Watchdog probes add pressure as super funds face rush

The corporate watchdog will pursue more than 20 live investigations into retail and industry superannuation funds.

The corporate watchdog will pursue more than 20 live investigations into retail and industry superannuation funds in a move adding to the pressures funds face, as the number of members looking to gain early access to their savings explodes to more than 430,000.

Although official numbers have not yet been circulated to the savings sector, a further 70,000 fund members on Friday are believed to have added their names to the list of savers wishing to withdraw up to $20,000 from their fund over the next two years, according to industry sources.

That added to the 361,000 registered super members that the Australian Taxation Office had logged over the three days from Tuesday to Thursday last week, as revealed by The Australian on Monday.

The government is expecting about 1.3 million savers in total to ask for early access to their nest eggs, but this estimate could soon be eclipsed as the scheme has already been inundated with more than 30 per cent of the total expected number of savers adding their names to the scheme in the first four days.

Many more are likely to have registered their interest over the weekend and on Monday.

The early drawdown scheme won’t be operational until April 20. Australians will be able to draw down up to $10,000 this year and a further $10,000 next year.

The ATO will contract those who have registered their interest when the application form is complete.

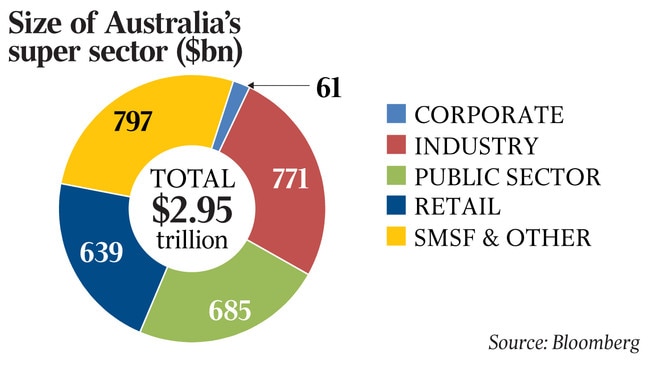

While the government reckons about $27bn will be drawn down under the scheme, the $3 trillion superannuation sector fears the total could be north of $50bn, which would pressure some smaller cash-starved funds to engage in a fire sale of assets — further lowering the value of already depressed asset values — or liquidate out of positions in long-term positions in infrastructure or property holdings. While the Australian Prudential Regulation Authority and the Australian Securities & Investments Commission have put several regulatory programs on hold during the coronavirus pandemic, The Australian can reveal the corporate watchdog will continue to pursue almost two dozen investigations into fund managers in the $3 trillion savings system.

In an answer to a question on notice handed to parliament in the last week of March, ASIC said it had 16 current investigations into the bank-run retail superannuation sector, of which just six were referrals from royal commissioner Kenneth Hayne.

There are also a further five investigations into union-and-employer-backed industry funds, although the watchdog declined to name which funds were being probed.

“ASIC has made clear its commitment to enforcement,” a spokesman for the regulator said.

“ASIC will maintain its enforcement activities and continue to investigate and take action where the public interest warrants us to do so against any person or entity that breaks the law.”

Some smaller union-and-employer-backed industry funds, which cater specifically to members in the shuttered retail, hospitality, tourism and entertainment sectors, are facing a triple-whammy cashflow strain as asset values tank, contributions stall as workers are laid off, and now as they stare down a potential tsunami of hardship withdrawals.

The ATO also gave super funds a six-month lifeline on transferring lost and unclaimed money to the government revenue agency amid the cashflow squeeze.

The move, which delays the mandatory transfer from April to October, will leave funds with an extra $3bn to $4bn in assets.

“We are providing this deferral so funds can focus on assisting their members,” the ATO said.

In a letter sent to Treasury last month, the Association of Superannuation Funds of Australia, Industry Super Australia and the Australian Institute of Superannuation Trustees said expected drawdowns of up to $65bn could exceed the industry fund-dominated MySuper sector’s cash reserves of about $45bn, forcing funds to engage in a fire sale of assets to cover payouts, which would harm the investments of remaining members’ assets.

The super sector is encouraging the ATO to make the payments to super members itself, which will then be repaid to the government revenue agency by funds in due course.

Some parts of the funds management sector have lobbied the government to allow the Reserve Bank to supply extra liquidity to the sector as super funds strain under the pressure of investment markets crumbling, their cohorts switch out of diversified investment strategies and into safer cash investments, longer-term investments in unlisted assets such as infrastructure return less.

The $180bn AustralianSuper, the nation’s largest fund, said its flagship balanced fund had fallen 6.4 per cent over the course of the financial year, in an update to members over the weekend.

AustralianSuper chief executive Ian Silk will take a 20 per cent haircut on his $1m salary, as the fund reduces the pay of the executive team and the board by the same margin, in a COVID-19 policy to be reviewed in October.

While the ATO is administering the superannuation drawdown scheme — as many funds lacked the capability to do so otherwise — super funds contacted by The Australian declined to clarify how many members had been inquiring about early access.

AustralianSuper is receiving close to 500 calls a day from members wanting to know about early access, and about 4000 members have clicked through a link on the fund’s website taking them to the ATO scheme.

Lucerne Alternative Investments Fund portfolio manager Jerome Lander said more savers were likely to switch out of unlisted asset classes.

“Australians have one last chance to cash out of their industry super funds holding large amounts of unlisted and unfairly priced assets, before their unit prices catch up with reality,” Mr Lander said.

“This is because the prices of illiquid infrastructure, property and private equity assets in many large funds do not yet reflect the devastating losses that have arisen from the bursting of the ‘everything bubble’,” he said.

Additional reporting: David Rogers

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout