HWL Ebsworth staff hope for strong IPO case

Employees at HWL Ebsworth, soon to be called Alarcon, will be hoping fundie sweet talking by chief Juan Martinez pays off, with potential for up to $1m of shares to be paid out to the group’s staff if its downsized IPO gets off the ground.

The $151m offer, priced at $2.30 a pop, has been doing the rounds of Macquarie and Bell Potter’s top institutional clients this week — scaled back from earlier ambitions of between $232m and $255m in part due to the firm’s $232m debt pile.

Martinez, the long-serving managing partner with 22 years under his belt, leads a bumper list of 269 partners, with many set to cash in as the company goes public, albeit held up in escrow arrangements for the first three years.

If they can pull it off, Martinez and his executive team, including CFO Kris Hopkins and strategy officer Russell Mailler, who knows his way around regulation after spending time within the ASX in senior regulatory roles, will hold 2 per cent of the open float, while the rest of the existing owner lawyers maintain a majority stake of 60.9 per cent.

The group’s incentive and retention deal sees those principal lawyers paid an annual base salary of $200,000, with an additional commitment to distribute up to 60 per cent of profits in cash awards and fortnightly bonuses.

On top of all that, Alarcon says it is considering an employee gift of up to $1m in shares.

Whether that comes to pass will be a matter for the board, chaired by former Toll director Kenneth Ryan and including Alumina chief Mark Ferraro, and Western Sydney Uni chancellor Peter Shergold.

Sibylle Krieger rounds out the board with her experience in listed law firms — formerly a partner of Xenith IP before its protracted merger with fellow listed intellectual property firm IPH.

If successful, the firm will become the fifth listed law firm to join the bourse, though the track record set by more recent predecessors Slater & Gordon or Shine Justice leave a lot to be desired.

The former raised $35m at $1 each in 2007 and tanked to lows of 44c earlier this year, while Shine continues to languish below its $1 offer price from its 2013 IPO.

Alarcon won’t have to try too hard to beat that performance … provided it makes the float.

Superyacht sails in

A new superyacht is making waves in Sydney’s Pittwater Peninsula, courtesy of seasoned yachtsman Marcus Blackmore.

The 96-foot Ammonite made its way into Australian waters this month, upsized from his previous 82-foot yacht of the same name, which Blackmore himself told a global boating magazine he had bought on a whim. “Why did I buy it? I don’t know … I just can,” he told a Boat International webcast earlier this year.

The third hull in Southern Wind’s SW96 series, the superyacht was launched out of Cape Town on August 31, before making the voyage to Sydney’s northern beaches under the stewardship of renowned sailor and Blackmore’s long time friend Kay Cottee.

Recounting his history in sailing, Blackmore told the webcast he had first fallen in love with the sport out of Mosman’s Middle Harbour Yacht Club, where he bought his first boat from fellow boating aficionado, the late Bob Oatley, and that after numerous hitouts in the annual Sydney-Hobart race he had his sights set on racing further afield.

Delivery of the new three-cabin superyacht with interiors designed by wife Caroline, even after some delays from COVID-19, sets Blackmore up for plenty of training time ahead of the Millennium Cup in New Zealand’s Bay of Islands in February.

There, he’s in a field of 12, upsized after coronavirus kept the competition tight last year, with US businessman Larry Finch’s Janice of Wyoming among his rivals, along with returning entrants Sassafras and Silvertip.

Between his new yacht and recently purchased Bayview abode, it is any wonder Blackmore took a step back from his eponymous vitamin maker earlier this year.

Wolfensohn’s ties

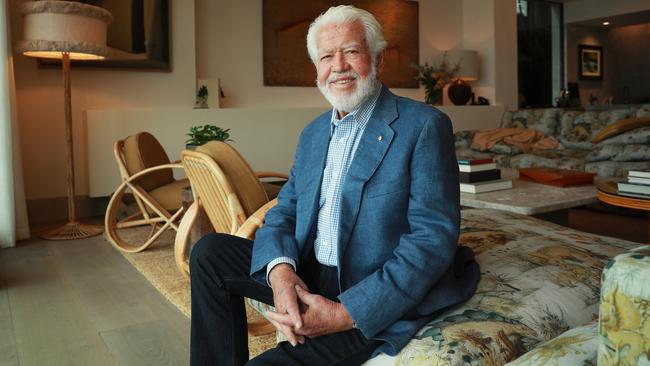

James Wolfensohn, who passed away at his home in Manhattan on Thursday, for many years had maintained an enduring connection to Australia.

Sydney-born lawyer turned investment banker Wolfensohn, who died aged 86, ran the World Bank for 10 years after being invited to the role by US president Bill Clinton.

His career was played out on the international stage, but Wolfensohn, who as a schoolboy lived in a small flat in Edgecliff and went to Woollahra Public and then Sydney Boys High, was the owner of 1000ha of southern NSW called Yabtree, near Wagga Wagga.

Guests to the estate had included then governor-general Quentin Bryce and her husband Michael.

Wolfensohn’s wife Elaine passed away only three months ago. The couple had three children.

But Wolfensohn, who early in his career was a lawyer with Allens, maintained just one corporate connection to Australia as the sole shareholder of his Jackson Hole Management Australia Pty Ltd vehicle, which was created in 2008.

Directors of the vehicle include his son Adam Wolfensohn, who runs New York-based asset manager Encourage Capital, which was formed from a merger that included Wolfensohn Funds Management.

Also a director of the Australian company is Wolfensohn’s son-in-law, New York lawyer Jascha Preuss, who is married to Naomi Wolfensohn.

Evans out to pasture

Westpac chief economist Bill Evans may be known for his financial prowess, but it was his racing experience that was cause for reflection as he retired from the Australian Turf Club board on Thursday.

In brief words to members at the group’s Rosehill Racecourse in Sydney, chairman Matt McGrath acknowledged Evans’ eight years with the racing club, opening the floor to have him share three highlights — watching Winx, the “rise and rise” of The Everest carnival and work done by McGrath and chief Jamie Barkley.

Evans retires in line with the group’s limits on board tenure after an effort to extend the limit to 12 years was narrowly voted down in August.

Silk Tim Hale, known for representing former NSW Labor minister Ian Macdonald at the ICAC inquiry, won the vote to take the vacated seat after pulling out racing big guns such as royalty Gai Waterhouse and former ATC chair Laurie Macri in his campaign.

Members also voted to grant Angela Belle McSweeney a second four-year term, her last as dictated by the same tenure rules.

Good thing there’s no limits at Evans’s long-time employer Westpac — he’s notched up 29 years as the bank’s top economics spokesman and isn’t showing any signs of slowing down.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout