Whether it is rising geopolitical tensions, soaring inflation or even climate risks, these should be embraced, not something that needs to be regulated away.

It’s that kind of thinking that has turned Macquarie into one of Australia’s most globally recognised business brands and is easily the nation’s single biggest services export.

Appearing at an Institute of International Finance Event in Sydney hosted in Westpac’s offices. Wikramanayake said banks should be looking at risks as a way to support and invest in their clients.

This could come down to securing energy supply in Europe; untangling supply chains or even moving further up the investment curve when it comes to building green energy. It could also come down to helping countries build out their trade and strategically important production bases.

“We thrive on change. And frankly, our financial services industry has to be adaptive and responsive to that change and help our clients and communities come through changes because change creates challenges and opportunities,” she says.

“We as an organisation always look for where change creates need in areas where we have the expertise”.

Wikramanayake’s comments came as Macquarie has been making headlines for different reasons. An important business book was released this week that lifts the lid on the black box that makes Macquarie tick. Written by my desk colleague at The Australian Joyce Moullakis and Singapore-based journalist Chris Wright, the book The Millionaires’ Factory was launched in Sydney across the road from Macquarie’s glass-walled Barangaroo offices. Assistant Treasurer Stephen Jones spoke at the event where he reflected that Macquarie which was built around an entrepreneurial streak, emerged as Australia’s enduring globally focused bank following Paul Keating’s deregulation of the finance sector.

The Macquarie boss doesn’t often appear at forums outside of scheduled Macquarie briefings, although she sits on the board of the IIF, the global banking advocacy group that often acts as the go-between for global financial regulators and banking industry.

The Washington-based board is one of the most globally connected banking organisations and includes high-powered names such as Citigroup chair John Dugan, UBS global chief Ralph Hamers and top executives from some of Asia’s and Europe’s biggest banks. Westpac chief executive Peter King is the other Australian representative on the IIF board.

Climate remains another opportunity for the investment bank. Although Macquarie is now one of the world’s biggest renewable energy investors – it has 100 gigawatts of renewable energy projects underway around the world – Wikramanayake urged caution, saying the transition needs to be a patient journey. In other words, the world can’t move too fast along the green energy path if it is likely to result in energy disruption.

“You can’t shut up what we have until we have the solutions,” she says. Here she pointed to Europe where a move too fast along the path of renewable energy for some countries has caused scarcity following the shocks of the Ukraine war.

Also too much disruption in energy supply leads to a “loss of a mandate” for the green transition, Wikramanayake cautions.

New battleground

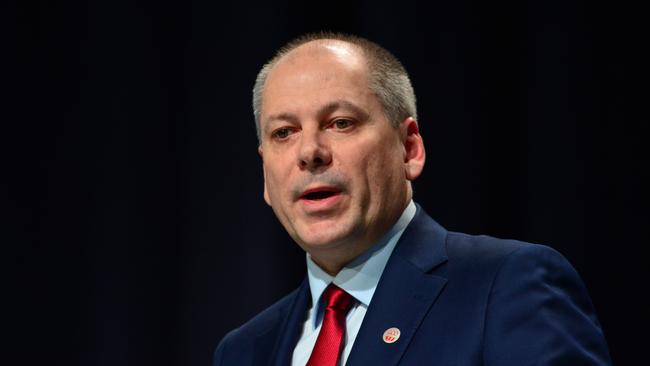

The IIF briefing in Sydney was nominally looking at risks developing through the global banking sector. Here IIF Washington-based chief Tim Adams pointed out that sanctions are becoming the new battleground between regulators and banks. The war in Ukraine as triggered a major global financial response against Russia but its individual banks that often end up doing the policing.

Adams says every jurisdiction has a different approach and a different legal regime so the banking industry is looking for “greater focus, cohesiveness and consistency on illicit financial flows”.

He nominates geopolitical risks as the biggest sleeper issue for the global banking sector with the US-China relationship one of the most economically important relationships in the world, but also the most fractured.

The push from US politicians for decoupling the reliance on china is real, Adams says.

“And the challenge for the financial sector is we’re gonna be seen as the lever or the pressure point for doing that. So already, we’re being called up before members of Congress, a lot of finger wagging, say, why are you doing business there? We need to pull back. And that’s incredibly difficult to do”.

Tech change

Westpac’s King highlighted to the same event that technology and cyber is one of the top risks for Australian banks. The volume of cyber attacks Australian banks are forced to defend each month runs into the hundreds of millions.

“One of the risks that we are very alert to is the fact that it doesn’t matter where you are in the world. Cyber attacks are effectively borderless,” King says.

This also means Australia and New Zealand can’t escape cyber threat when it comes to geopolitics stresses across the other side of the world.

While artificial intelligence is the hottest thing across all businesses at the moment – Wall Street banks are spending billions of dollars and bulking up on software engineers to help them get there, King says AI by itself can’t be the answer to everything in banking.

AI can be useful for Australian banks helping to protect against cyber attacks, fraud and scams on customers but banking remains heavily supervised which involves a human element.

With Microsoft-backed ChatGPT, the popular AI application, King questions where the data goes after you use it.

“How’s it secure for a bank like ours that will have regulatory requirements. You can see it changing the way we do business. But it’s got to be managed like any other change”.

More locally the Australian economy is clearly slowing as interest rates are pushed up – December quarter GDP figures released on Wednesday showed the slowest growth outside of Covid pandemic since 2019. But King believes the risks to the banking sector can be well contained.

“We don’t think this will be an event that just builds momentum,” he says. Rate rises will be a customer event as they juggle the rising cost of living. Even with a slowing economy King doesn’t expect unemployment to rise sharply.

“It will go up but we don’t think it’s of the scale that we’ve seen in previously deep and fast recessions. So it’s very manageable,” he says.

His view echoes similar comments from other banks in recent weeks from Commonwealth Bank to regional lenders like Suncorp or Bendigo Bank. Lending losses remain at record low levels and there is little stress in lending books.

johnstone@theaustralian.com.au

Shemara Wikramanayake, the chief executive of Macquarie Group takes a distinctly different approach to the risks that are fast-building across the global financial system.