Generation gap: Navigating advice in the great wealth transfer

The great wealth transfer is underway, but young investors are not their parents – as advisers are finding out.

The greatest wealth transfer in history is now underway and will hasten in the coming years as Boomers tip $3.5 trillion in assets to their children over the next two decades — and that’s just in Australia.

With all this money rolling down the generational hill, one challenge taking shape for advisers is the changing face of the client. Will millennials and Gen Z really want the same advice, given the same way, as their parents and grandparents?

Already, a split in generational attitudes and preferences is clear. For a start, we know younger investors put a high value on social responsibility and sustainability.

They’re more tech-savvy and more willing to invest in crypto. They’re also more willing to accept larger drawdowns, which means they can take higher risk, according to a new survey by Dimensional Fund Advisors.

Research released by the asset manager this week found 14 per cent of young investors would call their adviser if the market dropped 15 per cent. This compares with 21 per cent of older investors.

The results were similar in a scenario where the market slumped 30 per cent, Dimensional said.

Not much of a surprise there, with younger investors — who Dimensional defines as below the age of 40 — having time on their side.

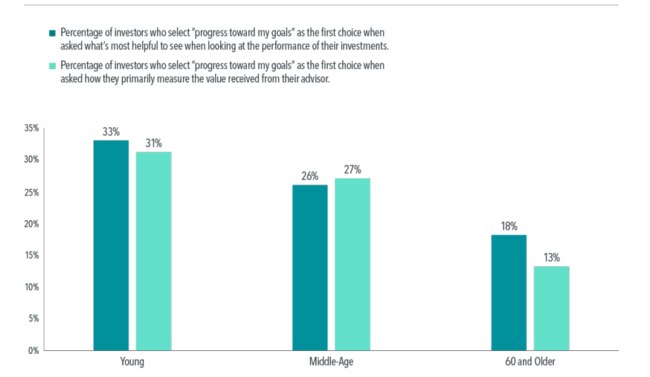

The study also showed a divergence in terms of investing priorities, with younger investors caring most about progress toward their goals, compared with older investors, who were more interested in absolute returns.

The findings were similar in terms of how investors measure the value of a financial adviser. Of the 87,000-odd responses collected between 2016 and 2023, young investors were more likely to assess the value of advice as the progress toward their goals, while older investors valued security and peace of mind.

“The emphasis on goals-based investing and a willingness to accept drawdowns creates an opportunity for advisers to better serve their younger clientele through targeting equity premiums while maintaining a broadly diversified portfolio,” Dimensional said of the findings.

“The results also highlight the value of holistic wealth management. Goals-based models, for example, are another tool available to help investors build solutions focused on financial goals rather than just short-term investment returns.”

From advice statements to TikTok

In the home market, an additional headwind facing both the advice industry and investors navigating this great wealth transfer is the low number of practising advisers.

From close to 30,000 serving Australians’ advice needs in 2018, just 15,000 operate in today’s market.

The low numbers mean some have had to close their books, so they’re not courting younger clients. Meanwhile, the lack of choice also limits young people’s options if they don’t like their mum and dad’s adviser.

For those looking to build their client base, some are well prepared for the generational shift, bringing in young advisers not only to train them up but also to appeal to younger investors, says KPMG national sector lead for asset and wealth management, Linda Elkins.

Younger Australians are open to advice and have a broad range of channels to get it, including TikTok, Elkins told The Australian.

“The financial planning businesses may employ younger advisers and take a dual management approach to a family. This makes good sense for their training and development and for the business,” she says.

“Younger people, from what I see, do like to get advice. But they’ll consider ‘advice’ in a broader range rather than the technical legal term. They may seek opinions, help or support from a range of places.”

Building appeal

Advisers need to think about how they build their appeal to a generation more than happy to get investing ideas from social media, Elkins says.

“They might come in and ask their adviser about something like bitcoin. So advisers need to build services that are more tailored to that future generation.

“And their needs are different too. They’re going to be saving for a home or, if they think that’s out of reach, they’ll want to know how to save a nest egg to support renting over a lifetime. Insurance needs will be different too.”

It isn’t always appropriate for the same adviser to advise different generations of a family, says Financial Advice Association Australia chief executive Sarah Abood.

“There are many planners that handle (intergenerational advice) well, and it’s fine. But it can be cleaner to say, here’s a different adviser and there’s no question of prioritising the interests of one generation over another,” she says.

“Instead, there might be another planner, perhaps who’s at a different life stage, engaging with those clients. So that can help in terms of ensuring there’s no conflict across the interests of the generations.”

Whether using the same adviser or not, for multigenerational wealth it’s worth having an understanding across the whole family of what succession looks like, what wealth distribution plans are, she says.

“When there’s been an event, say someone’s died, it’s terribly stressful and it’s probably not a great time to be trying to form a really important new relationship that’s based on trust with someone you haven’t met before.

“We would certainly encourage people to make sure that they’re engaging early and not leaving it until they’re stressed out by a terrible life event.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout