Super fund assets under management could shrink up to 25pc, RBA’s Philip Lowe warns

RBA governor Phil Lowe warns some funds could see managed assets hit hard as savers rush to early withdrawals.

Some super funds could see their funds under management shrink by up to 25 per cent as workers affected by the coronavirus crisis take advantage of early access to their savings, Reserve Bank governor Philip Lowe has warned.

Despite expectations that up to 1.5 million Australians will apply for the early access in the coming days and weeks, Dr Lowe on Tuesday said withdrawals would be manageable and there were no plans for the Reserve Bank to provide funds with a liquidity injection.

“Liquidity withdrawals from the super fund industry as a whole are perfectly manageable. For some funds withdrawals are going to be quite large and those funds will have to shrink,” Dr Lowe said in a Q&A session following a speech on the nation’s economic outlook.

“Some of the scenarios suggest up to 20-25 per cent of funds under management could be withdrawn for some particular funds. These funds have now had a month to get ready … So I am confident that they will be able to meet liquidity demands from their members.”

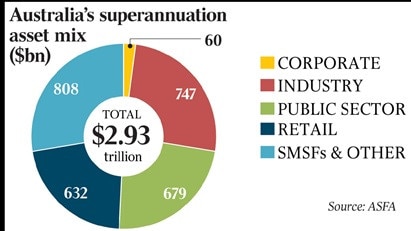

The super industry is already nursing heavy losses from the swift and brutal correction that swept through markets in February and March, adding to liquidity concerns, particularly for funds that have bet big on unlisted assets in recent years.

Funds in March suffered their worst monthly and quarterly returns since the introduction of compulsory super nearly three decades ago, with the median growth fund shedding 9 per cent in the month and 10.1 per cent over the quarter.

There are concerns some funds may be forced to sell assets in the coming weeks to meet the large volume of withdrawal requests, thereby locking in recent losses.

Prime Minister Scott Morrison in March announced the early access scheme, telling Australians who had lost their job due to the coronavirus that they would be allowed to take $10,000 out of their super savings, tax free, before June 30, and could access a further $10,000 between July and late September.

Initial treasury estimates were for 1.3 million workers to take advantage of the scheme, withdrawing up to $27bn from their nest eggs, but experts predict the final dollar figure could top $50bn as more workers are laid off. Already more than 975,000 workers have signed up for the scheme.

There have been widespread concerns that some funds, such as the $50bn Hostplus and $60bn REST, whose members primarily work in the hard-hit hospitality, tourism and retail sectors, may be at risk of a liquidity crisis due to high volumes of withdrawal requests.

Hostplus in recent days reportedly sought to redeem $1.5bn from property investor ISPT to shore up its liquidity ahead of a surge of withdrawal requests.

Dr Lowe appeared to dismiss suggestions funds would get liquidity support from the central bank.

“If the Reserve Bank was to provide a liquidity support facility it would need to pass the public interest test and we would need to be able to conclude it would be to support the stability of the financial system. At the moment we’re not in a position to conclude that,” he said.

Mr Lowe made the comments after giving a speech on the economic outlook through the coronavirus pandemic. The “next few months” would be difficult for the economy, he warned, with national output expected to fall by 10 per cent over the first half of the year and unemployment to hit 10 per cent by June.

“The unemployment rate would have been much higher than this without the government’s JobKeeper wage subsidy.”

ABS payroll data released on Tuesday showed 780,000 jobs had been lost in the three weeks to April, with a quarter of employees in the accommodation and food services industry losing their jobs over the period.