The $367bn behemoth still needs to perform as an asset manager as Schroder and other executives are well aware, as bonuses are paid in part on relative returns.

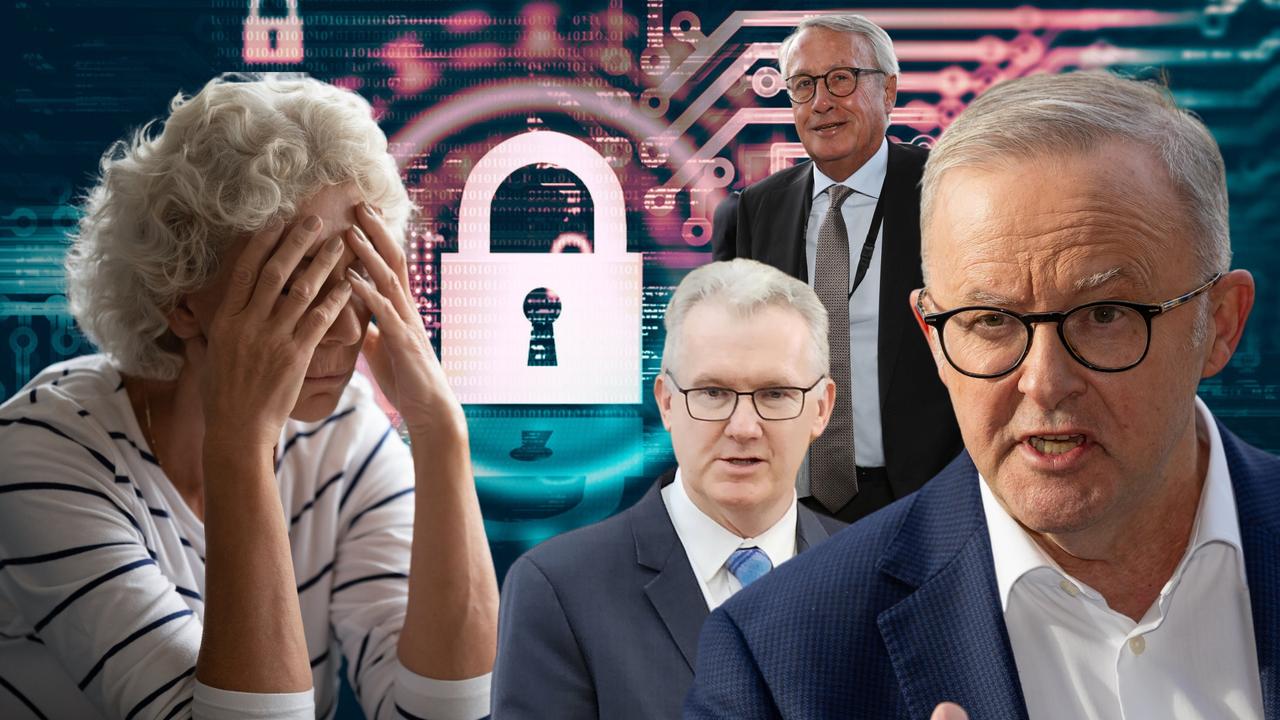

This month’s cyber attack underlined the challenges, and frankly, despite Friday’s release on the issue, AustralianSuper was slow to perform its role in ensuring members knew what was happening and how they were affected.

On paper, AustralianSuper is doing just fine thanks to the $315m a week in mandated inflows and with $367bn under management, Schroder has the future of many listed companies under his control, is a key player in Australia’s economic future and can stroll the global stage as a genuine tier-one asset manager.

Some of the macro figures are not as good as they seem. While the fund is one of the few to have positive competitive fund flows at $5.1bn in 2024, these are just one-third of the inflows in 2022, according to Connexus Financial figures.

This is the money coming from people who have left their primary fund and are looking for a new place to park their money, increasingly driven by financial planners to the likes of Hub24.

AustralianSuper has been extraordinarily good at collecting and managing money since its 2006 birth with net assets of $43bn, but the more problems raised the more questions are asked, and fewer people are choosing it as their preferred home.

Superannuation was always about managing retirement income, ensuring people have a satisfactory life after finishing work, and right now Schroeder is struggling to meet the service challenge. Its not that he hasn’t been warned, and the reminders just keep on coming, like this month’s cyber theft and last month’s ASIC action for allegedly failing to pay death benefits in a timely fashion.

Cyber theft is a real world problem. Former NAB chief Ross McEwan said the bank was hit 50 million times a month, which should have served as a warning to everyone – including the government, which handles more money and personal data than anyone.

In May 2023 Xavier O’Halloran from Super Consumers issued a report warning many super funds had inadequate controls.

Connexus’s David Bell is constantly warning the $4.2 trillion sector “its operational infrastructure is an area of concern”.

The best form of protection is to keep members informed but the super sector is not good at member communication for the simple fact that it in the past it hasn’t had to bother.

Everyone can get hit by cyber theft, so the key is how to handle it when it happens, and this is by keeping customers informed. This doesn’t mean simply putting a notice on your website, especially when those members who looked found out the online accounts functions had been overwhelmed and had shut down.

Superannuation fund churn stands at 3 per cent but will increase because demographics dictate that more people are closer to retirement, and as account balances grow people are starting to take notice.

This scrutiny means more people are asking questions and that gets the politicians and regulators asking too.

Many are not impressed.

In November 2023, APRA chair John Lonsdale said many funds were not as cyber-aware as they should be, and many were having a hard time “ensuring third party controls are effective, making sure that systematic security control testing is in place, and regularly testing incident response plans”.

ASIC wrote to trustees in January 2025 to warn them that they needed to “strengthen anti-scam practices or risk exposing members to harm” following a review of 15 trustees that found none had an organisation-wide scams strategy in place.

The drumbeats are getting louder, adding to the complexities facing Schroder.

Relaxed regulator

The accompanying table shows the ACCC’s weak record when it comes to knocking back mergers with none rejected this year and just six in the first three years of Gina Cass-Gottlieb’s reign.

Granted, her record is better than predecessor Rod Sims, who knocked back just four in the previous three years, but business concerns about an overzealous regulator are clearly plain wrong.

Some seven deals were withdrawn over three years after negative ACCC feedback.

Next financial year the ACCC begins its era of mandatory notification, which based on present records will be one-way traffic, with plenty of merger deal ticks.

As noted previously, the Cass-Gottlieb era has also seen less litigation.

The shock departure of enforcement commissioner Liza Carver after just 60 per cent of her term means Cass-Gottlieb will assume responsibility for enforcement at commission level, backed by Melinda McDonald at staff level. The timing of the departure could not be worse, with an election to delay the selection of a replacement, ahead of the mandatory merger regime and the landmark Google case. In all the move will heap more pressure on those remaining. None more so than Cass-Gottlieb.

The 62-year-old Carver is perceived to be at her best when she is driving the bus and by definition this wasn’t happening at the ACCC. None of which should have come as a surprise to Carver, given she has done time in the place before.

Carver will return to Herbert Smith Freehills where she worked prior to moving to the ACCC, joining Linda Evans, who she recruited to the firm prior to leaving.

Meanwhile, this week’s decision to allow Qube to get a monopoly on handling Australian car imports, even with the usual behavioural undertakings, beggars belief.

This was a big victory for Qube lawyer Simon Muys at Cass-Gottlieb’s old firm, Gilbert &Tobin.

It already owned the port handling facilities in Brisbane and Port Kembla and now has the Melbourne facilities owned by Wallenius Wilhemsen.

Granted. it is better to separate a big car-handling shipper from the port logistics, but these are now controlled by the biggest port logistic house on the street, Qube.

These are notoriously difficult to regulate.

After the big supermarket review the ACCC has also quietly cleared Woolworths’ purchase of the 75 per cent of ready-made meal provider Beak &Johnson it doesn’t already own, which hands more market power to the company which controls 32.5 per cent of supermarket sales.

The regulator has also delayed decisions on IAG’s purchase of Brisbane-based RACQ and Allianz’s purchase of Adelaide RAA, with both decisions due originally on April 24 just before the election. With the federal opposition nonsensically banging the drum about divestiture powers it was perhaps seen as better for the ACCC to keep the insurance decision on hold for a while.

Paul Schroder started his career at the ACTU as a rehab officer, helping members with chronic injuries, and as extraordinary as it might seem, these skills are badly needed now to develop AustralianSuper into a member-service-driven payments company.