On Friday, Bain will take a step towards formal ownership of Virgin Australia after a creditors’ meeting, which from day one was destined to be a sham because the deal was completed back on June 26 when Bain was named as the preferred bidder.

Its willingness to inject $125m into the airline in a $700m bid, relatively free of conditions, won the day and now only court formalities remain.

Whether the $700m deal is financially successful remains to be seen and will take several years to establish, given it is being done in arguably the worst climate for the airline industry in history.

After a couple of court formalities Deloitte’s Vaughan Strawbridge will have completed a textbook-perfect administration, exploiting the flexibility in the system and backing the certainty offered by a financial powerhouse in Bain.

On May 24, Bain’s Mike Murphy embarked on a PR campaign for fear of being overlooked in the process.

The unsecured bondholders will be disappointed because their plan offered an alternative with a higher return for them but less certainty for the survival of the airline and too little too late.

The unsecured creditors will get between 9c and 13c a share, which compares with the 10c price at which the bonds were trading at in April.

Equity holders will get zero and the circa $700m in cash which Bain will pay creditors for control compares with the $729m equity value of the company in April.

The vote in favour of its deed of company arrangement is almost certain, because if it fails then Bain will buy the assets separately under the agreement with the administrators Deloitte in June.

Asset sales are done outside the corporate entity, which means no JobKeeper payments, and another $49m washed against the wall which also means less for the creditors.

The unions are unlikely to let that happen.

Because the Virgin board didn’t call in Deloitte until late April, after the domestic airline industry was shot down, there was no cash to work with, and in the scheme of things Strawbridge has done a brilliant job.

One problem in working out if Bain will make any money from the $700m cash it will hand over is the reality that the airline is in the hands of politicians on the issue of just when domestic and international borders are reopened.

While backing Paul Scurrah as chief executive, at least for the moment, Bain’s Murphy is yet to name his board and finalise his executive team.

The only certainty is some involvement of former Jetstar boss Jayne Hrdlicka in at least a non-executive capacity.

The airline will remain in administration for the next few weeks to finalise a string of contract changes to reduce the $6.8bn in debt.

Concerns about the Virgin name were scotched by Sir Richard Branson’s support for the deal on Thursday. This was not surprising, given Bain is the majority owner of Virgin Voyages, his cruise company, and he and Bain boss Stephen Pagliuca discussed the deal.

There will be more job cuts in addition to the 3000 or one-third of the workforce already gone, but given the fact Virgin entered the pandemic in a fragile state with too much debt and an unworkable board, the good news is the airline looks like surviving.

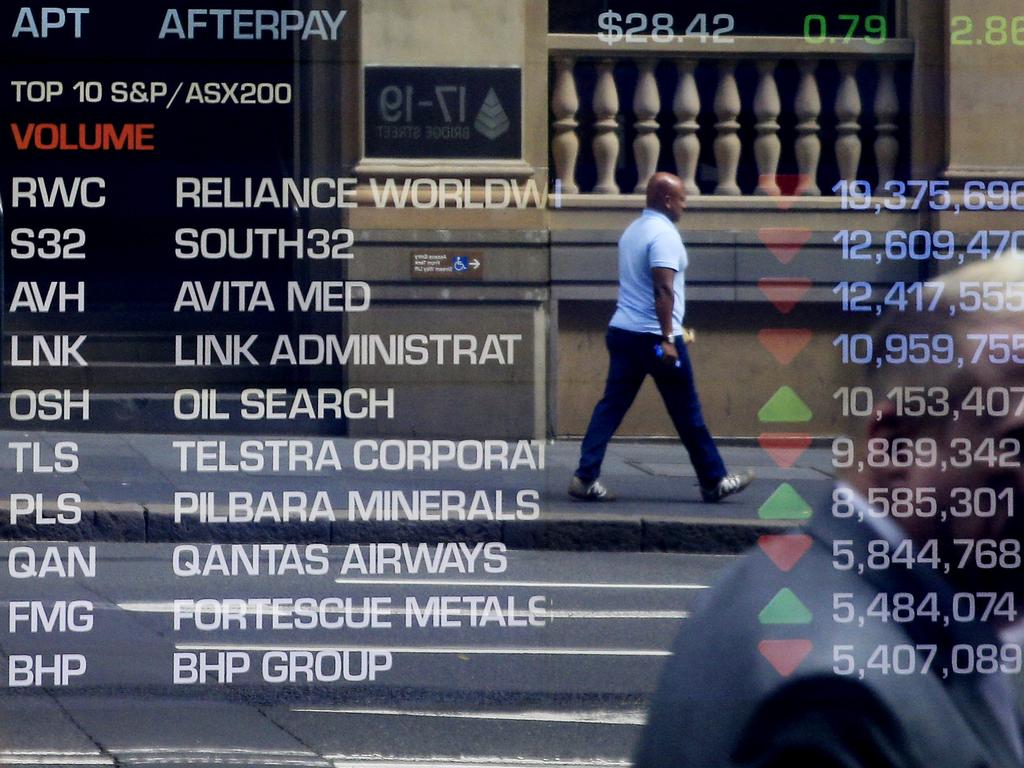

Qantas’s Alan Joyce will not take his foot off Virgin’s neck but has offered a lifeline of sorts by declaring he will charge passengers top dollar for their flights when the industry returns.

Scurrah has already indicated he is willing to cede market share to boost profitability, which means he will aim for 25 to 30 per cent of the domestic market.

The star of the show, Strawbridge, has managed the program with minimal input from the federal government.

This excludes the $49.3m in JobKeeper payments and $1.2bn in subsidies on the flights that have happened in the lockdowns.

Having refused to offer financial support before Virgin went into administration, the lack of further meaningful involvement is of course how it should be.

If Virgin survives, offering some competition, Treasurer Josh Frydenberg will be relieved, while the Nationals have already done their bit in mass subsidies to regional carrier Rex, which is based in Wagga where deputy Prime Minister Michael McCormac resides.

Virgin was big enough to pay Strawbridge’s team $26.8m, Clayton Utz et al $8.7m and Morgan Stanley, KordaMentha, Houlihan Lokey et al $16m — or $51.5m in total for the advisers.

Only big companies could pay those bills, which is why the government is looking at insolvency reforms.

On September 25 the present holiday given to directors who allow companies to trade while insolvent and the amnesty on statutory demands will end, among other concessions.

The latter are rules which mean if you issue a statutory demand for the $3000 you are owed by a company and you don’t get paid for 28 days you can wind them up.

Big companies with boards backed by expensive insurance policies will tend not to trade while they are insolvent, but some do.

Small companies will do so because more often than not the business owner’s entire life is based on the company’s finances, right down to home mortgages.

Insolvencies are down this year thanks to JobKeeper but are destined to soar next year as those payments disappear, and it is this end of the market which is looking for some relief.

Chapter 11, which is a debtor-led process, is also court-led, which means the lawyers take control, and with Virgin Deloitte’s Strawbridge has shown that wasn’t necessary.

Smaller companies have less money to play with.

The government has to put an end to the statutory demands relief at some stage, just as JobKeeper payments are also winding down.

Even though the country is in its deepest recession since the Depression, insolvency rates are down due to JobKeeper, at 373 in July against 429 in May, 1203 in the June quarter (down from 1747 in the March quarter), and at 7362 in the 2020 financial year, the lowest since 2005.

The industry is expecting a boom from the end of this quarter when JobKeeper is wound down which makes insolvency reform a matter of urgency.

ACCC extends reach

The ACCC has extended its international reach with a co-operation agreement with the US, Britain, Canada and New Zealand to help co-ordinate enforcement investigations with information-sharing. The deal, negotiated by ACCC international boss Macus Bezzi, boosts its reach and will be a stepping stone to further agreements like that already in the US, which undertakes section 155 discovery notices and interviews on behalf of the ACCC.

Lion tries again

Lion has formally initiated a new sale process for its dairy division after its $600m deal with Chinese-owned Mengniu was blocked by the federal government last month.

As reported last week Lion intends to run a short three-week process to test interest and will then proceed with more formal talks with any firm bids.

John Wylie’s Tanarra Capital, backed by a group of industry funds including Sun Super and Bega Cheese, is among the potential purchasers.