Cbus chair Steve Bracks canes board member idea for super-fuelled $50,000 home deposit

Super fund head Steve Bracks has slammed a proposal to let homebuyers access up to $50,000.

Australia’s biggest building and construction super fund — with $54bn under management — has been forced into damage control over a push by Cbus director Denita Wawn to let homebuyers access up to $50,000 of their retirement savings to buy or build a home.

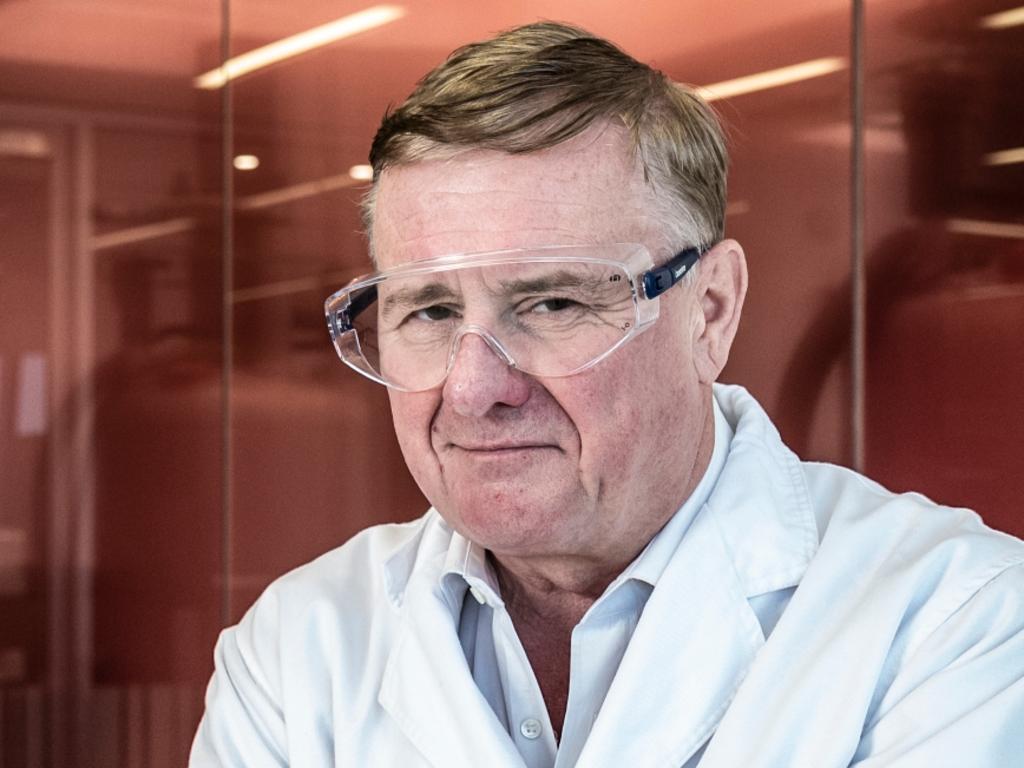

Cbus chair Steve Bracks intervened on Wednesday following pushback from board directors, union leaders and superannuation industry groups who said the Master Builders Australia policy proposal would drive up house prices and benefit the “baby boomer housing bubble”.

The Australian can also reveal super fund representatives and the Australian Institute of Superannuation Trustees met with the COVID Co-ordination Commission this week to discuss “harnessing the collective power of Australia’s $3 trillion pool of super capital” to inject large-scale investment in affordable housing.

The ACTU, Australian Workers Union and Electrical Trades Union on Wednesday criticised the MBA chief executive’s proposal to tap superannuation for first-home buyers.

AWU assistant national secretary and Cbus director Misha Zelinsky said “funnelling superannuation savings into the property market will just inflate the price of existing houses, with only a negligible impact on construction”.

“Pumping our retirement savings into existing residential property is simply a wealth transfer from kids to their parents,” Mr Zelinsky told The Australian.

“We need a proper government stimulus package for housing and construction — not thought bubbles that expect young kids and families to sacrifice their futures to prop up a baby-boomer housing bubble.”

Ms Wawn on Wednesday night refused to back down, saying it was “extraordinary that Master Builders is under attack for opening a debate about home ownership and the need to stimulate economic growth in the largest economic crisis since the Depression.”

“MBA has always supported home ownership as a priority for all Australians. It is the single biggest wealth creator for low and middle-income families,” Ms Wawn said.

“People can already get access their super to pay their mortgage if they are in financial difficulty so why shouldn’t they be able to access to it get into mortgage in the first place.”

Liberal senator Andrew Bragg, who has led the government pushback against criticism from Labor and the superannuation industry over its early access to super schemes, endorsed a widening of the First Home Super Saver Scheme to help young Australians buy a home. “For many people, the trade-off between a super contribution and assembling a deposit for a first home is real.

“I have had several people tell me that their super is their only chance of ever having a home,” Senator Bragg said.

Mr Bracks, a former Victorian premier, said “breaching preservation to allow withdrawals for housing would not be in our members’ best interests”.

The Cbus chair, whose fund has more than 774,000 members, said a 35-year-old member stood to lose around a quarter of their retirement savings if they were allowed to take $50,000 out for a housing deposit.

“Allowing access to super for housing will not make housing more affordable, but the nation will be paying a lot more for the Age Pension and the crisis of poverty among older Australia will be exacerbated,” Mr Bracks said.

AIST chief executive Eva Scheerlinck said the MBA proposal was flawed because it did “nothing to address the root cause of Australia’s housing affordability problem”.

The AIST met with the national COVID Co-ordination Commission, led by Nev Power, earlier this week to discuss “ways to increase super investment in affordable housing”.

Writing for The Australian, Ms Scheerlinck said the super industry was also talking with state governments about the potential for large-scale investment in affordable housing.

“While some profit-to-member super funds have invested in affordable housing where they can, this has not yet been achieved on a large scale in Australia. There are barriers that mean the overall level of institutional investment in affordable housing in Australia remains stubbornly modest,” Ms Scheerlinck said.

“Action to address barriers such as restricted land supply and unfavourable tax implications would open up an immediate opportunity for super funds to significantly scale up their investment in new housing.”

ACTU assistant secretary Scott Connolly urged Ms Wawn to withdraw her “galling thought bubble”, accusing the MBA of seeking to benefits its members by draining workers’ retirement savings and funnelling funds into the construction sector.

He said the median superannuation balance of workers aged 25 to 34 was $20,000 for women and $31,600 for men, “meaning more than half would empty their retirement savings just to buy a home”.

“Self-interested policy undermines your position as custodian of workers’ retirement savings,” he said in a letter to Ms Wawn on Wednesday.

Association of Superannuation Funds of Australia chief executive Martin Fahy described the MBA proposal as “simplistic voodoo economics”.

More Coverage

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout