsuit, Martinez is then alleged to have threatened Lewis with expulsion if he did not go along with his plans. Recall the firm had been seeking to raise as much as $350m, but took a significant trim to a smaller $151m offer after institutional clients raised concerns about its hefty debt pile.

As Margin Call pointed out at the time, Martinez and his executive team stood to gain 2 per cent of the open float, while the rest of the existing owner lawyers maintained a majority stake of 60.9 per cent.

Even the more slimline IPO would have presented Lewis a handy bonus, the lawyer now seeking court orders that other equity partners buy out his interest or, alternatively, damages.

Martinez stands accused of breaching fiduciary duties owed to Lewis as a partner of the firm, while the resolution to expel Lewis shortly before the abandoned IPO is argued to have no effect.

This week’s suit is not the first lobbed in relation to the float. Last month, HWL settled a case brought by former partner Sian Gilbert over almost $30,000 she said wasn’t paid to her because she did not support the firm’s IPO.

With several of his own partners fired up, Margin Call can only wonder how Martinez got (and is getting) along with his prospective investors.

Paws for concern

ASX debutant Mad Paws spruiks its culture as aligned to a set of values known as the “pack mentality”, but Margin Call can’t help but think the company has taken it a step far when it comes to its board.

Ahead of the dog walking group’s $12m IPO on Friday, two co-founders — chairman and serial entrepreneur Jan Pacas, as well as chief executive Justus Hammer — set out their plans to scale up the business and plot its life as a listed entity.

That includes both sitting on the company’s board, alongside two fellow non-executive directors who have caught Margin Call’s attention.

Both Mike Hill and Joshua May serve as the group’s independent directors — though their “independence” warrants some unpacking.

You see, cornerstone Mad Paws investor Bombora, which holds an 8.36 per cent stake post-listing, is part of an investment group Hill co-founded in 2014, and one he continues to serve as its managing director and co-chief investment officer.

May, meanwhile, is portfolio manager focused on pre-IPO strategy and is a director of the Bombora Investment Management board.

Not that those roles seem to bother the newly listed company.

Touching on the issue in its prospectus, Mad Paws notes that both men are considered to be independent directors, “free from any business or other relationship that could materially interfere with, or reasonably be perceived to interfere with the independent exercise of the directors’ judgment”, the document reads.

Further, in a separate note, the group points out that neither businessman has “the power to exercise or control the exercise of Bombora Investment Management’s rights to vote attached to the shares or to dispose the shares held by Bombora Investment Management”.

We wonder then whether either of the two will be privy to any share of the $160,000 cash transaction support fee invoiced by Bombora for various support and capital raising services.

Fees we are clearer on are those headed to the executive team, namely $25,000 to each of the co-founders turned executives Hammer and Alexis Soulopoulos, who will serve as the group’s chief of new business.

Along with previously mentioned Pacas, the founding trio also snare just over 17 million IPO options.

The IPO caps a big week for the German-born Hammer, who starts his first gig leading a listed entity just days after the $255m float of Airtasker, another company for which he is an investor and adviser.

He will no doubt be hoping for a similar blockbuster debut, along with fellow investors the likes of HotelsCombined co-founder Michael Doubinski, Marly Spoon’s Rolf Weber, even Commonwealth Bank’s Matt Comyn, who retains a stake of less than 1 per cent.

McPherson’s bid

Long has consumer products group McPherson’s Limited held some degree of fascination for Melbourne billionaires who orbit the empire built by late box king Richard Pratt.

On Thursday Raphael Geminder, who is married to Pratt’s daughter Fiona, lobbed an unconditional, all-cash $172m takeover offer for McPherson’s, whose board immediately branded the bid “utterly opportunistic” and said it “profoundly undervalues” the company.

Geminder, who earlier in the week was out and about helping his Pact Group client supermarket chair Aldi celebrate its 20th birthday in Australia, has created a new vehicle, Gallin Pty Ltd, to conduct the offer, with that entity ultimately owned by billionaire Geminder’s private Melbourne-based Kin Group.

Kin has in recent weeks built up a 4.9 per cent stake in McPherson’s, which these days is concentrating on health, beauty and wellness brands, using David Evans’ Evan & Partners to advise and execute on the takeover bid.

If Geminder is seeking insights into the underperforming McPherson’s, he need go no further than wife Fiona’s former brother-in-law Alex Waislitz, who has had a long association with the takeover target.

Until 2009 Waislitz was a director on the McPherson’s board as a consequence of a major shareholding he held in the group.