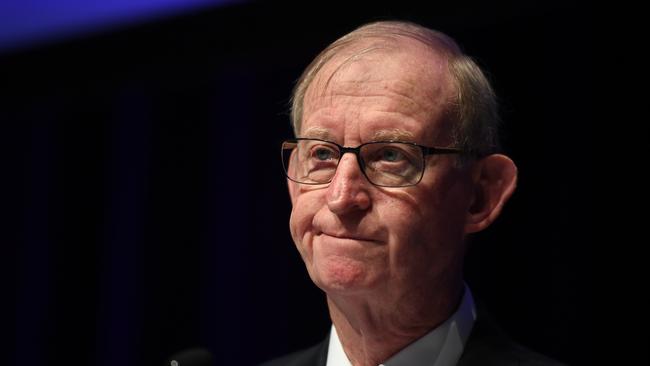

Helping superannuation fund liquidity a ‘moral hazard’, says AMP chair David Murray

Helping super funds deal with a rush of withdrawals creates dangerous precedent, says AMP chair David Murray.

AMP chairman David Murray has warned regulators against offering cheap loans to cash-strapped superannuation funds that are bracing for a potential deluge of withdrawal requests, unless they do so on “tough” terms.

Mr Murray, who chaired the 2014 financial system inquiry, has pushed back against calls from Labor for the Reserve Bank to provide liquidity support to super funds, following the government’s policy to allow early withdrawals of superannuation up to $20,000 for workers recently laid off.

“Were they to provide liquidity they create a moral hazard in super system for the future and therefore they would have to consider whether the terms are suitably tough,” Mr Murray told The Australian.

“Where trustees accept as precedent that in certain circumstances they can have access to this support, that in turn would lead them to make risk management decisions which are likely to be counter to members’ interests,” he added.

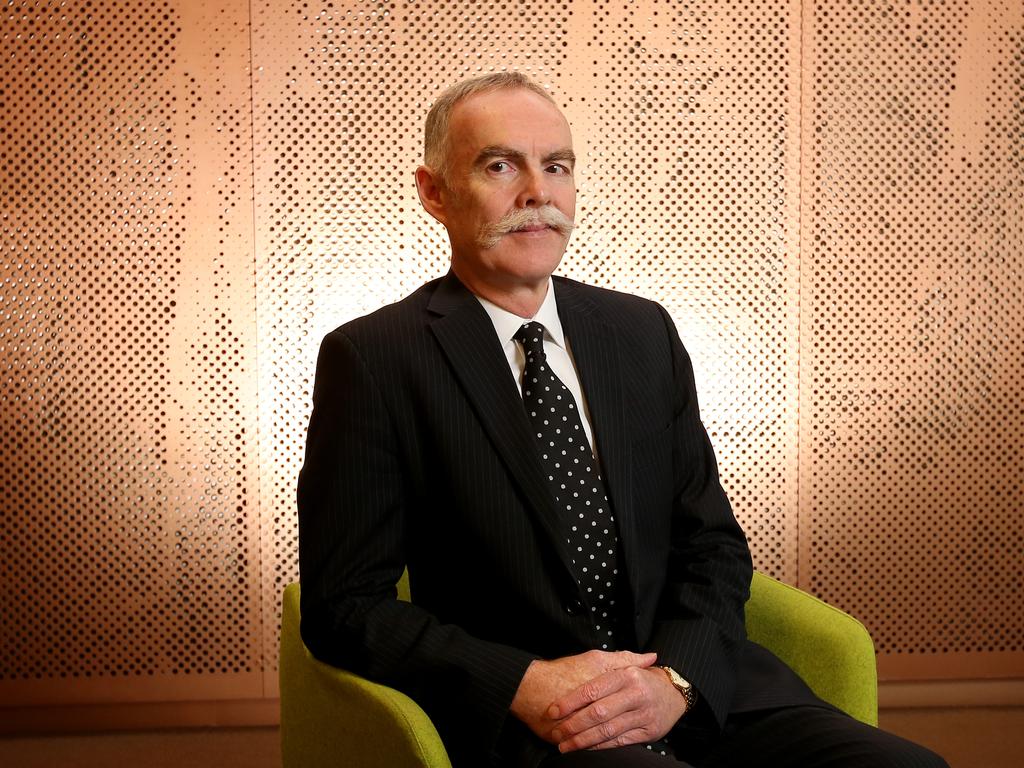

Labor treasury spokesman Jim Chalmers has written to Josh Frydenberg asking for government to consider “address the impending liquidity issues in the superannuation sector”.

Earlier this month the Reserve Bank said it would lend up to $90bn at 0.25 per cent interest to banks to help them provide repayment deferrals to customers.

“We should never confuse support for banking system with support for super system because the banking system pays a high price for that support already,” Mr Murray said.

He also applauded government efforts to cauterise the impact on businesses and the financial system during the significant recession expected incoming months, suggesting planning begin to rebuild the economy after the crisis begin now.

“We need a post crisis plan for rebuilding, akin to a post-war reconstruction plan,” he said. “We could engage in intergenerational building projects that might not have been approved in other times: including power generation, water management, fast inter urban transit, for example,” he added.

The latest economic crisis has thrown the spotlight on industry funds, such as Hostplus and REST, which have narrow membership bases concentrated in hospitality and retail, where significant job losses have occurred.

“Failure to diversify fund membership can be as dangerous as failure to diversify investments,” said superannuation minister Jane Hume on Monday.

Mr Murray said industry funds’ significant non-liquid asset holdings, such as airports, office towers, and roads, might be difficult to value in this environment.

“It’s naive to think that the value of an equity holding in any entity falls by less because it’s unlisted; in fact, it could fall more because it’s illiquid,” he said.

The Australian understands the government has little inclination to facilitate liquidity support for superannuation funds. In announcing the policy, Treasurer Josh Frydenberg said super funds collectively had around $300bn in cash collectively, and Treasury expected about $27bn would be withdrawn.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout