And even when times are tough for corporates, Australian CEOs seem to come out ahead.

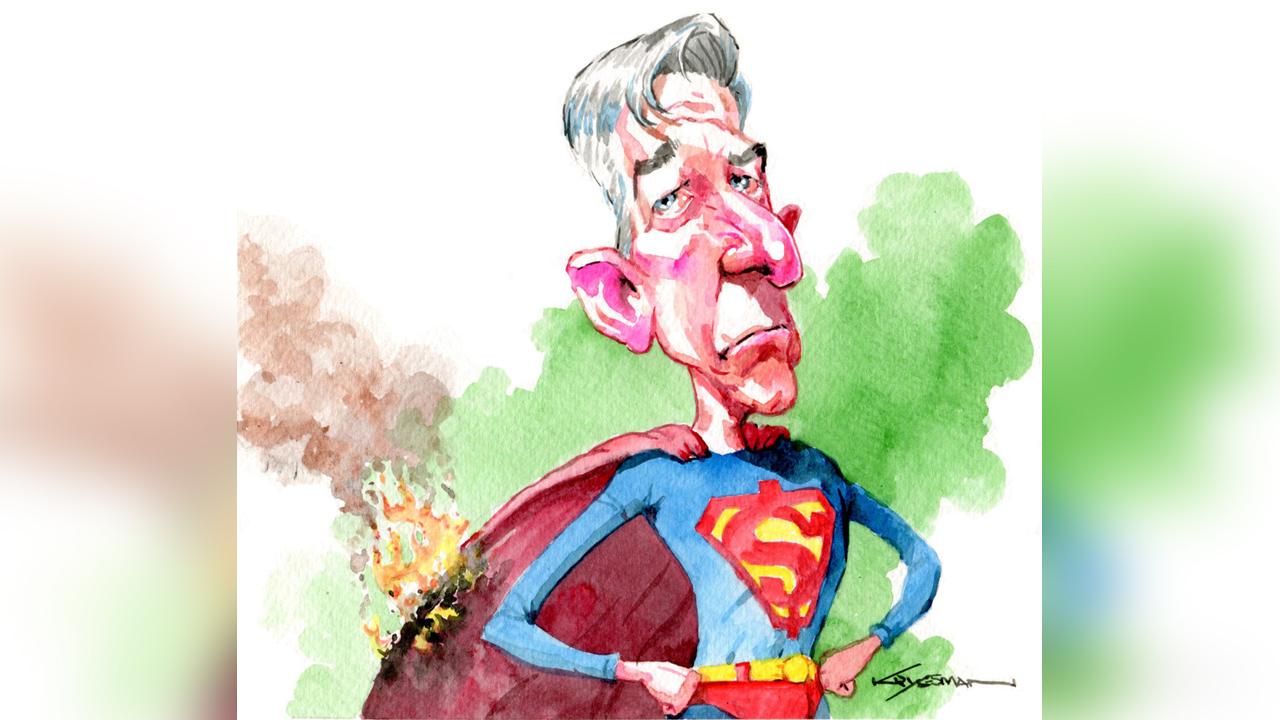

Former Qantas CEO Alan Joyce may have had $9.3m slashed from its final-year pay, but the blow was softened by more than $3.4m in payments for three months’ work before he left last September.

A year earlier, Joyce took home almost $15m, mostly from bonuses and awards and helped by the airline returning to profit. The former CEO cleared more than $120m during his time running the airline, and millions more in shares.

Over at Perpetual, there is a deeply uncertain future for the funds house. A high-priced deal to acquire rival fund Pendal could not reverse a sagging share price. Now a break-up of Perpetual is on the cards, with the best parts and storeyed brand name sold to private equiteer KKR. Outgoing boss Rob Adams collected $4.3m last year – $1m more than a year earlier.

Last financial year Perpetual’s shares fell 20 per cent – even after knocking back a takeover approach. Given the looming split, Adams has been placed on gardening leave for nine months as a new chief executive comes in. This means he continues to be paid and at the end stands to collect another $500,000 lump sum in redundancy payments as well as his normal entitlements.

If Adams is collecting $4m a year with Perpetual much worse off from where it started the year, should anyone then begrudge JB Hi-Fi boss Terry Smart for collecting $5.1m?

To be sure it’s a big figure. But shareholders would say Smart’s JB Hi-Fi machine had a stellar year and, in the face of a retail slump, the retailer’s shares are up more than 30 per cent to a record high, and big dividends were flowing back to investors. Half of those payments going to Smart are made up in shares released over several years.

Over at Wesfarmers, Kmart boss Ian Bailey took home a similar amount – again half in shares for an equally booming year. His boss, Wesfarmers’ Rob Scott, saw his remuneration fall by $1m, given safety issues inside Bunnings, but he still cleared $7m, putting him at the higher end of Australian executive pay.

Of course all the retailers were trumped by Victor Herrero, the former boss of the Lovisa, a fast-fashion company smaller and far less complicated than JB Hi-Fi. Lovisa’s generous option scheme delivered Herrero almost $30m in shares. This was in 2023, and we are now waiting for disclosure of his exit package.

At Telstra, Vicki Brady was paid a package of $5.6m in a strong year for the telco’s mobile business. This was up slightly from $5.2m a year earlier. As a comparison, former Telstra boss Andy Penn made $5.7m in his final year.

For all headlines around CEO pay, one thing is sure: companies do a terrible job of explaining the pay of their executives. And when companies reward their CEOs for mediocre jobs, such as seen in the Qantas fallout, this just adds to the reputational damage.

With cost of living front of mind, corporates have become bigger targets than ever and politicians are happy taking aim. Just this week we’ve seen outlandish calls to break up Qantas or the supermarkets.

Investment bank Macquarie for years has been at the front of the conversation about executive pay. It openly acknowledges it pays stunningly well when its bank does well for shareholders and less so in bad times. Added to this, its bonuses are locked away for the longer term.

Former Macquarie commodities boss Nick O’Kane was awarded a $57m package two years ago as his gas trading business generated an outsized profit even by Macquarie standards. Interestingly, a year later O’Kane accepted a job at a rival commodities house and he chose to walk away from more than $42m of that pay deal given it was held in Macquarie shares that were yet to vest.

His boss, Shemara Wikramanayake, has seen the equivalent of about $30m in each of the past two years. Two-thirds of her package is put out of reach in Macquarie shares under the bank’s retained profit share scheme.

For shareholders, the principle around pay should remain. If CEOs deliver sustainable returns for shareholders over time, they are entitled to be rewarded.

When things don’t go well, they should also feel it. Lendlease’s Anthony Lombardo got the message when his pay went down $1m after a terrible year for the property company (Lendlease’s historic issues started catching up with him). He still took home $2.6m. This year is shaping up as a turning point for Lombardo and his shareholders.

Time and again there is more upside than downside for CEOs. And while they are the ones in the spotlight, remember pay is more often than not set by boards that are fearful their prized executive is about to walk out the door.

BHP boss Mike Henry has won a 4 per cent increase to his base salary. The increase is “to ensure BHP’s executive remuneration remains competitive to attract, motivate and retain key talented senior executives and is consistent with the global market,” says BHP director Christine O’Reilly, who heads up the board’s remuneration committee. Last year Henry was paid $US7.3m, down slightly from the $US7.5m a year earlier.

For investors, it always pays to dig a little deeper into the numbers. Increasingly, CEOs are graded similarly to the UK system on remuneration. Here, there’s a frank report card on performance.

BHP’s report shows Henry last year came in below target on several measures to meet his full bonus payments. The mining boss was graded down after a worker died at one of BHP’s jointly owned coal mines in Queensland. Henry got full marks for sustainability but fell short on financials and was marked down with lower production at several operations.

The weighting of bonus payments were important at Woolworths. There, short-term bonus payments are 60 per cent graded on financial returns such as earnings and sales, while non-financial like customer satisfaction and safety makes up the balance.

Former boss Brad Banducci was paid $5.4m last year but had his pay marked down given reputational hits and poor total shareholder returns. After two separate workplace deaths in recent years, Woolworths has now increased the weighting around employee safety, including a measure known as the severity rate, which is an indicator of severe injuries.

How Qantas executives were graded on their pay is why the airline flew into trouble. Too much incentive was placed on financial metrics such as sales and profit, and not enough on looking after customers and reputation.

Under new chair John Mullen, bonus payments for CEO Vanessa Hudson will carry a much higher weighting to customer measures (now 30 per cent, from 20 per cent) and a measure on cost savings that had guided Alan Joyce’s firm focus has been dropped.

Long-term bonuses will also include a new reputation measure. It could be argued Joyce was merely delivering on the scorecard he had been set, but that’s an easy out. CEOs need to take a wider view.

Then there’s the Musk principle. His massive pay deal – backed by shareholders – sees the Tesla co-founder entitled to stock options over the next decade. Musk and his board argue it directly ties Musk’s incentive to Tesla’s performance. The EV maker hasn’t paid Musk a base salary for years, instead he has been paid through stock options based on Tesla passing certain hurdles. If shareholders win, he wins – or so the theory goes. Tesla’s shares are down nearly 10 per cent in a year where tech rivals are booming.

And at $US46bn, it’s all about proportionality. Such a package overshadows anything else going. It’s many multiples of Tesla’s cashflows and stands to dilute other shareholders if delivered at current prices. The question is, can one single person really deliver that much value?

eric.johnston@news.com.au

While no Australian companies can match the $US46bn ($68bn) pay deal Tesla shareholders backed for Elon Musk, local bosses are doing OK.