A case in point is the $419.9m business registry modernisation, which is part of last year’s budget plans to put the ASIC business registry under ATO control and update its systems.

The long overdue measure is welcome provided, after some years of trying to sell the Traralgon registry and then combine it with the tax office, that something actually happens this year.

Australia has 2.4 million companies, which is a lot for a country with a population of 25.7 million people and antiquated registry operations, so an upgrade combined with a full rollout of the digital identity system would be a boon.

Next in line for action rather than talk is the regulatory architecture around the new payments platform, which has been in place since early 2018. Already the digital system is the biggest way of transferring money around the economy, with payments totalling $417bn this year against $369bn for debit cards, $254bn for credit cards and $6bn for “buy now pay later”.

McLean Roche estimates the consumer cost of the payments system at $22.5bn a year, which if open to competition would be actually productive cash used on spending rather than going into the pockets of the big four banks and their Visa and MasterCard services.

The big reform to payments was the Reserve Bank’s new payments platform, the digital system that was meant to be the lever opening the system to competition, but to do so requires an access regime that no one has quite got around to doing some two years later.

The reason is that its board is run by the RBA and the top seven banks, so the incentive to break the oligopoly is non-existent.

This is why Tuesday’s digital business plan could be the most crucial reform this government makes and actually go close to achieving the $1.5bn in additional economic activity Tuesday’s statement trumpeted.

But to get there needs real leadership, not just talk — actual implementation of the measures outlined.

The federal government has handled the pandemic well, but it remains to be seen whether it scores good marks on the recovery. This includes seemingly little things like mandating the adoption of electronic invoicing by July 2022 for all government agencies and importantly to drag big business into the fold.

If there is a system of electronic invoicing, small business would get its money faster because big business would run out of excuses and all of a sudden there would be more money in the hands of the right people.

“Buy now, pay later” is meant to be the big innovator in the market, even though its stockmarket ranking is way ahead of actual runs on the board.

Afterpay hits participating retailers with a 4 per cent levy that comes off their bottom line, so just imagine the difference if the fee could be competed away.

That is the prize for actually opening up access to the digital payments platform, so bank competitors could get their nose into the system.

