Soaring directors’ insurance costs ‘chilling the productive spirit of boards’

Australia’s strict laws on corporate disclosure make it a ‘global outcast’ for directors’ liabilty insurance, John O’Sullivan says.

Former Credit Suisse chairman John O’Sullivan has warned that skyrocketing directors’ and officers’ insurance premiums are “chilling the productive spirit in Australian boardrooms”.

Mr O’Sullivan, a former partner in law firm Herbert Smith Freehills and general counsel for the Commonwealth Bank who pulled out of the race to head corporate regulator ASIC three years ago, said Australia’s strict laws on corporate disclosure made it a “global outcast” for directors’ and officers’ (D&O) liabilty insurance.

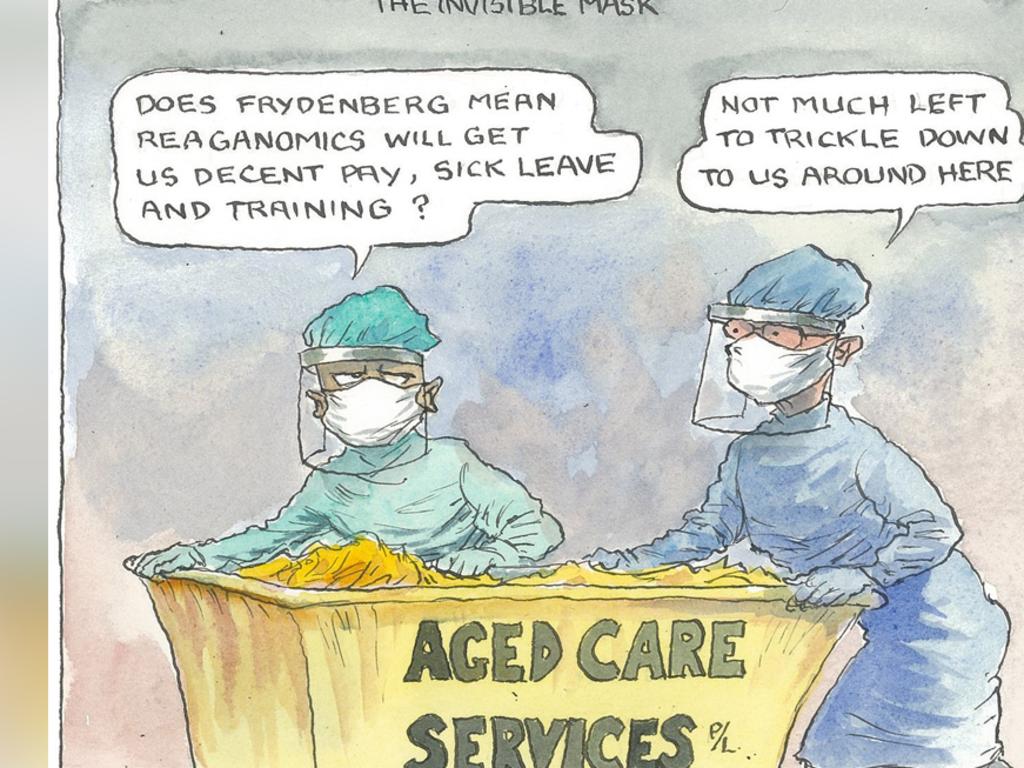

While welcoming this week’s announcement by Treasurer Josh Frydenberg of a six-month easing of liability on directors inadvertently breaching disclosure laws during the COVID-19 crisis, Mr O’Sullivan said there was still a need for permanent reform of the disclosure laws.

Despite the temporary changes, directors fear strict laws on continuous disclosure combined with the rise of class actions and litigation funders has created an increasingly worrying situation, result in skyrocketing D&O liability insurance costs.

With the rise in class actions and court decisions, many insurance companies have pulled out of the market for D&O liability insurance in Australia, sending premiums soaring and making insurance cover hard to get for smaller organisations.

Mr O’Sullivan, whose current roles include being a director of AMP and one of the NSW government’s representatives on the board of motorway company WestConnex, argued it was Australia’s strict disclosure laws that had attracted litigation funders to Australia.

“The government’s announcement of temporary changes to continuous disclosure laws is a good short-term response to the COVID-19 problem,” he said.

“But, ultimately, they will have to solve the disclosure issue on a permanent basis.” He said Australia was a “global outlier” with its regime of strict liability for disclosure.

“No other comparable country has strict liability for disclosure cases,” he said.

“Every other country we would compare ourselves with — the US, the UK and Canada, for example — has a due diligence defence for directors in disclosure cases.”

He said this worked “perfectly well” in those countries, “but Australia has become a global outlier for disclosure rules”.

This was attracting global funders of disclosure litigation, he said.

“That in turn means Australia becomes the global outcast for D&O insurance and chills the productive spirit in Australian boardrooms.

“In a post-COVID world, we can’t afford to force boards to play defence instead of offence all the time.”

