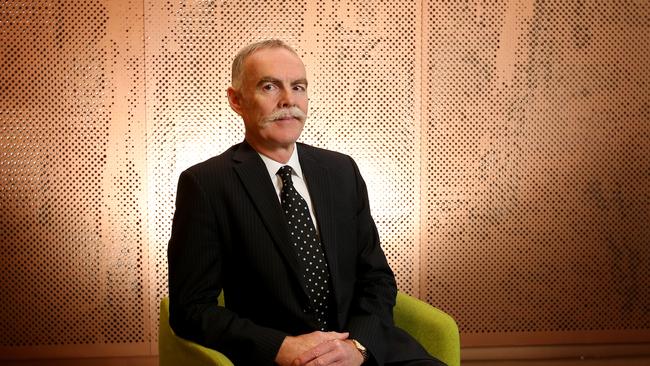

Industry funds can play role to rescue distressed companies: AustralianSuper’s Ian Silk

Ian Silk says AustralinSuper ‘has a key role to play’ in helping to rebuild the balance sheets of corporate Australia.

The $170bn AustralianSuper is being approached by an increasing number of companies and investment banks proposing debt and equity financing deals to get through the current financial crisis.

“We are getting a lot of approaches both directly from companies and through investment banks,” AustralianSuper chief executive Ian Silk told The Australian on Tuesday.

“AustralianSuper believes that, as a long-term patient provider of capital, the fund has a key role to play at this time in helping to rebuild the balance sheets of corporate Australia.”

Australia’s largest super fund, AustralianSuper has been involved in $5.5bn in equity raisings and corporate underwritings in 50 different transactions since 2013.

This included more than $1bn in capital underwriting for three banks — Commonwealth, Westpac and NAB — in 2015 in the wake of the global financial crisis.

The confirmation from AustralianSuper, which has been moving to bring more of its investing in-house, that it is being increasingly approached to be part of financing deals, comes as Virgin Australia has approached the federal government seeking a $1.4bn loan from the federal government in the wake of the COVID-19 crisis.

This could occur as part of a broader package of assistance for the aviation industry, which has been hard hit by the crisis.

Some sources said it would not be a good look for federal government to finance all of the aviation industry bailout on its own at a time when millions of Australians are now out of work. It is understood various financing options are being discussed between the governments and other players to provide some assistance to struggling industries, including possible industry fund involvement.

A key player in negotiations currently under way to help some critical industries under pressure is believed to be former ACTU secretary Greg Combet, who is also chairman of the $160bn industry super fund investment vehicle IFM Investors as well as chairman of Industry Super Australia.

Mr Combet, who was appointed to a federal government advisory commission last week, led by former Fortescue Metals chief executive Nev Power, is believed to be playing a key negotiating role between the government and the broader $700bn industry super fund movement.

While the $3 trillion super industry could see an outflow of between $30bn and $50bn over the next few months as unemployed workers seek to access their super, industry funds in particular are believed to be keen to deploy their firepower to assist Australian companies where possible.

With many funds having complained at a lack of investment opportunities in Australia, the current crisis could provide an ideal opportunity for them to step up their stake in major corporate names, depending on their liquidity. The federal government’s move this week to insist that all foreign takeover deals be submitted to the Foreign Investment Review Board is also expected to increase the potential for deals to be brought to industry funds to supply local equity.

Australian Super and IFM combined to buy a 50 per cent stake in NSW electricity company Ausgrid in 2016 in a $16bn deal, after the federal government declared the utility could not be bought by foreigners.

The FIRB announcement has made it difficult for private equity players to bid for Australian companies in their own right, given that almost all private equity funds here involve foreign investors.

AustralianSuper has done a string of private investment deals involving major listed companies. In 2014 it was involved in the float of private hospital group Healthscope, taking a stake of 10 per cent. In 2018 it was involved in a $450m capital raising for Transurban.

Australian Investment Council chief executive Yasser El-Ansary said he expected the future would see more partnerships between big super funds and private equity funds to buy businesses during the current COVID-19 crisis.

He cited examples last year of a deal between AustralianSuper and BGH Capital to make a $4.1bn offer to buy Healthscope. That deal did not go ahead as it was overbid by a $4.4bn offer by Canadian private equity group Brookfield Asset Management. That deal is believed to have seen AustralianSuper make some $700m on its investment in Healthscope.

Another successful deal was the $2.1bn bid by AustralianSuper and BGH to buy the Navitas education group. “That was publicly listed and has now been taken private,” Mr El-Ansary said. “It is reasonable to expect more of those kind of deals in the period ahead over comings months and years.

“The role of super funds makes a lot of sense in parallel with private equity,” he added. “The opportunity for super funds to play a significant role from a funding perspective and a capital perspective is critically important.

“There is a deep pool of capital in those institutional investors to unlock growth opportunities and turnaround opportunities to take businesses which are currently in the public market into private ownership.”

Mr El-Ansary said he expected the current crisis would also encourage super funds to expand investments in unlisted companies. “There will be a need to generate returns to compensate for the losses which have occurred so far,” he said. “I would expect to see super funds expand their private capital over the next few months.”