Challenger hit by coronavirus superannuation withdrawals

Life insurer and fund manager Challenger has revealed a 10 per cent drop in its funds under management for the March quarter.

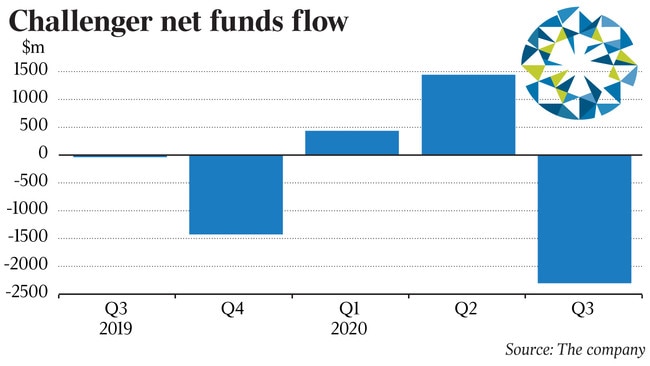

Challenger has started to feel the pinch of super funds pulling cash out of the market in preparation of a wave of early withdrawals, with the life insurer and fund manager revealing outflows over the past month.

While Challenger’s 10 per cent hit to its funds under management during the March quarter was mostly on the back of the market meltdown in March, it has revealed its portfolio also saw some redemptions.

Superannuation funds are boosting up cash reserves amid expectations that up to 1.5 million Australians will apply for the early access to their retirement savings in the coming days and weeks. Analysts expect the final dollar of drawdowns figure could top $50bn as more workers are laid off. Already more than 975,000 workers have signed up for the scheme.

The rule changes to allow early release of super funds were in response to the hammer blow to the economy following the COVID-19 shutdown.

Challenger suffered a $2.3bn net funds outflow in the March quarter due in part to “the impact of the coronavirus pandemic and market sell-off resulted in significant fund movements as large superannuation funds and other investors rebalanced their portfolios and sought liquidity,” the company said in an update. Funds under management stood at $74.8bn at the end of the quarter.

The bulk of the outflows – or $1.6bn – was Challenger’s own doing as the life insurer shook up of its portfolio as part of efforts to cut its exposure to holdings of junk bonds.

Despite the drop in funds, Challenger reaffirmed its previous guidance for normalised pre-tax net profit be between $500m-$550m in the year to end-June. Shares in Challenger ended at $4.37, down 0.9 per cent in a slightly lower market.

Releasing its March quarter results, Challenger said total life insurance sales were up 9 per cent, helped in part by strong Japanese and institutional sales, while total assets under management fell 8 per cent to $79bn.

“The drop in (assets under management) includes the effect of major market movements in the period as well as some redemptions in funds management as superannuation funds seek liquidity to fund members switching to cash and withdrawing funds,” Challenger chief executive officer Richard Howes said earlier Wednesday.

“Considering the extreme disruption, Challenger’s sales were relatively resilient, largely due to the diversification built through the partnership ... in Japan and institutional relationships”.

He noted Challenger’s funds management business also benefited from equity inflows as large superannuation funds and other investors “rebalanced their portfolios”.

Challenger’s annuity sales fell 10 per cent in the March quarter, reflecting the combined effect of ongoing shake-up of the financial advice industry in the wake of the Hayne royal commission as well as the impacts of the pandemic. Quarterly annuity sales in Australia, Challenger’s core market, were down 37 per cent on the same time a year ago.

Australian term annuity sales have been significantly impacted by disruption in the retail financial advice market following the royal commission, particularly following the major reduction in financial planners at the wealth arms of the big four banks, AMP and IOOF which have traditionally been a significant source of annuity sales.

Challenger’s investment portfolio at the end of March was down 4 per cent on the quarter at $19bn as it marked down the values for its fixed income, property, equities and infrastructure investments in the wake of the March sell-off.

Challenger has also been attempting to cut its exposure to high-yielding or junk bonds as it moved into investment grade assets.

Companies regulated by the Australian Prudential Regulation Authority are slapped with a capital charge that varies according to how risky the assets in the portfolio are — the more risky an investment, the more capital the company is required to hold.

Challenger, which has long-dated commitments to pay retirees a guaranteed income until they die, invests in a range of assets to help fund those liabilities.

At the end of March, some 15 per cent of Challenger’s book was non-investment grade, down from 25 per cent at the end of December.

Challenger said its life insurance arm is currently holding in excess of $3.5bn in cash and liquid fixed income, which can be deployed as markets stabilise and “relative value opportunities emerge”.