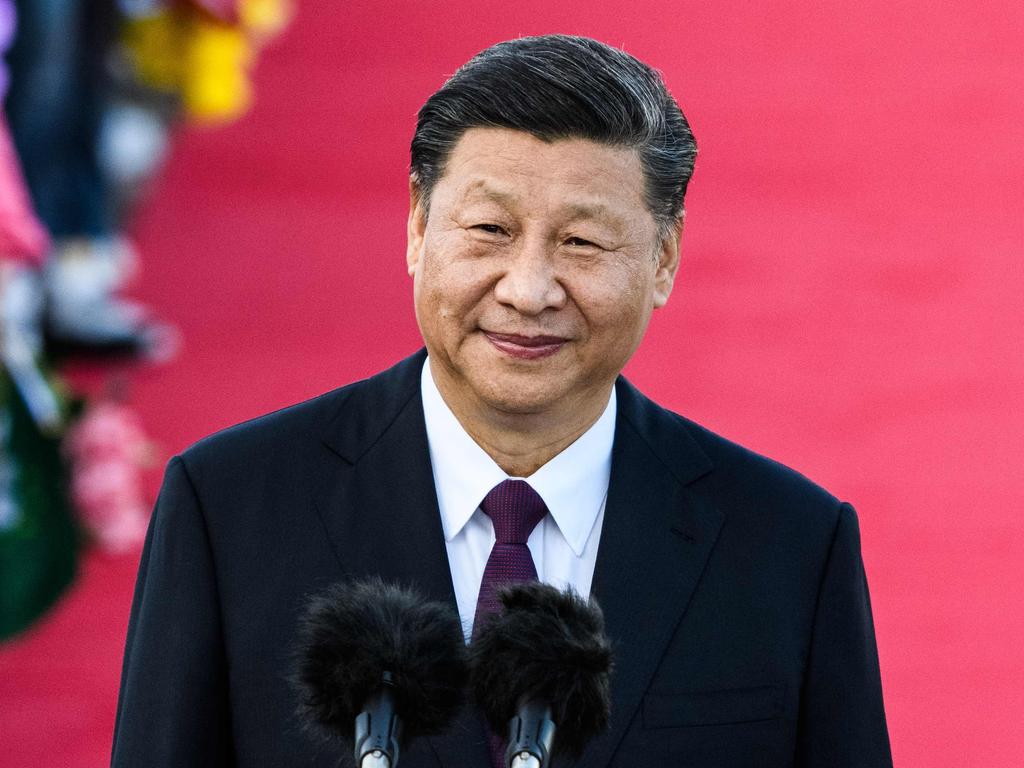

There are many reasons why the Chinese economy can recover quickly and one of them is an open payments system so the WeChats of the world can compete with the main banks.

China mobile payments, which includes AliPay and WeChat, have been around for nine years and handles $41 trillion in payments, against Visa and MasterCard, which have been around for 60 years and handle $24 trillion.

Open access is one innovation that can allow newcomers to leverage other reforms such as positive credit reporting and consumer data rights.

The former allows a new entrant to get a good idea of someone’s ability to pay and the latter gives people access to their own bank and soon energy and phone records.

The incumbents in all three sectors are anxious to keep competitors out, so what is needed is an outsider to demand action.

All of the above and much of the useful initiatives in Tuesday’s release are well known and have been recommended by the Productivity Commission, various parliamentary inquiries and the government’s own budgets, but by definition — by being in the release — have yet to happen.

The thing missing is converting talk into action and that will come.

As an aside, with Scott Morrison due to talk up manufacturing policy on Thursday after a slew of reforms unveiled in the past two weeks, one could say it’s been a noisy lead-up to the budget next week.

Traditionally, the budget lead-up is left for the treasurer to have clean air unless the prime minister is not anxious for the treasurer to be seen as leading the show.

This happened with Fraser-Howard, Hawke-Keating and, on occasions, with Howard-Costello, which makes you think someone wants to keep Josh Frydenberg in a box.

Wine and milk flows

As Treasury Wine Estates boss Tim Ford prepares to answer the detailed questions China has asked about his wine exports, he will also be looking at just how he needs to handle the trade going forward.

This may well include considering local bottling and distribution points in China and detailed partnerships like those engaged by dairy exports such as A2 Milk. This inevitably means less control.

There was some concern in the industry over delays in getting product into China in recent weeks, with some trying to land as much wine as possible ahead of a perceived 60-day “grace” period expiring on October 17.

The perception was wine entered before mid-October would escape any early duty that may be imposed.

Just how much the export delays are wine-specific is not known because traders across the board are complaining about shipping difficulties.

The present MUA industrial action is one cause and another is demand with Asia on the China trade.

On some estimates, Penfolds could be worth as much as $11bn on its own against the $6.4bn market of the company today, but the bullish valuation is based on China exports.

China is a crucial market for Treasury Wine and Penfolds, accounting for 17 per cent of sales and 35 per cent of its earnings.

A2 Milk uses a variety of means of getting product into China, including the corporate daigou who source material in New Zealand and Australia to ship to China, trading platforms like JD. Com and Alibaba, and also a tight strategic relationship with China State Farm. In signing the new deal, A2 said State Farm would help on a range of issues such as import services, local market regulatory consulting and product traceability control.

It was noted last month A2 said it had an exclusive due diligence on a $NZ270m ($250m) investment in financially troubled New Zealand dairy, Mataura Valley Milk. A2 is looking at buying a 75 per cent stake from a company called China Animal Husbandry Group, which is a subsidiary of China State Farm. The Chinese will retain a 25 per cent holding.

A2 said the deal was more part of its attempt to broaden its product range into more nutritional powders to complement output from its 19 per cent-owned Synlait Milk.

The federal government’s digital business plan is a winner provided someone in government actually takes leadership on implementation, because much of the document details opportunities that are long waiting to happen.