RBA should not bolster superannuation funds: AMP

Central bank support for cash-starved funds facing pandemic-related withdrawals adds too much risk, AMP chief claims.

AMP chief Francesco De Ferrari is adamant that adding leverage to the $3 trillion superannuation system, through central bank support for cash-starved funds facing pandemic-related withdrawals, adds too much risk and is not in members’ interests.

As part of the federal government’s stimulus packages, it is allowing drawdowns of super balances of up to $20,000 per eligible person. But the move has spurred fierce debate about the cash levels held by funds in sectors such as hospitality or retail, which have large numbers of susceptible members.

Labor has asked the government to consider liquidity issues in super and several industry fund executives have called for the Reserve Bank to provide cheap loans to assist funds expected to struggle to meet a flurry of withdrawal requests.

AMP has a more diverse superannuation customer base and doesn’t expect any withdrawal issues, though Mr De Ferrari still warns against any central bank intervention.

“Irrespective of who the fund is, if it’s an industry fund or a retail fund, this is essentially like saying ‘I am going to start putting leverage in the management of pension money’,” he told The Australian.

“I do not think pensions, or the investment of your super money, should really have leverage … We have seen when you put leverage, if this thing keeps going down, you will lose even more.

“This will have to come at a cost. This is the public’s money … Personally, I would find it challenging to conclude that it’s in members’ best interest to put leverage in how I manage their pension money.”

His comments follow those of AMP chairman and Financial System Inquiry chief David Murray, who last week warned against regulators offering loans to funds bracing for a potential deluge of withdrawal requests, unless they did so on “tough” terms.

Mr Murray said RBA support would create “a moral hazard in the super system” and impact risk management decisions within funds.

Treasury modelling has pointed to less than 1 per cent, or $27bn, of the $3 trillion super pool being withdrawn. But parts of the industry — alongside research firm Rice Warner — argue the final figure could be almost double that.

Mr De Ferrari said AMP modelling suggested the wealth group would see withdrawals at close to 1 per cent of retail super balances.

“We would probably be within the general market average … we feel that actually for us this will be something that is manageable,” he said.

“For everyone this (withdrawal) should really be last resort, because generally in investment principles you don’t want to sell at the bottom of markets.” AMP has dumped guidance for 2020 underlying profit to be “broadly flat” on last year, due to the havoc the pandemic is wreaking in financial markets and the local economy.

AMP’s infrastructure and real assets division would be more frequently revaluing its portfolio, given the market shock to listed assets, but the coronavirus-related decline in prices would also create “opportunities” for the division to make acquisitions, Mr De Ferrari said.

Mr De Ferrari is focused on navigating the crisis and remains committed to AMP’s turnaround and broader reform of the super and financial advice system.

“Once we’ve dealt with the emergency, I think we will all sit down and see how do we make a good superannuation model the best in the world,” he said.

AMP is experiencing its highest ever level of customer contact.

In the past new weeks inquiries through its contact centres were 78 per cent above normal levels.

Inquiries to AMP’s bank arm are running at more than double normal levels.

Mr De Ferrari made several direct calls to customers on Monday — including from AMP’s bank and super funds — to gauge their experience with the company and how it could be of more help.

After a string of ASX-listed companies cutting executive pay to help navigate the crisis, Mr De Ferrari said all options were on the table at AMP, including remuneration changes.

“We are going through the discussion of all these trade-offs as we speak,” he added. “It will include all the levers that we have.”

AMP is still reeling from the fallout of the Hayne royal commission and a number of scandals which led to mammoth fund outflows of $6.3bn last year.

Mr De Ferrari kicked off a three-year transformation plan in 2019 to simplify the group and position it for the future. That includes completing the sale of its life insurance division by June 30, 2020.

When asked how he had confidence the deal would be ruled off, Mr De Ferrari said: “We are really benefiting from the fact that the deal was meant to settle in a year, now we had two years and for example, we have done a significant number of dry runs on the physical separation and execution … So our degree of confidence of being able to effectively execute has really gone up.”

The transaction has been signed off by China’s regulators but still requires the green light from counterparts in Australia and New Zealand.

Mr De Ferrari stands behind his overall strategy despite the near-term challenges posed by the pandemic.

“On certain aspects we’ll have to prioritise, but on our key priorities we still want to drive them very hard because that’s what makes sense for our customers.”

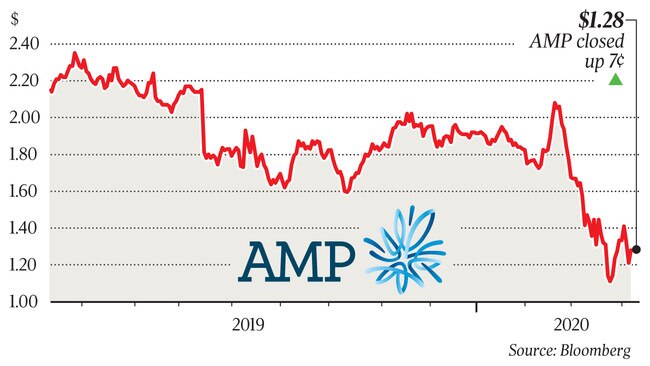

AMP shares climbed almost 5.8 per cent to $1.28 on Monday, outpacing ASX200 gains.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout