Perpetual Investments’ funds under management plunge

Perpetual Investments has sought to reassure shareholders after its funds under management sank 19pc due to COVID-19.

Perpetual Investments’ funds under management plunged 19 per cent in the three months through March as the coronavirus crisis wreaked havoc on markets, but chief executive Rob Adams has sought to reassure shareholders by pointing to non-market derived revenues in other divisions which provide a degree of protection against equity volatility.

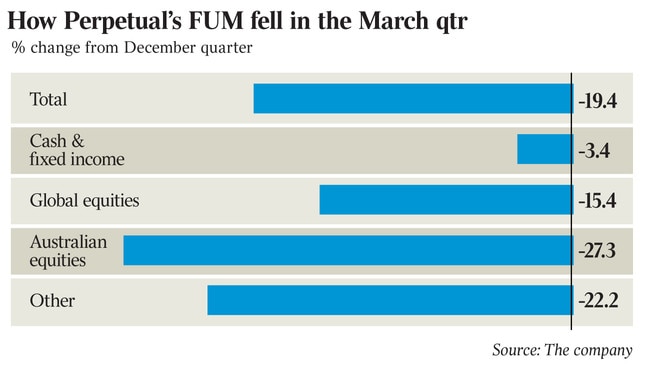

Funds under management for Perpetual’s investments arm closed out the quarter at $21.4bn, down 19 per cent on the December quarter, and 22 per cent lower than the prior corresponding period.

The fall in the value of total FUM was predominantly due to the impact of COVID-19 on Australian and global investment markets, the fund manager said, with net outflows of $0.8bn, primarily from Australian equities ($0.6bn) and cash and fixed income ($0.2bn).

“It has been an extremely challenging quarter with extraordinary market volatility as markets react to the rapidly evolving COVID-19 situation,” Mr Adams said.

“During these times, fundamentals matter and we remain focused on our investors. Value investing is a powerful long-term wealth creator, and we have remained true to label throughout economic cycles.”

Performance fees of $2.2m crystallised during the quarter, with $2.7m in fees earned year to date, he added.

Funds under advice at Perpetual Private, the group’s wealth arm, also took a hit in the quarter, dropping $2bn, or 13 per cent, to $13.2bn.

The sharp decline was largely due to the COVID-19 market correction and was partially offset by $0.2bn of net inflows in the quarter.

Twelve new advisers joined Perpetual Private over the three months, taking its total number of advisers to 82, with further positive flows expected as they transition their clients across to the group.

Perpetual Corporate Trust enjoyed a better quarter, growing funds under administration to $782.95bn, up from $772.2bn in the prior quarter after it won several new mandates, the company said.

The $1.3bn investment house was in a “strong financial position,” Mr Adams said, with $305m in available liquid funds against capital requirements of $169m.

More than 40 per cent of the company’s revenues were not directly linked to investment markets, he told shareholders, providing it with some protection equity market volatility.

As part of a cost-cutting drive, Perpetual identified further savings in the quarter which will see expense growth of 2.5 per cent to 3.5 per cent for the financial year, down from the previously forecast 4.5 per cent.

The acquisition of US-based ESG specialist Trillium Asset Management, announced earlier this year, is on track to be completed by June 30, the company confirmed, and it is working on the launch of an Australian-domiciled Trillium fund to take to institutional and retail investors.

“Our strategy remains clear. We believe that adding world-class global investment capabilities to complement our existing Australian capabilities will set up the business for long-term success,” Mr Adams said, though he cautioned that current market conditions “may make execution of transactions more difficult in the shorter term”.

Perpetual in February said it was exploring a move into growth and momentum investing as part of its expansion plans, with Mr Adams saying he didn’t want the veteran investment shop to be restricted to a value-only approach.

Perpetual shares ended the session flat at $28.19.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout