L’Oreal ANZ’s marketing boss on the cosmetics giant’s ‘digital first’ future

Cosmetics giant L’Oreal’s recently appointed marketing boss Georgia Hack explains how the brand’s digital marketing sends its products into the coveted “coffee conversation” to drive growth.

L’Oreal’s recently appointed chief digital and marketing officer, Georgia Hack, says the beauty giant has its sights set firmly on a digital-first future. The former David Jones marketer now leads L’Oreal’s 32 brands in the Australian and New Zealand markets.

For L’Oreal, the year has been punctuated with significant business and growth milestones in the Australasian market.

In August, it completed its landmark acquisition of Melbourne-based skincare brand, Aesop for $US2.5bn. From September, the company also saw the arrival of a new regional chief executive, Alex Davison, who previously headed L’Oreal’s Greece operations.

According to L’Oreal’s 2023 half-year results, the company generated €20.57bn in sales. Globally, the company’s market capitalisation sits at $US210.78bn.

Brand Finance’s 2023 report also crowned L’Oreal as the most valuable cosmetics brand, valued at $US12bn, up 7 per cent on the previous year. Brand Finance said the increase may be a result of the company’s “digital marketing strategies and enhanced online presence”.

What started as a Parisian hair dye company in 1909 has undergone seismic transformation over the past century.

A pivotal moment in L’Oreal’s history that ignited its growth trajectory can be traced from the late 1950s, when the company’s chairman François Dalle started to expand the business internationally and acquired new brands.

Dalle would not recognise the technology-infused landscape companies such as L’Oreal now navigate.

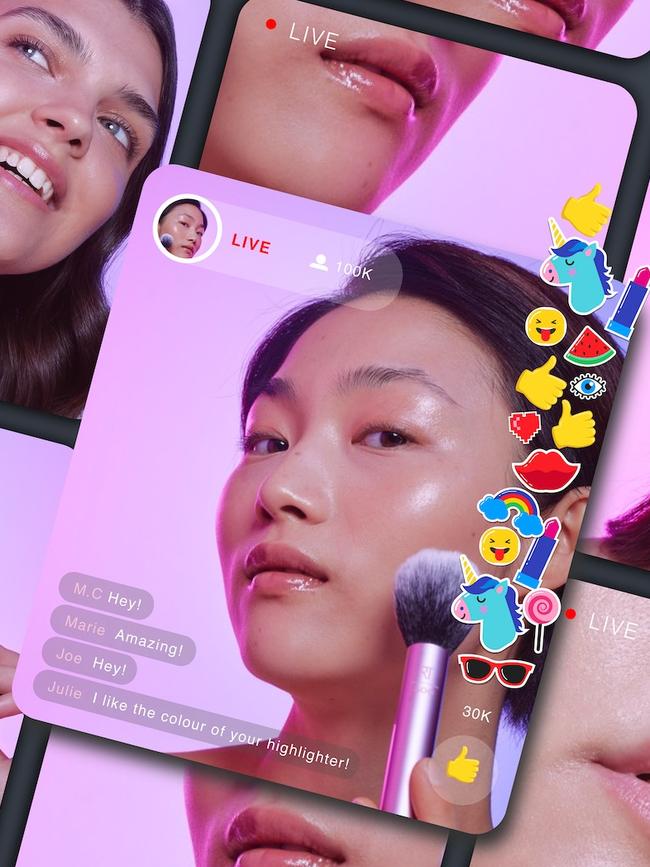

Ms Hack said: “We are living in this digital world, so how we connect with consumers is definitely digital first. And the investment that we make in that space, and how we start to consider the types of talent that we have in the businesses, is definitely focused on a digital-first mindset.”

Some of the company’s recent digital investments include Modiface, an AI and augmented reality tech platform, which L’Oreal acquired in 2018.

It allows consumers to try on makeup virtually and assess their skin, and therefore, help inform purchasing decisions. In 2019, the technology was integrated with Amazon in the US and Japanese markets.

The tool was introduced to the Australia/New Zealand market in 2020, and hosts 18 brands on the platform, including a virtual makeup try-on for beauty brands such as Yves Saint Laurent, Armani and Maybelline NY, and an “instant skin reader” for cult skincare brand Kiehl’s. There are also hair diagnosis tools for brands such as Kérastase.

The brands that are available on the Modiface tech platform see higher engagement with consumers, and have seen an increase in sales as a result.

“The way in which we connect with consumers is obviously moving at this lightning speed. And it’s because of the speed of digital,” Ms Hack said.

“When we say ‘digital-first’, it‘s like, how do we continue to engage with a consumer that’s moving at an incredibly fast rate based on the technology platforms that we all engage with?”

While L’Oreal’s digital transformation over the decades points to how the company is embracing change, from Ms Hack’s marketing vantage point, some things are eternal, such as marketing theories, which have stood the test of time. Those include understanding consumers and being “super-clear on your brand positioning and purpose”.

The company recently conducted a study to understand which customer touchpoints are important for brand equity and conversion.

It found that in-store experiences are the most crucial to both converting sales and building brand equity, followed by recommendations from family and friends.

Those beauty recommendations, often shared over coffee and catch-ups between friends, are highly influential when it comes to driving purchase decisions.

They are also hard to measure, but L’Oreal sees their intrinsic value, despite their relative opacity, compared to other data points that are often used to gauge marketing performance.

“I think for us, it’s hard to put a price or a budget around ‘recommendation’, because that’s the outcome,” Ms Hack said.

“We absolutely invest significantly within the digital space to drive that top-of-mind awareness and consideration. And then it’s also within the in-store environment as well, knowing that it’s crucial to educate consumers on the beauty products.

“L’Oreal is a marketing-led business and a brand-led business. A huge part of our success to date is the investment in brand and the investment in understanding those metrics that you can’t measure, and having the impact.

“That’s why we do the touchpoint study so that we understand, ‘Yes, we can see a conversion outcome of this channel and that channel’.

“But actually, if you want to be in the coffee conversation … it’s an outcome of the sum of the other parts working for you.”

Ms Hack, who was previously David Jones’ general manager of marketing communications, and prior to that head of marketing at Country Road Group, said she had seen the industry more broadly prioritise sales-driving marketing over brand awareness.

“With the rise of digital, we’ve been so conversion focused – on short-term gains – but what we’ve all realised as marketers is that if you’re not topping up the top of the bucket and driving your awareness and consideration, then your conversion will obviously be great in the short term, but long-term might see (a reduced) impact.

“We’re very focused as a business. Most of our investment is around that awareness/consideration piece, because we know that over time that is what will really benefit us.”

Despite the cost of living crisis consumers are still investing in beauty, although they are changing the way they spend on beauty products, according to Ms Hack.

One of the most notable trends the business has observed is the rise of ‘clean’ beauty and skincare as a dominant category for the company.

Customers are increasingly eager to understand the efficacy of products and ingredients, which Ms Hack attributes to the ever-growing amount of information available to consumers.

“The rise of information (and) social media has absolutely driven this shift where consumers are more knowledgeable than ever before,” she said.

Digital channels have also brought customers closer not only to brands, but influential figures and experts.

“Not only can you hear from a celebrity, but you can also hear from a dermatologist in regards to why a beauty product is relevant for you,” she said.

The growing number of media channels means L’Oreal – and the brands within its portfolio – need to meet customers where they are consuming content.

Ms Hack said those channels may change, but to find growth “is really about the story that we need to tell”.

“Not only do you have to be on multiple touchpoints,” she said. “The story that you communicate across all of those touchpoints is equally as relevant.”