Mr O’Sullivan is a member of the corporate governance committee of the Australian Institute of Company Directors (AICD), which has been calling for reform of the system for some time.

While the high level of uncertainty because of the COVID crisis has exacerbated the problem, company directors are still concerned that the combination of the strict disclosure laws and the rise of litigation funders has created a toxic mix of potential legal action that calls for long-term reform.

Concern about the situation prompted federal Attorney-General Christian Porter in March to ask the parliamentary joint committee on corporations and financial services to hold an inquiry into the rise of what he described as the “booming” litigation funding industry and its role in encouraging class actions. He said the committee, which has been asked to deliver its report to parliament by November 9, would be given broad terms of reference to inquire into “all aspects of the class action system, including whether further regulation of litigation funders is needed to improve justice outcomes”.

Mr O’Sullivan said COVID-19 would be the “burning platform Australia needs to restart reforms — the kind of reforms needed to significantly improve productivity in Australia for the benefit of everyone”.

He said this could include areas of financial services and corporate regulation.

Recent moves by the government to allow virtual annual meetings and legally binding electronic signatures on a temporary basis should become permanent. Mr O’Sullivan was in the running to become the chair of ASIC three years ago but withdrew after Labor opposed his appointment, criticising his close ties with then PM Malcolm Turnbull.

The two have known each other since they were teenagers, when Mr O’Sullivan led the debating team for St Joseph’s College and Mr Turnbull was debating for Sydney Grammar.

Mr O’Sullivan hasa quietly set about rebuilding a new portfolio of roles, including directorships of AMP and WestConnex, a member of the Takeovers Panel and chair of new global fintech investment company Serendipity Capital, a role he took up in April.

He admitted he still had some pangs of disappointment that he didn’t get the chance to run ASIC.

“It was unfortunate that it got so badly politicised that I had to withdraw,” he said. “Having said that, I think I have probably enjoyed what I have done since then a hell or a lot more than I would have enjoyed the ASIC job.

“I wish (current chairman) James Shipton well. He has my sympathy and my best wishes.”

Mr O’Sullivan was asked by his old colleague and former CBA chief executive David Murray to become a director of AMP in 2018, when it was facing some of its biggest challenges ever.

Asked about this role, Mr O’Sullivan says carefully: “I have enjoyed my time on the board, which has been a challenging and stimulating job.”

He is excited about his new role as chair Serendipity Capital, which was set up by another formed CBA colleague, Hong Kong-based Rob Jesudason, whom he met when they were both working at Credit Suisse.

Two other founders are Singapore-based Anton Jerga, a mergers and acquisition specialist who worked at Citigroup and CBA, and South Africa-based Sean Harpur, a former general manager of group strategy at the CBA.

Former CBA CEO Ian Narev is an adviser to the company, which will be based in Singapore.

Mr O’Sullivan said Serendipity was investing in fintechs and financial services companies.

It focused on three key forces shaping the investment and financial services world: technology and digital assets, sustainability and the unique macroeconomic environment facing the world.

“It sees these three forces which will shape our lives in the next 10 to 15 years,” Mr O’Sullivan said. “It rides the key forces which are going to shape the landscape, particularly the financial landscape in the next 10 to 15 years.”

While many may see emerging markets as risky, they have become a market for some cutting- edge fintechs, with their big consumer bases leapfrogging to technologies such as mass market mobile phone banking.

One of Serendipity’s investments is TymeGlobal, a Hong Kong investor in digital banks with operations in Hong Kong, Vietnam and South Africa.

One of the fastest-growing “greenfield” digital banks in the world, it has more than 800,000 customers. Tyme launched a digital-only bank in South Africa in 2019 in partnership with African Rainbow Capital.

“It has developed a very simple technique to open bank accounts on a mobile phone,” Mr O’Sullivan said. “It’s very global. It acquired 1.2 million customers in its first year of operation, the fastest growth of any neobank globally.”

Tyme was also looking at digital banking opportunities in other emerging countries, such as Cambodia and Indonesia.

Late last year it invested in Pollination Global, a climate change-focused advisory and investment firm with offices in Europe, the US, Asia and Australia.

Its latest move is a $US4m investment in San Francisco artificial intelligence company Deep Labs, which works with MasterCard, Visa and American Express.

While they had pursued very different careers since they met as high school debaters, Mr O’Sullivan maintains a strong friendship with Mr Turnbull.

“Whatever you think about his politics, Malcolm has undoubtedly led a big life,” he said.

“He has had a front-row seat, not merely in Australian politics, but for Australian business, media and the law for 40 years.

“Malcolm has been at the top of the tree not only in politics, but he has been a leading lawyer and one of the country’s leading investment bankers when he ran Goldman Sachs in Australia.

“He will leave a much bigger mark on a far bigger span of Australian life and commerce than most prime ministers.”

Mr O’Sullivan may have missed out on running ASIC, but he has his hands full. “I recognise I have had a very lucky career and life to date,” he said. “But I still have a lot to do yet.”