Family twist to Raphael Geminder bid for McPherson’s

Raphael Geminder is plotting to take over a flagging company in which his brother-in-law, Alex Waislitz, once held a major stake.

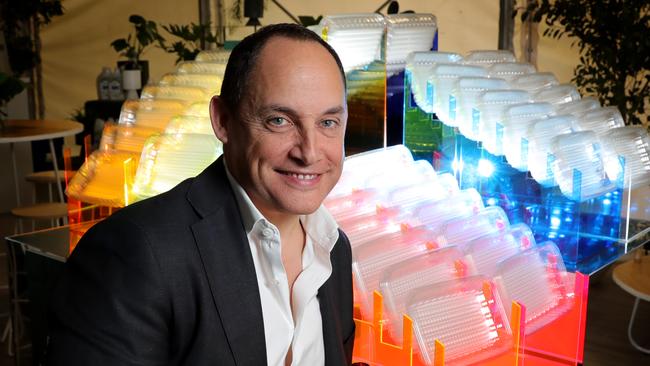

Billionaire industrialist Raphael Geminder, whose private investment empire spans food, packaging and retail, is setting himself up as a company turnaround specialist following a unconditional all-cash takeover for underperforming diversified industrial play McPherson’s.

It is the same McPherson’s that 20 years ago included Mr Geminder’s brother-in-law Alex Waislitz as its biggest shareholder and a director.

Only two years ago Mr Geminder seized a 20 per cent stake in then struggling The Reject Shop, and while he failed to grab full control of the retailer he appointed directors and helped lead a strategy change which has seen the chain perform strongly and its share price almost triple.

Now he is trying his hand at another poor industrial, with big plans to grab control and revitalise it.

McPherson’s has tried it hand at almost everything, from book publishing and producing the telephone directory to selling cutlery. More recently it has focused on beauty and wellness through a string of acquisitions.

Gallin, a wholly-owned subsidiary of Mr Geminder’s family vehicle Kin Group, on Thursday launched its tilt at the struggling McPherson’s at $1.34 per share, representing a 9.8 per cent premium to the last closing share price of $1.22 and valuing the company at around $177m.

However McPherson’s rejected the bid as “utterly opportunistic” and said it “profoundly undervalues” the company. “The board recommends that shareholders take no action at this time,” it added.

Billionaire Mr Waislitz, Mr Geminder’s brother-in-law, was a director of McPherson’s 20 years ago and his Thorney Investments was once McPherson’s largest shareholder with a stake of just over 20 per cent.

It was something of a sneak attack by Mr Geminder, who is married to Fiona Geminder, daughter of the late billionaire Richard Pratt, and who was recently valued by The List in his own right at $1.18bn. His Kin investment house has been quietly buying up shares in McPherson’s since December.

As the takeover bid was announced on Thursday Kin also outed itself as holding 4.95 per cent of the issued capital through a number of nominee companies.

Mr Geminder is seeking 100 per cent of the business, but is also signalling he will opt for a smaller stake if he can get seats on the board and help guide the company’s resurrection.

An industrial company with a share price that has flatlined for decades, McPherson’s has dabbled in a wide range of activities including printing where it once published the telephone directory, to homewares, cutlery and beauty products. In recent years it has specialised in health and wellness and owns pharmacy and healthcare brands such as Dr LeWinn’s, Lady Jayne, Glam by Manicare and Swisspers.

A statement from Kin said McPherson’s share price has underperformed the benchmark All Ordinaries Index over 12 months and 10 years, while investor trust has been severely eroded.

“McPherson’s management has suffered a significant erosion in trust and credibility among investors following a series of strategic missteps and sustained underperformance,’’ a Kin statement said.

Mr Geminder’s investment vehicle pointed out that the current share price of $1.22 (before the bid) is close to half the level of a recent capital raising only last October when McPherson’s raised around $45m. But not long after the completion of the raising the company downgraded its earnings outlook and withdrew fiscal 2021 guidance, leading to a sharp fall in its share price.

Kin is arguing McPherson’s has a chequered history of acquisitions and expansion, most recently Dr LeWinn’s which has disappointed while also incurring a $5.7m provision for hand sanitiser inventory. There is also uncertainty over the outlook for Chinese exports following the trading update and downgrade.

“However, it must be stressed that turning around McPherson’s is not a simple process. It requires an extended effort. Kin has the risk appetite and patience to see through a turnaround of McPhersons which is likely to take several years given the size of the challenges.

“While the offer is for 100 per cent of McPherson’s, Kin Group would be willing to accept a lesser stake provide it is sufficient to attain board representation and influence change.”

Shares in McPherson’s were last trading at $1.385, up 16.5 cents or 13.52 per cent.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout