The ESG backlash gets real as outflows hit hard

Investors are bailing from ESG funds amid underperformance, questions over transparency and a backlash against boardroom agendas.

Money managers chasing the green dollar are now paying the price for their exuberance, with warning signs flashing for an industry once desperate to showcase its ethical evolution.

A shift is underway, with investors bailing from ESG (environmental, social and governance) funds amid underperformance, questions over transparency and a backlash against “woke” boardroom agendas.

The turn against ESG funds comes at the worst moment, with regulators taking aim at greenwashing (the exaggeration of green credentials) just as the money is flowing out the door.

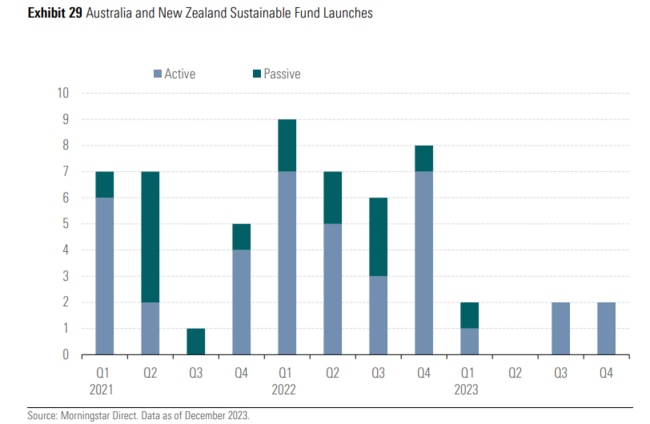

The number of sustainable fund launches in the local market dropped dramatically last year, from 30 in 2022 to just eight in 2023, according to Morningstar.

Beyond the Australian market, we’ve just seen the first quarter of net outflows from ESG funds globally, with investors yanking $2.5bn from sustainable funds in the final quarter of 2023, the research house says.

As investors cool on the green wave, institutional money is taking a closer look under the hood of sustainable funds, with Vanguard among the first to get caught out. ASIC last year sued the $12 trillion asset management giant for including companies that violated ESG criteria in its Ethically Conscious Global Aggregate Bond Index fund. (Vanguard self-reported the breach to ASIC.)

But at a court hearing this month, it became clear the landmark case would not be a cut and dry affair, perhaps signalling a challenge to ASIC’s thumping litigation push. Federal Court judge Michael O’Bryan criticised the declarations the regulator sought over Vanguard’s conduct and claims in its product disclosure statements.

“In this area of law, (be) wary about attributing certain assumptions to readers which are not generated by the text they are reading. It’s just their assumptions. They could make assumptions based on their own ethical framework,” O’Bryan warned the regulator.

The outcome of the case is being closely watched, but ASIC’s message hasn’t wavered. And it’s a simple one: Funds and corporates claiming to be green better have the evidence to back it up.

Regulators around the globe are parroting a similar mantra in a move that could well put sustainable funds in the too-hard basket for good. Indeed, it already appears to be having this effect. Some, like money manager Abrdn, have started removing the word “sustainable” from their funds altogether. Others are updating strategies to omit or restrict the ESG focus.

Investors switch off – and out

Australia’s biggest super funds have yet to move away from sustainable labels, but members have not been so patient: the $124bn UniSuper has already suffered a plunge in its greenest fund, with assets diving 28 per cent since June after being exposed to a raft of electric vehicle and battery makers, including Tesla.

From assets under management of $2.5bn in mid-2023, UniSuper’s Global Environmental Opportunities Fund – perhaps the greenest super strategy in the market, and the most concentrated – has lost $700m, or a third of its value, largely on the back of weakness in the EV market.

More than half of the decline is due to members switching out of the strategy. If nothing else, this tells us that even the most environmentally conscious aren’t willing to stay green if it means putting up with substandard returns.

That’s not to say all green super funds have underperformed. Pure-play ethical fund Australian Ethical, which uses both positive and negative screens, is sitting on a 25 per cent financial-year-to-date return in its international shares super option.

What has become evident, though, is regardless of returns in ESG funds, investors in these funds are in for a bumpier ride due to the restricted investment universe. This is perhaps too high a price for some to pay in a time of higher interest rates, recession fears and geopolitical risks.

Ambition versus execution

Despite a clear ESG backlash, the green influence still weighs heavy. Institutional investors, regulators and corporates are increasingly preoccupied with the same big issue: the challenge of matching up climate ambitions and execution. Not all are pulling in the same direction.

NAB chair Phil Chronican has already flagged that corporates are at a potential inflection point in terms of aspirations on climate change.

“Most large corporates have set out an aspiration to get their operations to net zero. They’re trying to find a path there. But there are a lot of uncertainties, sometimes technology isn’t there,” he told The Australian last week.

“We’re now moving to a much tighter regime of compliance and we could swing the pendulum or change the balance too quickly, where companies start fearing (they may) fall foul of their disclosure obligations or greenwashing and may retreat from (stated climate) ambitions.”

New climate-reporting standards, which will require large entities, including the major super funds, to disclose information about climate-related risks and opportunities, are a source of angst in the community and represent the biggest change to reporting in 50 years, Zenith Investment Partners’ Dugald Higgins warns.

“This is obviously a big transition for the industry, and they need to get it right. From an accounting perspective, it is a massive change,” he said. “And the really daunting issue is the auditing and assurance part. That’s where people start to get nervous. How do we get it right, and what if we run the risk of getting it wrong?”

Past greenwashing cases have, for the most part, one thing in common: The wrongdoing is rarely due to an entity deliberately misleading investors.

“It’s almost always been due to a miscommunication between people on the investing side doing one thing and another division, such as marketing, saying ‘Oh that’s too difficult for people to understand, we’ll go ahead and simplify it’,” Higgins said.

Going forward, the message is clear: Funds need to walk a fine line between transparency and clarity.

“You can’t just make things as simple as possible, the regulator will nail you for it.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout